Pizza Hut 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

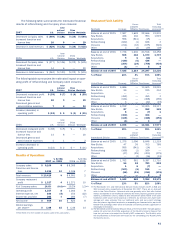

Prior to the acquisition, we accounted for our fifty percent

ownership interest using the equity method of accounting.

Thus, we reported our fifty percent share of the net income

of the unconsolidated affiliate (after interest expense and

income taxes) as Other (income) expense in the Consolidated

Statements of Income. We also recorded a franchise fee for

the royalty received from the stores owned by the unconsoli-

dated affiliate. Since the date of the acquisition, we have

reported Company sales and the associated restaurant costs,

G&A expense, interest expense and income taxes associated

with the restaurants previously owned by the unconsolidated

affiliate in the appropriate line items of our Consolidated

Statement of Income. We no longer record franchise fee

income for the restaurants previously owned by the uncon-

solidated affiliate, nor do we report other income under the

equity method of accounting. As a result of this acquisition,

Company sales and restaurant profit increased $576 mil-

lion and $59 million, respectively, franchise fees decreased

$19 million and G&A expenses increased $33 million in the

year ended December 29, 2007 compared to the year ended

December 30, 2006. As a result of this acquisition, Com-

pany sales and restaurant profit increased $164 million and

$16 million, respectively, franchise fees decreased $7 million

and G&A expenses increased $8 million in the year ended

December 30, 2006 compared to the year ended Decem-

ber 31, 2005. The impacts on operating profit and net income

were not significant in either year.

EXTRA WEEK IN 2005 Our fiscal calendar results in a 53rd

week every five or six years. Fiscal year 2005 included a 53rd

week in the fourth quarter for the majority of our U.S. busi-

nesses as well as our international businesses that report

on a period, as opposed to a monthly, basis. In the U.S., we

permanently accelerated the timing of the KFC business clos-

ing by one week in December 2005, and thus, there was no

53rd week benefit for this business. Additionally, all China

Division businesses report on a monthly basis and thus did

not have a 53rd week.

The following table summarizes the estimated increase

(decrease) of the 53rd week on fiscal year 2005 revenues

and operating profit:

Inter-

national Unallo-

U.S. Division cated Total

Revenues

Company sales $ 58 $ 27 $ — $ 85

Franchise and license fees 8 3 — 11

Total Revenues $ 66 $ 30 $ — $ 96

Operating profit

Franchise and license fees $ 8 $ 3 $ — $ 11

Restaurant profit 14 5 — 19

General and administrative

expenses (2) (3) (3) (8)

Equity income from

investments in

unconsolidated affiliates — 1 — 1

Operating profit $ 20 $ 6 $ (3) $ 23

MAINLAND CHINA 2005 BUSINESS ISSUES Our KFC business

in mainland China was negatively impacted by the interruption

of product offerings and negative publicity associated with a

supplier ingredient issue experienced in late March 2005 as

well as consumer concerns related to Avian Flu in the fourth

quarter of 2005. As a result of the aforementioned issues,the

China Division experienced system sales growth in 2005 of

11%, excluding foreign currency translation which was below

our ongoing target of at least 22%. During the year ended

December 30, 2006, the China Division recovered from these

issues and achieved growth rates of 23% for both system

sales and Company sales, both excluding foreign currency

translation. During 2005, we entered into agreements with

the supplier of the aforementioned ingredient. As a result, we

recognized recoveries of approximately $24 million in Other

income (expense) in our Consolidated Statement of Income

for the year ended December 31, 2005.

SIGNIFICANT 2008 GAINS AND CHARGES In 2008, we expect

that our results of operations will be significantly impacted

by several events, including the sale of our interest in our

unconsolidated affiliate in Japan and refranchising gains and

charges related to our U.S. business.

In December 2007, we sold our interest in our unconsoli-

dated affiliate in Japan for $128 million in cash (includes the

impact of related foreign currency contracts that were settled

in December 2007). Our international subsidiary that owned

this interest operates on a fiscal calendar with a period end

that is approximately one month earlier than our consolidated

period close. Thus, consistent with our historical treatment

of events occurring during the lag period, the pre-tax gain on

the sale of this investment of approximately $87 million will

be recorded in the first quarter of 2008. We also anticipate

pre-tax gains from refranchising in the U.S. of $20 million to

$50 million in 2008. We expect, that together these gains

will be partially offset by charges relating to G&A productivity

initiatives and realignment of resources, as well as invest-

ments in our U.S. brands to drive stronger growth. The net

impact of all of the aforementioned gains and charges is

expected to generate approximately $50 million in operating

profit in 2008.

While we will no longer have an ownership interest in

the entity that operates both KFCs and Pizza Huts in Japan,

it will continue to be a franchisee as it was when it operated

as an unconsolidated affiliate. Excluding the one-time gain,

we do not expect that the sale of our interest in our Japan

unconsolidated affiliate will have a significant impact on our

subsequently reported results of operations in 2008 and

beyond as the Other income we recorded representing our

share of earnings of the unconsolidated affiliate has histori-

cally not been significant ($4 million in 2007).

FUTURE TAX LEGISLATION — MAINLAND CHINA On March 16,

2007, the National People’s Congress in mainland China

enacted new tax legislation that went into effect on January 1,

2008. Upon enactment,which occurred in the China Division’s

2007 second fiscal quarter, the deferred tax balances of all

Chinese entities, including our unconsolidated affiliates, were