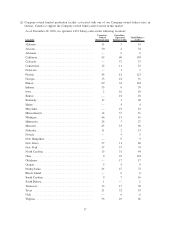

Panera Bread 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.value of our confidential and proprietary information could be harmed. If this occurs, our business and operating

results could be adversely affected.

Damage to our brands or reputation could negatively impact our business.

Our success depends substantially on the value of our brands and our reputation for offering a memorable

experience with superior customer service. Our brands have been highly rated in annual consumer studies and have

received high recognition in several industry publications. We believe that we must protect and grow the value of

our brands through our Concept Essence to differentiate ourselves from our competitors and continue our success.

Any incident that erodes consumer trust in or affinity for our brands could significantly reduce their value. If

consumers do not continue to perceive us as a company that customers can trust to serve high quality food in a warm,

friendly, comfortable environment, our brand value could suffer, which could have an adverse effect on our

business.

Competition may adversely affect our operations and consolidated results of operations.

The restaurant industry is highly competitive with respect to location, customer service, price, taste, quality of

products, and overall customer experience. We compete with specialty food, casual dining, and quick-service

restaurant retailers, including national, regional, and locally owned restaurants. Many of our competitors or

potential competitors have substantially greater financial and other resources than we do, which may allow them to

react to changes in pricing, marketing, and the restaurant industry better than we can. Additionally, other companies

may develop restaurants that operate with concepts similar to ours. We also compete with other restaurant chains

and other retail businesses for quality site locations and hourly employees. If we are unable to successfully compete

in our markets, we may be unable to sustain or increase our revenues and profitability.

Additionally, competition could cause us to modify or evolve our products, designs, or strategies. If we do so,

we cannot guarantee that we will be successful in implementing the changes or that our profitability will not be

negatively impacted.

Loss of senior management or the inability to recruit and retain associates could adversely affect our

future success.

Our success depends on the services of our senior management and associates, all of whom are “at will”

employees. The loss of a member of senior management could have an adverse impact on our business or the

financial market’s perception of our ability to continue to grow.

Our success also depends on our continuing ability to hire, train, motivate, and retain qualified associates in our

bakery-cafes, fresh dough facilities, and support centers. Our failure to do so could result in higher associate

turnover and increased labor costs, and could compromise the quality of our service, all of which could adversely

affect our business.

We operate in Canada and therefore, we may be exposed to uncertainties and risks that could negatively

impact our consolidated results of operations.

We recently expanded our operations into Canadian markets. Our expansion into Canada has made us subject

to Canadian economic conditions, particularly currency exchange rate fluctuations, increased regulations, quotas,

tariffs, and political factors, any of which could have a material adverse effect on our consolidated financial

condition and results of operations if our Canadian operations continue to expand. Further, we may be exposed to

new forms of competition not present in our domestic markets, as well as subject to potentially different

demographic tastes and preferences for our products.

If we fail to comply with governmental laws or regulations or if these laws or regulations change, our

business could suffer.

In connection with the operation of our business, we are subject to extensive federal, state, local, and foreign

laws and regulations, including those related to:

• franchise relationships;

• building construction and zoning requirements;

12