Pizza Hut 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46 YUM! BRANDS, INC.

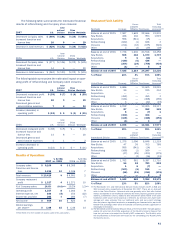

In December 2007, we sold our interest in our unconsoli-

dated affiliate in Japan for $128 million (includes the impact

of related foreign currency contracts that were settled in

December 2007). The international subsidiary that owned

this interest operates on a fiscal calendar with a period end

that is approximately one month earlier than our consolidated

period close. Thus, consistent with our historical treatment

of events occurring during the lag period, the pre-tax gain on

the sale of this investment of approximately $87 million will

be recorded in the first quarter of 2008. However, the cash

proceeds from this transaction were transferred from our inter-

national subsidiary to the U.S. in December 2007 and are

thus reported on our Consolidated Statement of Cash Flows

for the year ended December 29, 2007. The offset to this cash

on our Consolidated Balance Sheet at December 29, 2007 is

in accounts payable and other current liabilities.

In 2006,net cash used in investing activities was $476 mil-

lion versus $345 million in 2005. The increase was driven by

the 2006 acquisitions of the remaining interest in our Pizza

Hut U.K. unconsolidated affiliate and the Rostik’s brand and

associated intellectual properties in Russia. The lapping of

proceeds related to the 2005 sale of our fifty percent inter-

est in our former Poland/Czech Republic unconsolidated

affiliate also contributed to the increase. These factors were

partially offset by an increase in proceeds from refranchising

in 2006.

Net cash used in financing activities was $678 million versus

$670 million in 2006. The increase was driven by higher share

repurchases and higher dividend payments, partially offset by

an increase in net borrowings.

In 2006,net cash used in financing activities was $670 mil-

lion versus $827 million in 2005. The decrease was driven by

an increase in net borrowings and lower share repurchases,

partially offset by a reduction in the excess tax benefits from

share-based compensation and higher dividend payments.

Consolidated Financial Condition

The increase in short-term borrowings at December 29,

2007 was primarily due to the classification of $250 million

in Senior Unsecured Notes as short-term borrowings due to

their May 2008 maturity date, partially offset by the repay-

ment of two term-loans in the International Division during

the year ended December 29, 2007. The increase in long-term

debt was primarily due to the 2007 issuance of $600 million

aggregate principal amount of 6.25% Senior Unsecured Notes

that are due March 15, 2018 and $600 million aggregate

principal amount of 6.875% Senior Unsecured Notes that are

due November 15, 2037.

Liquidity and Capital Resources

Operating in the QSR industry allows us to generate substan-

tial cash flows from the operations of our company stores

and from our franchise operations, which require a limited

YUM investment. In each of the last six fiscal years, net cash

provided by operating activities has exceeded $1 billion. We

expect these levels of net cash provided by operating activities

to continue in the foreseeable future. Additionally, we estimate

that refranchising proceeds, prior to income taxes, will total

at least $400 million in 2008. Our discretionary spending

includes capital spending for new restaurants, acquisitions

of restaurants from franchisees, repurchases of shares of

our Common Stock and dividends paid to our shareholders.

Unforeseen downturns in our business could adversely impact

our cash flows from operations from the levels historically real-

ized. However, we believe our ability to reduce discretionary

spending and our borrowing capacity would allow us to meet

our cash requirements in 2008 and beyond.

DISCRETIONARY SPENDING During 2007, we invested $742

million in our businesses, including approximately $307 mil-

lion in the U.S., $189 million for the International Division and

$246 million for the China Division. For 2008, we estimate

capital spending will be between $700 and $750 million.

We returned approximately $1.7 billion to our sharehold-

ers through share repurchases and quarterly dividends in

2007. This is the third straight year that we returned over

$1.1 billion to our shareholders. Under the authority of our

Board of Directors, we repurchased 41.8 million shares of

our Common Shares for $1.4 billion during 2007. At Decem-

ber 29, 2007, we had remaining capacity to repurchase up

to $813 million of our outstanding Common Stock (excluding

applicable transaction fees) under an October 2007 authoriza-

tion by our Board of Directors that allowed us to repurchase

$1.25 billion of the Company’s outstanding Common Stock

(excluding applicable transaction fees) to be purchased

through October 2008. Subsequent to the Company’s year

end, our Board of Directors authorized additional share repur-

chases of up to an additional $1.25 billion of the Company’s

outstanding Common Stock (excluding applicable transaction

fees) to be purchased through January 2009.

In October 2007, the Company announced that we plan to

substantially increase the amount of share buybacks over the

next two years; buying back a total of up to $4 billion of the

Company’s outstanding Common Stock, helping to reduce our

diluted share count by as much as 20%. Since the announce-

ment of this plan, the Company has repurchased $437 million

of our outstanding Common Stock through December 29,

2007. We expect this two-year share repurchase program will

be funded by a combination of the Company’s ongoing free

cash flow, additional debt and refranchising proceeds. The

completion of this plan will depend on the Company’s cash

flows, credit rating, proceeds from our refranchising efforts

and availability of other investment opportunities, among

other factors.

During the year ended December 29, 2007, we paid cash

dividends of $273 million. Additionally, on November 16, 2007

our Board of Directors approved cash dividends of $0.15

per share of Common Stock to be distributed on February 1,

2008 to shareholders of record at the close of business on

January 11, 2008.

For 2008, we expect to return over $2 billion to share-

holders through both cash dividends and significant share

repurchases. We are now expecting a reduction in average

diluted shares outstanding of approximately 8% for 2008

and an ongoing annual dividend payout ratio of 35%–40% of

net income.