Pizza Hut 2007 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 YUM! BRANDS, INC.

G&A expenses increased 2% in 2006. The increase

was primarily driven by higher compensation related costs,

including amounts associated with investments in strategic

initiatives in China and other international growth markets,

partially offset by lapping higher prior year litigation related

costs. The net impact of the additional G&A expenses associ-

ated with acquiring the Pizza Hut U.K. business, the favorable

impact of lapping the 53rd week in 2005 and the unfavorable

impact of foreign currency translation was not significant.

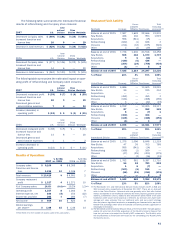

Worldwide Other (Income) Expense

2007 2006 2005

Equity income from investments in

unconsolidated affiliates $ (51) $ (51) $ (51)

Gain upon sale of investment in

unconsolidated affiliate(a) (6) (2) (11)

Recovery from supplier(b) —— (20)

Contract termination charge(c) —8 —

Wrench litigation income(d) (11) — (2)

Foreign exchange net (gain) loss

and other (3) (7) —

Other (income) expense $ (71) $ (52) $ (84)

(a) Fiscal years 2007 and 2006 reflects recognition of income associated with receipt

of payments for a note receivable arising from the 2005 sale of our fifty percent

interest in the entity that operated almost all KFCs and Pizza Huts in Poland and

the Czech Republic to our then partner in the entity. Fiscal year 2005 reflects the

gain recognized at the date of this sale.

(b) Relates to a financial recovery from a supplier ingredient issue in mainland China

totaling $24 million in 2005, $4 million of which was recognized through equity

income from investments in unconsolidated affiliates.

(c) Reflects an $8 million charge associated with the termination of a beverage agree-

ment in the U.S. segment in 2006.

(d) Fiscal years 2007 and 2005 reflect financial recoveries from settlements with

insurance carriers related to a lawsuit settled by Taco Bell Corporation in 2004.

Worldwide Closure and Impairment Expenses and

Refranchising (Gain) Loss

See the Store Portfolio Strategy section for more detail of our

refranchising and closure activities and Note 5 for a summary

of the components of facility actions by reportable operating

segment.

Operating Profit

% Increase/

(Decrease)

2007 2006 2007 2006

United States $ 739 $ 763 (3) —

International Division 480 407 18 9

China Division 375 290 30 37

Unallocated and corporate

expenses (257) (229) 12 (7)

Unallocated other income

(expense) 97NM NM

Unallocated refranchising

gain (loss) 11 24 NM NM

Operating profit $ 1,357 $ 1,262 89

United States operating

margin 14.2% 13.6% 0.6ppts. 0.8ppts.

International Division

operating margin 15.6% 17.6% (2.0)ppts. 0.1ppts.

Neither unallocated and corporate expenses, which comprise

G&A expenses, nor unallocated refranchising gain (loss) are

allocated to the U.S., International Division or China Division

segments for performance reporting purposes. The increase

in unallocated and corporate expenses in 2007 was driven

by an increase in annual incentive compensation and proj-

ect costs. The decrease in 2006 unallocated and corporate

expenses was driven by the lapping of the unfavorable impact

of 2005 litigation related costs.

U.S. operating profit decreased 3% in 2007. The decrease

was driven by higher restaurant operating costs, principally

commodities and labor, partially offset by lower G&A expenses,

lower closure and impairment expenses and an increase in

Other income.

Excluding the unfavorable impact of lapping the 53rd

week in 2005, U.S. operating profit increased 3% in 2006.

The increase was driven by the impact of same store sales

on restaurant profit (due to higher average guest check) and

franchise and license fees, new unit development and lower

closures and impairment expenses. These increases were

partially offset by the unfavorable impact of refranchising,

higher G&A expenses and a charge associated with the termi-

nation of a beverage agreement in 2006. The impact of lower

commodity costs and lower property and casualty insurance

expense on restaurant profit was largely offset by higher other

restaurant costs, including labor, advertising and utilities.

International Division operating profit increased 18% in

2007 including a 6% favorable impact from foreign currency

translation. The increase was driven by the impact of same

store sales growth and new unit development on restaurant

profit and franchise and license fees. The increase was par-

tially offset by higher G&A expenses (including expenses

which were previously netted within equity income prior to

our acquisition of the remaining fifty percent of the Pizza Hut

U.K. business) and higher restaurant operating costs.

Excluding the unfavorable impact of lapping the 53rd

week in 2005, International Division operating profit increased

11% in 2006. The increase was driven by the impact of same

store sales growth and new unit development on franchise

and license fees and restaurant profit. These increases were

partially offset by higher restaurant operating costs and lower

equity income from unconsolidated affiliates. Foreign currency

translation did not have a significant impact.

China Division operating profit increased 30% in 2007

including a 7% favorable impact from foreign currency trans-

lation. The increase was driven by the impact of same store

sales growth and new unit development on restaurant profit.

The increase was partially offset by higher restaurant operat-

ing costs and G&A expenses.

China Division operating profit increased 37% in 2006

including a 4% favorable impact from foreign currency trans-

lation. The increase was driven by the impact of same store

sales growth and new unit development on restaurant profit as

well as an increase in equity income from our unconsolidated

affiliates. These increases were partially offset by higher G&A

expenses and the lapping of a prior year financial recovery

from a supplier.