Pizza Hut 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

willing buyer would pay for the intangible asset and is generally

estimated by discounting the expected future cash flows associ-

ated with the intangible asset. We also perform our annual test

for impairment of our indefinite-lived intangible assets at the

beginning of our fourth quarter. No impairment of indefinite-lived

intangible assets was recorded in 2007, 2006 and 2005.

Our amortizable intangible assets are evaluated for impair-

ment whenever events or changes in circumstances indicate that

the carrying amount of the intangible asset may not be recov-

erable. An intangible asset that is deemed impaired is written

down to its estimated fair value, which is based on discounted

cash flows. For purposes of our impairment analysis, we update

the cash flows that were initially used to value the amortizable

intangible asset to reflect our current estimates and assumptions

over the asset’s future remaining life.

DERIVATIVE FINANCIAL INSTRUMENTS Historically we have

engaged in transactions involving various derivative instruments

to hedge interest rates and foreign currency denominated pur-

chases, assets and liabilities. These derivative contracts are

entered into with financial institutions. We do not use derivative

instruments for trading purposes and we have procedures in place

to monitor and control their use.

We account for these derivative financial instruments in

accordance with SFAS No. 133, “Accounting for Derivative Instru-

ments and Hedging Activities” (“SFAS 133”) as amended by SFAS

No. 149, “Amendment of Statement 133 on Derivative Instru-

ments and Hedging Activities” (“SFAS 149”). SFAS 133 requires

that all derivative instruments be recorded on the Consolidated

Balance Sheet at fair value. The accounting for changes in the fair

value (i.e.,gains or losses) of a derivative instrument is dependent

upon whether the derivative has been designated and qualifies as

part of a hedging relationship and further, on the type of hedging

relationship. For derivative instruments that are designated and

qualify as a fair value hedge, the gain or loss on the derivative

instrument as well as the offsetting gain or loss on the hedged

item attributable to the hedged risk are recognized in the results

of operations. For derivative instruments that are designated and

qualify as a cash flow hedge, the effective portion of the gain or

loss on the derivative instrument is reported as a component of

other comprehensive income (loss) and reclassified into earnings

in the same period or periods during which the hedged transaction

affects earnings. For derivative instruments that are designated

and qualify as a net investment hedge, the effective portion of the

gain or loss on the derivative instrument is reported in the foreign

currency translation component of other comprehensive income

(loss). Any ineffective portion of the gain or loss on the deriva-

tive instrument for a cash flow hedge or net investment hedge is

recorded in the results of operations immediately. For derivative

instruments not designated as hedging instruments, the gain or

loss is recognized in the results of operations immediately. See

Note 15 for a discussion of our use of derivative instruments,

management of credit risk inherent in derivative instruments and

fair value information.

COMMON STOCK SHARE REPURCHASES From time to time,

we repurchase shares of our Common Stock under share repur-

chase programs authorized by our Board of Directors. Shares

repurchased constitute authorized, but unissued shares under the

North Carolina laws under which we are incorporated. Addition-

ally, our Common Stock has no par or stated value. Accordingly,

we record the full value of share repurchases, upon the trade

date, against Common Stock except when to do so would result

in a negative balance in our Common Stock account. In such

instances, on a period basis, we record the cost of any further

share repurchases as a reduction in retained earnings. Due to the

large number of share repurchases and the increase in our Com-

mon Stock market value over the past several years, our Common

Stock balance is frequently zero at the end of any period. Accord-

ingly, $1,154 million and $713 million in share repurchases were

recorded as a reduction in retained earnings in 2007 and 2006,

respectively. We have no legal restrictions on the payment of

dividends. See Note 19 for additional information.

PENSION AND POST-RETIREMENT MEDICAL BENEFITS In the

fourth quarter of 2006,we adopted the recognition and disclosure

provisions of SFAS No. 158, “Employers’ Accounting for Defined

Benefit Pension and Other Postretirement Plans—an amendment

of FASB Statements No. 87, 88, 106 and 132(R)” (“SFAS 158”).

SFAS 158 amends SFAS No. 87, “Employers’ Accounting for Pen-

sions” (“SFAS 87”), SFAS No. 88, “Employers’ Accounting for

Settlements and Curtailments of Defined Benefit Plans and for

Termination Benefits” (“SFAS 88”), SFAS No. 106, “Employers’

Accounting for Postretirement Benefits Other Than Pensions”

(“SFAS 106”) and SFAS No. 132(R), “Employers’ Disclosures

about Pensions and Other Postretirement Benefits.”

SFAS 158 required the Company to recognize the funded

status of its pension and post-retirement plans in the Decem-

ber 30, 2006 Consolidated Balance Sheet, with a corresponding

adjustment to accumulated other comprehensive income, net of

tax. Gains or losses and prior service costs or credits that arise

in future years will be recognized as a component of other com-

prehensive income to the extent they have not been recognized

as a component of net periodic benefit cost pursuant to SFAS 87

or SFAS 106.

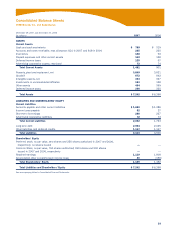

The incremental effects of adopting the provisions of SFAS

158 on the Company’s Consolidated Balance Sheet at Decem-

ber 30,2006 are presented as follows. The adoption of SFAS 158

had no impact on the Consolidated Statement of Income.

Before After

Application of Application of

SFAS 158 Adjustments SFAS 158

Intangible assets, net $ 350 $ (3) $ 347

Deferred income taxes 283 37 320

Total assets 6,334 34 6,368

Accounts payable and other

current liabilities 1,384 2 1,386

Other liabilities and deferred

credits 1,048 99 1,147

Total liabilities 4,815 101 4,916

Accumulated other

comprehensive loss (89) (67) (156)

Total shareholders’ equity 1,519 (67) 1,452

QUANTIFICATION OF MISSTATEMENTS In September 2006, the

Securities and Exchange Commission (the “SEC”) issued Staff

Accounting Bulletin No. 108, “Considering the Effects of Prior Year

Misstatements when Quantifying Misstatements in Current Year

Financial Statements” (“SAB 108”). SAB 108 provides interpre-

tive guidance on how the effects of the carryover or reversal of

prior year misstatements should be considered in quantifying a

current year misstatement for the purpose of a materiality assess-

ment. SAB 108 requires that registrants quantify a current year

misstatement using an approach that considers both the impact

of prior year misstatements that remain on the balance sheet and

those that were recorded in the current year income statement