Pizza Hut 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

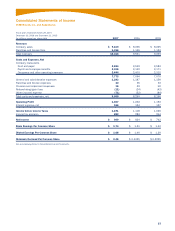

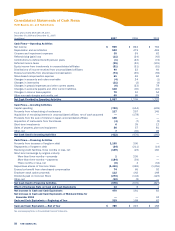

60 YUM! BRANDS, INC.

Consolidated Statements of Shareholders’ Equity

and Comprehensive Income

YUM! Brands, Inc. and Subsidiaries

Accumulated

Fiscal years ended December 29, 2007, Other

December 30, 2006 and December 31, 2005 Issued Common Stock Retained Comprehensive

(in millions, except per share data) Shares Amount Earnings Income (Loss) Total

Balance at December 25, 2004 581 $ 659 $ 1,074 $ (131) $ 1,602

Net income 762 762

Foreign currency translation adjustment arising during

the period (31) (31)

Foreign currency translation adjustment included in

net income 6 6

Minimum pension liability adjustment (net of tax impact

of $8 million) (15) (15)

Net unrealized gain on derivative instruments (net of

tax impact of $1 million) 1 1

Comprehensive Income 723

Dividends declared on Common Stock ($0.2225 per

common share) (129) (129)

China December 2004 net income 6 6

Repurchase of shares of Common Stock (43) (974) (82) (1,056)

Employee stock option exercises (includes tax impact

of $94 million) 17 242 242

Compensation-related events (includes tax impact

of $5 million) 1 73 73

Balance at December 31, 2005 556 $ — $ 1,631 $ (170) $ 1,461

Adjustment to initially apply SAB No. 108 100 100

Net income 824 824

Foreign currency translation adjustment arising during

the period (includes tax impact of $13 million) 59 59

Minimum pension liability adjustment (net of tax impact

of $11 million) 17 17

Net unrealized gain on derivative instruments

(net of tax impact of $3 million) 5 5

Comprehensive Income 905

Adjustment to initially apply SFAS No. 158 (net of tax

impact of $37 million) (67) (67)

Dividends declared on Common Stock

($0.4325 per common share) (234) (234)

Repurchase of shares of Common Stock (40) (287) (713) (1,000)

Employee stock option and SARs exercises

(includes tax impact of $68 million) 13 210 210

Compensation-related events (includes tax impact

of $3 million) 1 77 77

Balance at December 30, 2006 530 $ — $ 1,608 $ (156) $ 1,452

Net income 909 909

Foreign currency translation adjustment arising during

the period 93 93

Foreign currency translation adjustment included in

net income 1 1

Pension and post-retirement benefit plans (net of tax

impact of $55 million) 96 96

Net unrealized loss on derivative instruments (net of

tax impact of $8 million) (14) (14)

Comprehensive Income 1,085

Adjustment to initially apply FIN 48 (13) (13)

Dividends declared on Common Stock

($0.45 per common share) (231) (231)

Repurchase of shares of Common Stock (42) (252) (1,154) (1,406)

Employee stock option and SARs exercises

(includes tax impact of $69 million) 10 181 181

Compensation-related events (includes tax impact

of $5 million) 1 71 71

Balance at December 29, 2007 499 $ — $ 1,119 $ 20 $ 1,139

See accompanying Notes to Consolidated Financial Statements.