Panera Bread 2010 Annual Report Download - page 31

Download and view the complete annual report

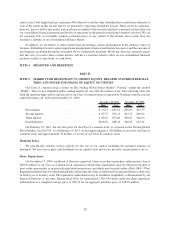

Please find page 31 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF CONSOLIDATED FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

General

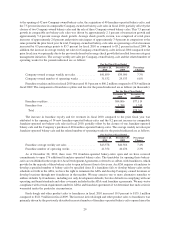

Our revenues are derived from Company-owned net bakery-cafe sales, fresh dough and other product sales to

franchisees, and franchise royalties and fees. Fresh dough and other product sales to franchisees are primarily

comprised of sales of fresh dough, produce, tuna, and cream cheese to certain of our franchisees. The cost of food

and paper products, labor, occupancy, and other operating expenses relate primarily to Company-owned net bakery-

cafe sales. The cost of fresh dough and other product sales to franchisees relates primarily to the sale of fresh dough,

produce, tuna, and cream cheese to franchisees. General and administrative, depreciation and amortization, and pre-

opening expenses relate to all areas of revenue generation.

Our fiscal year ends on the last Tuesday in December. Each of our fiscal years ended December 28, 2010 and

December 29, 2009, had 52 weeks. Our fiscal year ended December 30, 2008 had 53 weeks, with the fourth quarter

comprising 14 weeks.

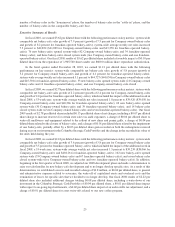

Use of Non-GAAP Measurements

We include in this report information on Company-owned, franchise-operated, and system-wide comparable

net bakery-cafe sales percentages. In fiscal 2010, we modified the method by which we determine bakery-cafes

included in our comparable net bakery-cafe sales percentages to include those bakery-cafes with an open date prior

to the first day of our prior fiscal year, which we refer to as our base store bakery-cafes. Previously, comparable net

bakery-cafe sales percentages were based on bakery-cafes that had been in operation for 18 months. While this

methodology modification did not have a material impact on previously reported amounts, prior periods have been

updated to conform to current methodology. Company-owned comparable net bakery-cafe sales percentages are

based on sales from Company-owned bakery-cafes included in our base store bakery-cafes. Franchise-operated

comparable net bakery-cafe sales percentages are based on sales from franchise-operated bakery-cafes, as reported

by franchisees, that are included in our base store bakery-cafes. System-wide comparable net bakery-cafe sales

percentages are based on sales at Company-owned and franchise-operated bakery-cafes that are included in our

base store bakery-cafes. Acquired Company-owned and franchise-operated bakery-cafes and other restaurant or

bakery-cafe concepts are included in our comparable net bakery-cafe sales percentages after we have acquired a

100 percent ownership interest and such acquisition occurred prior to the first day of our prior fiscal year.

Comparable net bakery-cafe sales exclude closed locations.

Comparable net bakery-cafe sales percentages are non-GAAP financial measures, which should not be

considered in isolation or as a substitute for other measures of performance prepared in accordance with generally

accepted accounting principles in the United States, or GAAP, and may not be equivalent to comparable net bakery-

cafe sales as defined or used by other companies. We do not record franchise-operated net bakery-cafe sales as

revenues. However, royalty revenues are calculated based on a percentage of franchise-operated net bakery-cafe

sales, as reported by franchisees. We use franchise-operated and system-wide sales information internally in

connection with store development decisions, planning, and budgeting analyses. We believe franchise-operated and

system-wide sales information is useful in assessing consumer acceptance of our brand, facilitates an understanding

of our financial performance and the overall direction and trends of sales and operating income, helps us appreciate

the effectiveness of our advertising and marketing initiatives, to which our franchisees also contribute based on a

percentage of their net sales, and provides information that is relevant for comparison within the industry.

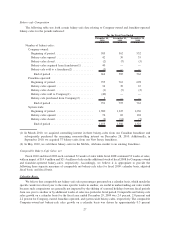

We also include in this report information on Company-owned, franchise-operated, and system-wide average

weekly net sales. Average weekly net sales are calculated by dividing total net sales in the period by operating weeks

in the period. Accordingly, year-over-year results reflect sales for all locations, whereas comparable net bakery-cafe

sales exclude closed locations and are based on sales from bakery-cafes included in our base store bakery-cafes.

New stores typically experience an opening “honeymoon” period during which they generate higher average

weekly net sales in the first 12 to 16 weeks they are open as customers “settle-in” to normal usage patterns from

initial trial of the location. On average, the “settle-in” experienced is 5 percent to 10 percent less than the average

weekly net sales during the “honeymoon” period. As a result, year-over-year results of average weekly net sales are

generally lower than the results in comparable net bakery-cafe sales. This results from the relationship of the

24