Panera Bread 2010 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Share Repurchase Authorization

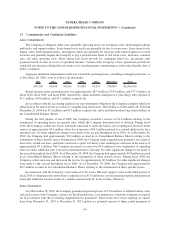

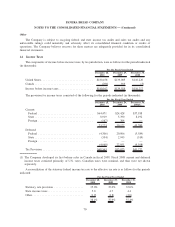

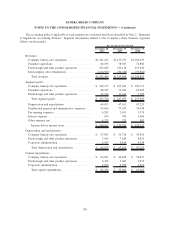

During fiscal 2010, fiscal 2009, and fiscal 2008, the Company purchased shares of Class A common stock

under authorized share repurchase authorizations. Repurchased shares may be retired immediately and resume the

status of authorized but unissued shares or may be held by the Company as treasury stock. See Note 12 for further

information with respect to the Company’s share repurchase authorizations.

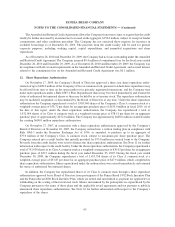

17. Stock-Based Compensation

The Company accounts for its stock-based compensation arrangements in accordance with the accounting

standard for share-based payments in the Company’s consolidated financial statements and accompanying notes,

which requires the Company to measure and record compensation expense in its consolidated financial statements

for all stock-based compensation awards using a fair value method.

As of December 28, 2010, the Company had one active stock-based compensation plan, the 2006 Stock

Incentive Plan (“2006 Plan”), and had options and restricted stock outstanding (but can make no future grants) under

two other stock-based compensation plans, the 1992 Equity Incentive Plan (“1992 Plan”) and the 2001 Employee,

Director, and Consultant Stock Option Plan (“2001 Plan”).

2006 Stock Incentive Plan

In the first quarter of fiscal 2006, the Company’s Board of Directors adopted the 2006 Plan, which was

approved by the Company’s stockholders in May 2006. The 2006 Plan provided for the grant of up to

1,500,000 shares of the Company’s Class A common stock (subject to adjustment in the event of stock splits

or other similar events) as incentive stock options, non-statutory stock options and stock settled appreciation rights

(collectively “option awards”), restricted stock, restricted stock units, and other stock-based awards. Effective

May 13, 2010, the Plan was amended to increase the number of the Company’s Class A common stock shares

available to grant to 2,300,000. As a result of stockholder approval of the 2006 Plan, effective as of May 25, 2006,

the Company will grant no further stock options, restricted stock or other awards under the 2001 Plan or the 1992

Plan. The Company’s Board of Directors administers the 2006 Plan and has sole discretion to grant awards under the

2006 Plan. The Company’s Board of Directors has delegated the authority to grant awards under the 2006 Plan,

other than to the Company’s Chairman and Chief Executive Officer, to the Company’s Compensation and Stock

Option Committee (“the Committee”).

Long-Term Incentive Program

In the third quarter of 2005, the Company adopted the 2005 Long Term Incentive Plan (“2005 LTIP”) as a

sub-plan under the 2001 Plan and the 1992 Plan. In May 2006, the Company amended the 2005 LTIP to provide that

the 2005 LTIP is a sub-plan under the 2006 Plan. Under the amended 2005 LTIP, certain directors, officers,

employees, and consultants, subject to approval by the Committee, may be selected as participants eligible to

receive a percentage of their annual salary in future years, subject to the terms of the 2006 Plan. This percentage is

based on the participant’s level in the Company. In addition, the payment of this incentive can be made in several

forms based on the participant’s level including performance awards (payable in cash or common stock or some

combination of cash and common stock as determined by the Committee), restricted stock, choice awards of

restricted stock or options, or deferred annual bonus match awards. On July 23, 2009, the Committee further

amended the 2005 LTIP to permit the Company to grant stock settled appreciation rights (“SSARs”) under the

choice awards and to clarify that the Committee may consider the Company’s performance relative to the

performance of its peers in determining the payout of performance awards, as further discussed below. For fiscal

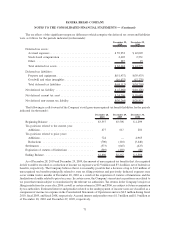

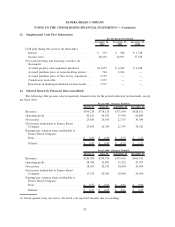

2010, fiscal 2009 and fiscal 2008, compensation expense related to performance awards, restricted stock, and

deferred annual bonus match was $19.3 million, $12.1 million, and $6.9 million, respectively.

73

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)