Pizza Hut 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

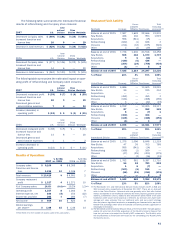

In 2007, U.S. Company same store sales were down 3%

due to transaction declines partially offset by an increase

in average guest check. In 2006, U.S. Company same store

sales were flat as a decrease in transactions was offset by

an increase in average guest check.

In 2007, the increase in U.S. franchise and license fees

was driven by refranchising and new unit development, par-

tially offset by store closures. In 2006, the increase in U.S.

franchise and license fees was driven by new unit develop-

ment, refranchising and same store sales growth, partially

offset by store closures.

Excluding the favorable impact of the Pizza Hut U.K. acqui-

sition, International Division Company sales decreased 1%

in 2007. The decrease was driven by refranchising and store

closures, partially offset by same store sales growth and new

unit development. Excluding the favorable impact of the Pizza

Hut U.K. acquisition, International Division Company sales

were flat in 2006. The impacts of refranchising and store

closures were partially offset by new unit development and

same store sales growth.

Excluding the unfavorable impact of the Pizza Hut U.K.

acquisition, International Division franchise and license fees

increased 14% and 13% in 2007 and 2006, respectively. The

increases were driven by new unit development and same

store sales, partially offset by store closures. 2007 was also

favorably impacted by refranchising.

In 2007 and 2006, the increases in China Division Com-

pany sales and franchise and license fees were driven by new

unit development and same store sales growth.

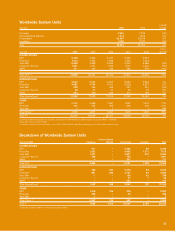

Company Restaurant Margins

Inter-

national China

2007 U.S. Division Division Worldwide

Company sales 100.0% 100.0% 100.0% 100.0%

Food and paper 29.2 29.9 36.4 31.0

Payroll and employee

benefits 30.5 26.1 13.2 25.3

Occupancy and other

operating expenses 27.0 31.7 30.3 29.1

Company restaurant margin 13.3% 12.3% 20.1% 14.6%

Inter-

national China

2006 U.S. Division Division Worldwide

Company sales 100.0% 100.0% 100.0% 100.0%

Food and paper 28.2 32.2 35.4 30.5

Payroll and employee

benefits 30.1 24.6 12.9 25.6

Occupancy and other

operating expenses 27.1 31.0 31.3 28.7

Company restaurant margin 14.6% 12.2% 20.4% 15.2%

Inter-

national China

2005 U.S. Division Division Worldwide

Company sales 100.0% 100.0% 100.0% 100.0%

Food and paper 29.8 33.1 36.2 31.4

Payroll and employee

benefits 30.2 24.1 13.3 26.4

Occupancy and other

operating expenses 26.2 30.7 33.1 28.2

Company restaurant margin 13.8% 12.1% 17.4% 14.0%

In 2007, the decrease in U.S. restaurant margin as a percent-

age of sales was driven by the impact of higher commodity

costs (primarily cheese and meats) and higher wage rates,

due primarily to state minimum wage rate increases. The

decrease was partially offset by the favorable impact of lower

self-insured property and casualty insurance expense driven

by improved loss trends, as well as the favorable impact

on restaurant margin of refranchising and closing certain

restaurants.

In 2006, the increase in U.S. restaurant margin as a per-

centage of sales was driven by the impact of lower commodity

costs (primarily meats and cheese), the impact of same store

sales on restaurant margin (due to higher average guest

check) and the favorable impact of lower self-insured property

and casualty insurance expense. The increase was partially

offset by higher occupancy and other costs,higher labor costs,

primarily driven by wage rates and benefits, and the lapping

of the favorable impact of the 53rd week in 2005. The higher

occupancy and other costs were driven by increased advertis-

ing and higher utility costs.

In 2007, the increase in International Division restaurant

margin as a percentage of sales was driven by the impact

of same store sales growth on restaurant margin as well as

the favorable impact of refranchising certain restaurants. The

increase was almost fully offset by higher labor costs (primar-

ily wage rates) and the impact of lower margins associated

with Pizza Hut units in the U.K. which we now operate. As a

percentage of sales, Pizza Hut U.K. restaurants negatively

impacted payroll and employee benefits and occupancy and

other expenses and positively impacted food and paper.

In 2006, the increase in International Division restaurant

margin as a percentage of sales was driven by the impact of

same store sales growth on restaurant margin as well as the

favorable impact of refranchising and closing certain restau-

rants. These increases were offset by higher labor costs and

higher food and paper costs.

In 2007, the decrease in China Division restaurant mar-

gin as a percentage of sales was driven by higher commodity

costs (primarily chicken products), the impact of lower mar-

gins associated with new units during the initial periods of

operation and higher labor costs. The decrease was partially

offset by the impact of same store sales growth on restau-

rant margin.

In 2006, the increase in China Division restaurant margin

as a percentage of sales was driven by the impact of same

store sales growth on restaurant margin. The increase was

partially offset by the impact of lower margins associated with

new units during the initial periods of operations.

Worldwide General and Administrative Expenses

G&A expenses increased 9% in 2007, including a 2% unfa-

vorable impact of foreign currency translation. Excluding the

additional G&A expenses associated with acquiring the Pizza

Hut U.K. business (which were previously netted within equity

income prior to our acquisition of the remaining fifty percent

of the business) and the unfavorable impact of foreign cur-

rency translation, G&A expense increased 4%. The increase

was driven by higher annual incentive and other compensation

costs, including amounts associated with strategic initiatives

in China and other international growth markets.