Panera Bread 2010 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

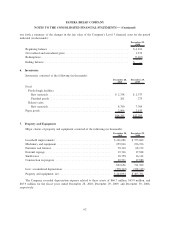

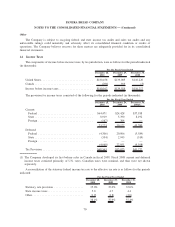

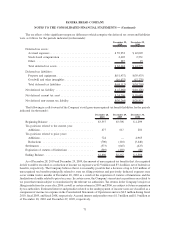

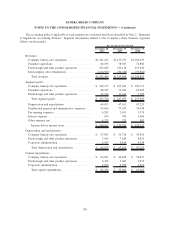

15. Deposits and Other

Deposits and other consisted of the following (in thousands):

December 28,

2010

December 29,

2009

Deposits ............................................... $5,032 $3,800

Deferred financing costs .................................... 561 821

Investment in municipal revenue bonds ......................... 1,365 —

Total deposits and other .................................... $6,958 $4,621

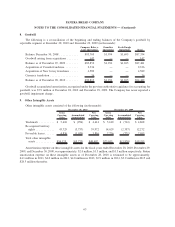

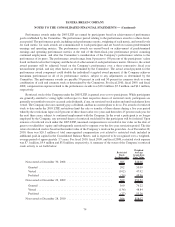

16. Stockholders’ Equity

Common Stock

The holders of Class A common stock are entitled to one vote for each share owned. The holders of Class B

common stock are entitled to three votes for each share owned. Each share of Class B common stock has the same

dividend and liquidation rights as each share of Class A common stock. Each share of Class B common stock is

convertible, at the stockholder’s option, into Class A common stock on a one-for-one basis. At December 28, 2010,

the Company had reserved 2,735,881 shares of its Class A common stock for issuance upon exercise of awards

granted under the Company’s 1992 Equity Incentive Plan, 2001 Employee, Director, and Consultant Stock Option

Plan, and the 2006 Stock Incentive Plan, and upon conversion of Class B common stock.

Registration Rights

At December 28, 2010, 94.3 percent of the Class B common stock is owned by the Company’s Executive

Chairman of the Board (“Chairman”). Certain holders of Class B common stock, including the Chairman, pursuant

to stock subscription agreements, can require the Company under certain circumstances to register their shares

under the Securities Exchange Act of 1933, or have included in certain registrations all or part of such shares at the

Company’s expense.

Preferred Stock

The Company is authorized to issue 2,000,000 shares of Class B preferred stock with a par value of $.0001. The

voting, redemption, dividend, liquidation rights, and other terms and conditions are determined by the Board of

Directors upon approval of issuance. There were no shares issued or outstanding in fiscal years 2010 and 2009.

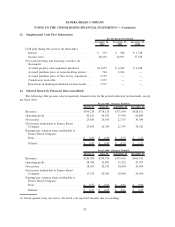

Treasury Stock

Pursuant to the terms of the Panera Bread 1992 Stock Incentive Plan and the Panera Bread 2006 Stock

Incentive Plan and the applicable award agreements, the Company repurchased 44,002 shares of Class A common

stock at a weighted-average cost of $77.99 per share during fiscal 2010, 32,135 shares of Class A common stock at a

weighted-average cost of $53.66 per share during fiscal 2009, and 20,378 shares of Class A common stock at a

weighted-average cost of $49.87 per share during fiscal 2008, as were surrendered by participants as payment of

applicable tax withholdings on the vesting of restricted stock. Shares so surrendered by the participants are

repurchased by the Company at fair market value pursuant to the terms of those plans and the applicable award

agreements and not pursuant to publicly announced share repurchase authorizations. The shares surrendered to the

Company by participants and repurchased by the Company are currently held by the Company as treasury stock.

72

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)