Pizza Hut 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 YUM! BRANDS, INC.

adjusted. The impacts on our income tax provision and oper-

ating profit in the year ended December 29, 2007 were not

significant. We currently estimate that these income tax rate

changes will positively impact our 2008 net income between

$10 million and $15 million compared to what it would have

otherwise been had no new tax legislation been enacted.

MEXICO VALUE ADDED TAX (“VAT”) EXEMPTION On October 1,

2007, Mexico enacted new legislation that eliminated a tax

ruling that allowed us to claim an exemption related to VAT

payments. Beginning on January 1, 2008, we will be required

to remit VAT on all Company restaurant sales resulting in

lower Company sales and restaurant profit. As a result of

this new legislation, we estimate that our 2008 International

Division’s Company sales and restaurant profit will be unfavor-

ably impacted by approximately $38 million and $34 million,

respectively. Additionally, the International Division’s system

sales growth and restaurant margin as a percentage of sales

will be negatively impacted by approximately 0.3% and 1.2 per-

centage points, respectively.

CHINA 2008 REPORTING ISSUES We have historically not

consolidated an entity in China in which we have a majority

ownership interest, instead accounting for the unconsolidated

affiliate using the equity method of accounting. Our partners

in this entity are essentially state-owned enterprises. We have

not consolidated this entity due to the historical effective

participation of our partners in the significant decisions of

the entity that were made in the ordinary course of business

as addressed in Emerging Issues Task Force (“EITF”) Issue

No. 96-16, “Investor’s Accounting for an Investee When the

Investor Has a Majority of the Voting Interest but the Minority

Shareholder or Shareholders Have Certain Approval or Veto

Rights”. Concurrent with a decision that we made on Janu-

ary 1, 2008 regarding top management of the entity, we no

longer believe that our partners effectively participate in the

decisions that are made in the ordinary course of business.

Accordingly, we will begin to consolidate this entity in 2008.

The change will result in higher Company sales, restaurant

profit, G&A expenses and Income tax provision, as well as

lower franchise and license fees and Other income. Had this

change occurred at the beginning of 2007, our China Division’s

Company sales, restaurant profit and G&A expenses would

have increased approximately $227 million, $49 million and

$5 million, respectively, and our franchise and license fees

and Other income would have decreased $14 million and

$13 million, respectively. The net impact of these changes and

the resulting minority interest would have resulted in Operat-

ing profit increasing by $11 million with an offsetting increase

in Income tax provision such that Net income would not have

been impacted.

STORE PORTFOLIO STRATEGY From time to time we sell

Company restaurants to existing and new franchisees where

geographic synergies can be obtained or where franchisees’

expertise can generally be leveraged to improve our overall

operating performance, while retaining Company ownership

of strategic U.S. and international markets. In the U.S., we

are targeting Company ownership of restaurants potentially

below 10% by year end 2010, down from its current level of

22%. Consistent with this strategy, 756 Company restaurants

in the U.S. were sold to franchisees in 2006 and 2007. In the

International Division, we expect to refranchise approximately

300 Pizza Huts in the U.K. over the next several years reduc-

ing our Pizza Hut Company ownership in that market from

approximately 80% currently to approximately 40%. Refran-

chisings reduce our reported revenues and restaurant profits

and increase the importance of system sales growth as a

key performance measure. Additionally, G&A expenses will

decline over time as a result of these refranchising activities.

The timing of such declines will vary and often lag the actual

refranchising activities as the synergies are typically depen-

dent upon the size and geography of the respective deals.

G&A expenses included in the tables below reflect only direct

G&A that we are no longer incurring as a result of stores that

were operated by us for all or some of the respective previous

year and were no longer operated by us as of the last day of

the respective year.

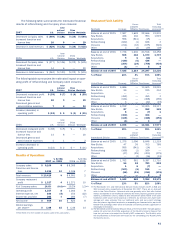

The following table summarizes our worldwide refranchis-

ing activities:

2007 2006 2005

Number of units refranchised 420 622 382

Refranchising proceeds, pre-tax $ 117 $ 257 $ 145

Refranchising net gains, pre-tax $ 11 $ 24 $ 43

In addition to our refranchising program, from time to time

we close restaurants that are poor performing, we relocate

restaurants to a new site within the same trade area or we

consolidate two or more of our existing units into a single unit

(collectively “store closures”). Store closure (income) costs

includes the net of gain or loss on sales of real estate on

which we formerly operated a Company restaurant that was

closed, lease reserves established when we cease using a

property under an operating lease and subsequent adjust-

ments to those reserves, and other facility-related expenses

from previously closed stores.

The following table summarizes worldwide Company store

closure activities:

2007 2006 2005

Number of units closed 204 214 246

Store closure (income) costs $ (8) $ (1) $ —

The impact on operating profit arising from refranchising

and Company store closures is the net of (a) the estimated

reductions in restaurant profit, which reflects the decrease

in Company sales, and G&A expenses and (b) the estimated

increase in franchise fees from the stores refranchised. The

amounts presented below reflect the estimated historical

results from stores that were operated by us for all or some

portion of the respective previous year and were no longer

operated by us as of the last day of the respective year. The

amounts do not include results from new restaurants that we

opened in connection with a relocation of an existing unit or

any incremental impact upon consolidation of two or more of

our existing units into a single unit.