Pizza Hut 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38 YUM! BRANDS, INC.

Dramatically Improve U.S. Brand Positions, Consistency and

Returns The Company continues to focus on improving its

U.S. position through differentiated products and marketing

and an improved customer experience. The Company also

strives to provide industry leading new product innovation

which adds sales layers and expands day parts. We are the

leader in multibranding, with nearly 3,700 restaurants provid-

ing customers two or more of our brands at a single location.

We continue to evaluate our returns and ownership positions

with an earn the right to own philosophy on Company owned

restaurants. Our ongoing earnings growth model calls for

annual operating profit growth of 5% in the U.S. with same

store sales growth of 2% to 3% and leverage of our General

and Administrative (“G&A”) infrastructure.

Drive Industry-Leading, Long-Term Shareholder and Fran-

chisee Value The Company is focused on delivering high

returns and returning substantial cash flows to its sharehold-

ers via share repurchases and dividends. The Company has

one of the highest returns on invested capital in the Quick

Service Restaurants (“QSR”) industry. Additionally, 2007 was

the third consecutive year in which the Company returned over

$1.1 billion to its shareholders through share repurchases

and dividends. The Company is targeting an annual dividend

payout ratio of 35% to 40% of net income.

2007 HIGHLIGHTS

Diluted earnings per share of $1.68 or 15% growth

Worldwide system sales growth of 8% driven by new-unit

growth in mainland China and the International Division

Worldwide same store sales growth of 3% and operating

profit growth of 8%

Double digit operating profit growth of 30% from the

China Division and 18% from the International Division,

offsetting a 3% decline in the U.S.

Effective tax rate of 23.7%

Payout to shareholders of $1.7 billion through share

repurchases and dividends, with repurchases helping to

reduce our diluted share count by a net 4%

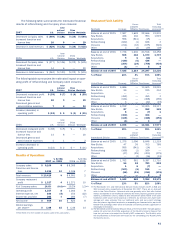

Significant Known Events, Trends or Uncertainties

Impacting or Expected to Impact Comparisons of

Reported or Future Results

The following factors impacted comparability of operating

performance for the years ended December 29,2007, Decem-

ber 30, 2006 and December 31, 2005 and could impact

comparability with our results in 2008.

MAINLAND CHINA COMMODITY INFLATION China Division res-

taurant margin as a percentage of sales declined to 20.1%

during 2007 from 20.4% in 2006. This decline was driven

by rising chicken costs in mainland China, which make up

approximately 40% of mainland China’s cost of food and

paper, and higher restaurant labor costs in mainland China.

Rising chicken costs are resulting from both lower than

expected availability and increased demand in the market.

The increased costs were partially offset in 2007 by strong

same store sales growth, including the impact of menu pricing

increases. In mainland China, we expect that high commodity

inflation (including higher chicken costs) will continue into the

first half of 2008 and moderate later in the year.

U.S. RESTAURANT PROFIT Our resulting U.S. restaurant mar-

gin as a percentage of sales decreased 1.3 percentage points

in 2007 and increased 0.8 percentage points in 2006. Our

U.S. restaurant profit was impacted in 2007 and 2006 by

several key events and trends. These include the negative

impact on the Taco Bell business of adverse publicity related

to a produce-sourcing issue in the fourth quarter of 2006

and an infestation issue in one franchise store in February

2007, fluctuations in commodity costs, and lower self-insured

property and casualty insurance reserves.

Taco Bell experienced significant sales declines at both

Company and franchise stores in the fourth quarter 2006

and for almost all of 2007, particularly in the northeast U.S.

where both issues originated. For the full year 2007, Taco

Bell’s Company same store sales were down 5%. Taco Bell’s

Company same store sales were flat in the fourth quarter of

2007 and we believe that Taco Bell will fully recover from these

issues. However, our experience has been that recoveries of

this type vary in duration.

In 2007, we experienced significant increases in commod-

ity costs resulting in approximately $44 million of commodity

inflation. This inflation was primarily driven by meats and

cheese products. We expect these unfavorable commodity

trends to continue in 2008 resulting in commodity inflation

of approximately 5% for the full year, with the majority of this

impact seen in the first half of the year. In 2006, restaurant

profits were positively impacted versus 2005 by a decline in

commodity costs, principally meats and cheese, of approxi-

mately $45 million.

The sizeable February 2008 beef recall in the U.S. had

no impact on our results though the impact, if any, on beef

prices going forward is not yet known.

Self-insurance property and casualty insurance expenses

were down $27 million versus the prior year in both 2007

and 2006, exclusive of the estimated reduction due to refran-

chising stores. The favorability in insurance expenses was

the result of improved loss trends, which we believe are pri-

marily driven by safety and claims handling procedures we

implemented over time, as well as workers’ compensation

reforms at the state level. We anticipate that given the sig-

nificant favorability in 2007, property and casualty expense in

2008 will be significantly higher in comparison. The increased

expenses are currently expected to be most impactful to our

second quarter of 2008.

PIZZA HUT UNITED KINGDOM ACQUISITION On Septem-

ber 12, 2006, we completed the acquisition of the remaining

fifty percent ownership interest of our Pizza Hut United King-

dom (“U.K.”) unconsolidated affiliate from our partner, paying

approximately $178 million in cash, including transaction

costs and net of $9 million of cash assumed. Additionally,

we assumed the full liability, as opposed to our fifty percent

share, associated with the Pizza Hut U.K.’s capital leases of

$97 million and short-term borrowings of $23 million. This

unconsolidated affiliate operated more than 500 restaurants

in the U.K.