Panera Bread 2010 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13. Commitments and Contingent Liabilities

Lease Commitments

The Company is obligated under non-cancelable operating leases for its bakery-cafes, fresh dough facilities

and trucks, and support centers. Lease terms for its trucks are generally for five to seven years. Lease terms for its

bakery-cafes, fresh dough facilities, and support centers are generally for ten years with renewal options at certain

locations and generally require the Company to pay a proportionate share of real estate taxes, insurance, common

area, and other operating costs. Many bakery-cafe leases provide for contingent rental (i.e., percentage rent)

payments based on sales in excess of specified amounts. Certain of the Company’s lease agreements provide for

scheduled rent increases during the lease terms or for rental payments commencing at a date other than the date of

initial occupancy.

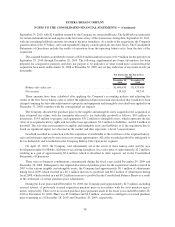

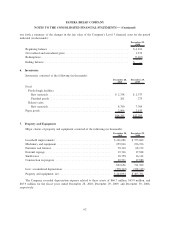

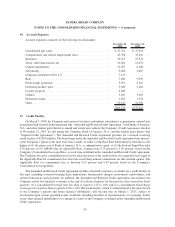

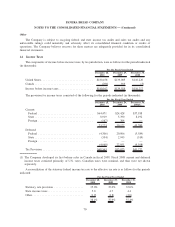

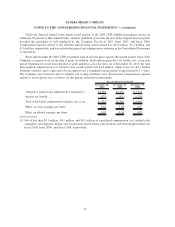

Aggregate minimum requirements under non-cancelable operating leases, excluding contingent payments, as

of December 28, 2010, were as follows (in thousands):

2011 2012 2013 2014 2015 Thereafter Total

$93,303 94,444 94,566 92,959 91,013 540,065 $1,006,350

Rental expense under operating leases was approximately $87.4 million, $79.9 million, and $77.9 million, in

fiscal 2010, fiscal 2009, and fiscal 2008, respectively, which included contingent (i.e. percentage rent) expense of

$1.1 million, $0.8 million, and $1.1 million, respectively.

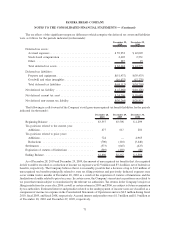

In accordance with the accounting guidance for asset retirement obligations the Company complies with lease

obligations at the end of a lease as it relates to tangible long-lived assets. The liability as of December 28, 2010 and

December 29, 2009 was $5.2 million and $4.3 million, respectively, and is included in other long-term liabilities in

the Consolidated Balance Sheets.

During the first quarter of fiscal 2008, the Company recorded a reserve of $1.2 million relating to the

termination of operating leases for specific sites, which the Company determined not to develop. During fiscal

2010, the Company, settled two leases, and made a decision to open one bakery-cafe resulting in a decrease in the

reserve of approximately $0.4 million, offset by an increase of $0.2 million related to a revised sublet factor for a

specified cafe. No other significant changes were made to the accrual throughout fiscal 2010. As of December 28,

2010, the Company had approximately $0.6 million accrued in its Consolidated Balance Sheets relating to the

termination of these specific leases. During fiscal 2009, the Company made required lease payments on certain of

these sites, settled one lease, and made a decision to open two bakery-cafes resulting in a decrease in the reserve of

approximately $0.5 million. The Company increased its reserve by $0.4 million for the termination of operating

leases for three additional sites it closed or determined not to develop. No other significant changes were made to

the accrual throughout fiscal 2009. As of December 29, 2009, the Company had approximately $0.8 million accrued

in its Consolidated Balance Sheets relating to the termination of these specific leases. During fiscal 2008, the

Company settled one lease and decreased the reserve by approximately $0.3 million. No other significant changes

were made to the accrual throughout fiscal 2008. As of December 30, 2008, the Company had approximately

$0.9 million accrued in its Consolidated Balance Sheets relating to the termination of these specific leases.

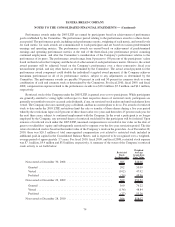

In connection with the Company’s relocation of its St. Louis, Missouri support center in the third quarter of

fiscal 2010, it simultaneously entered into a capital lease of $1.5 million for certain personal property and purchased

municipal industrial revenue bonds of a similar amount from St. Louis County, Missouri.

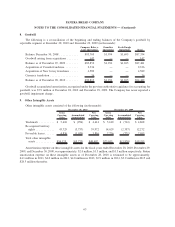

Lease Guarantees

As of December 28, 2010, the Company guaranteed operating leases of 27 franchisee or affiliate bakery-cafes

and one location of the Company’s former Au Bon Pain division, or its franchisees, which the Company accounted

for in accordance with the accounting requirements for guarantees. These leases have terms expiring on various

dates from December 31, 2010 to December 31, 2023 and have a potential amount of future rental payments of

66

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)