Panera Bread 2010 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Earnings Per Share

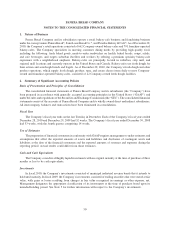

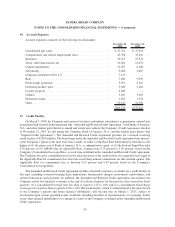

The Company accounts for earnings per common share in accordance with the relevant accounting guidance

which requires companies to present basic earnings per share and diluted earnings per share. Basic earnings per

share is computed by dividing net income attributable to the Company by the weighted-average number of shares of

common stock outstanding during the year. Diluted earnings per common share is computed by dividing net income

attributable to the Company by the weighted-average number of shares of common stock outstanding and dilutive

securities outstanding during the year.

Foreign Currency Translation

The Company has three Company-owned bakery-cafes in Canada which use the Canadian Dollar as their

functional currency. Assets and liabilities are translated into U.S. dollars using the current exchange rate in effect at

the balance sheet date, while revenues and expenses are translated at the weighted-average exchange rate during the

fiscal period. The resulting translation adjustments are recorded as a separate component of accumulated other

comprehensive income in the Consolidated Balance Sheet and Consolidated Statements of Stockholders’ Equity.

Gains and losses resulting from foreign currency transactions have not historically been significant and are included

in other expense, net in the Consolidated Statements of Operations.

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments, which include short-term investments in

trading securities, municipal industrial revenue bonds, accounts receivable, accounts payable, and other accrued

expenses, approximate their fair values due to their short maturities. The Company’s investments in trading

securities are stated at fair value, with gains or losses resulting from changes in fair value recognized currently in

earnings as other expense, net in the Consolidated Statements of Operations.

Stock-Based Compensation

The Company accounts for stock-based compensation in accordance with the accounting standard for stock-

based compensation, which requires the Company to measure and record compensation expense in the Company’s

consolidated financial statements for all stock-based compensation awards using a fair value method. The Company

maintains several stock-based incentive plans under which the Company may grant incentive stock options, non-

statutory stock options and stock settled appreciation rights (collectively, “option awards”) to certain directors,

officers, employees and consultants. The Company also may grant restricted stock and restricted stock units and the

Company offers a stock purchase plan where employees may purchase the Company’s common stock each calendar

quarter through payroll deductions at 85 percent of market value on the purchase date and the Company recognizes

compensation expense on the 15 percent discount.

For option awards, fair value is determined using the Black-Scholes option pricing model, while restricted

stock is valued using the closing stock price on the date of grant. The Black-Scholes option pricing model requires

the input of subjective assumptions. These assumptions include estimating the expected term until the option

awards are either exercised or canceled, the expected volatility of the Company’s stock price, for a period

approximating the expected term, the risk-free interest rate with a maturity that approximates the option awards

expected term, and the dividend yield based on the Company’s anticipated dividend payout over the expected term

of the option awards. Additionally, the Company uses its historical experience to estimate the expected forfeiture

rate in determining the stock-based compensation expense for these awards. The fair value of the awards is

amortized over the vesting period. Options and restricted stock generally vest ratably over a four-year period

beginning two years from the date of grant and options generally have a six-year term. Stock-based compensation

expense was included in general and administrative expenses in the Consolidated Statements of Operations.

56

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)