Panera Bread 2010 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

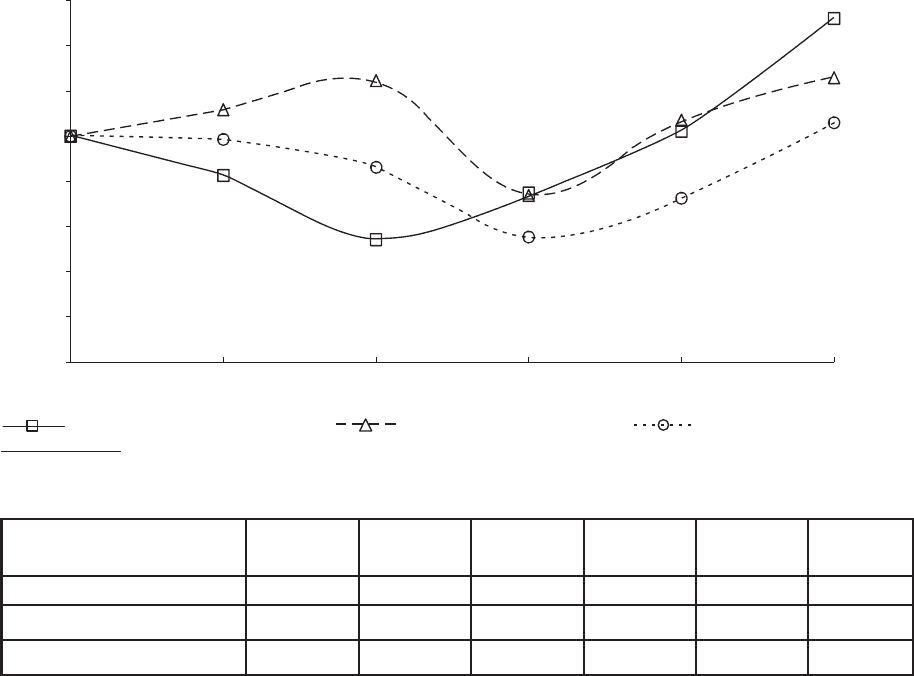

COMPARISON OF CUMULATIVE TOTAL RETURN

(Assumes $100 Investment on December 27, 2005)

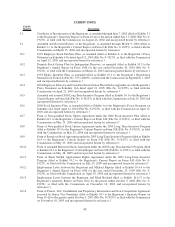

The following graph and chart compares the cumulative annual stockholder return on our Class A common

stock over the period commencing December 27, 2005 and ending on December 28, 2010, to that of the total return

for The NASDAQ Composite Index and the Standard & Poor’s (S&P) MidCap Restaurants Index, assuming an

investment of $100 on December 27, 2005. In calculating cumulative total annual stockholder return, reinvestment

of dividends, if any, is assumed. The indices are included for comparative purposes only. They do not necessarily

reflect management’s opinion that such indices are an appropriate measure of the relative performance of our

Class A common stock and are not intended to forecast or be indicative of future performance of the Class A

common stock. The following graph and related information shall not be deemed “soliciting material” or to be

“filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference in

any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as

amended, whether made before or after the date hereof and irrespective of any general incorporation language in

any such filing. We obtained information used on the graph from Research Data Group, Inc., a source we believe to

be reliable, but we disclaim any responsibility for any errors or omissions in such information.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Panera Bread Company, The NASDAQ Composite Index

And S&P MidCap Restaurants

$0

$20

$40

$60

$80

$100

$120

$140

$160

12/27/05 12/26/06 12/25/07 12/30/08 12/29/09 12/28/10

Panera Bread Company NASDAQ Composite S&P MidCap Restaurants

* $100 invested on 12/27/05 in stock or 12/31/05 in index, including reinvestment of dividends.

Indexes calculated on month-end basis.

Base Period

December 27,

2005

December 26,

2006

December 25,

2007

December 30,

2008

December 29,

2009

December 28,

2010

Panera Bread Company $100.00 $ 82.66 $ 54.19 $74.83 $102.26 $152.15

NASDAQ Composite Index $100.00 $111.74 $124.67 $73.77 $107.12 $125.93

S&P MidCap Restaurants Index $100.00 $ 98.60 $ 86.01 $55.28 $ 72.45 $105.97

For the S&P MidCap Restaurants Index and the NASDAQ Composite Index, the total return to stockholders is

based on the values of such indices as of the last trading day of the relevant calendar year, which may be different

from the end of our fiscal year.