Panera Bread 2010 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

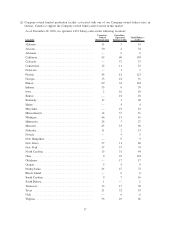

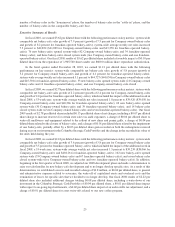

Location

Company-

Owned

Bakery-Cafes

Franchise-

Operated

Bakery-Cafes

Total Bakery-

Cafes

Washington .................................. 16 1 17

WestVirginia ................................ — 7 7

Wisconsin ................................... — 25 25

District of Columbia ........................... 1 — 1

Ontario, Canada............................... 3 — 3

662 791 1,453

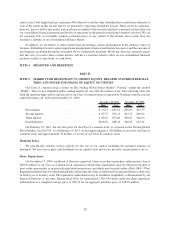

ITEM 3. LEGAL PROCEEDINGS

On January 25, 2008 and February 26, 2008, purported class action lawsuits were filed against us and three of

our current or former executive officers by the Western Washington Laborers-Employers Pension Trust and Sue

Trachet, respectively, on behalf of investors who purchased our common stock during the period between

November 1, 2005 and July 26, 2006. Both lawsuits were filed in the United States District Court for the Eastern

District of Missouri, St. Louis Division. Each complaint alleges that we and the other defendants violated

Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 10b-5

under the Exchange Act in connection with our disclosure of system-wide sales and earnings guidance during the

period from November 1, 2005 through July 26, 2006. Each complaint seeks, among other relief, class certification

of the lawsuit, unspecified damages, costs and expenses, including attorneys’ and experts’ fees, and such other relief

as the Court might find just and proper. On June 23, 2008, the lawsuits were consolidated and the Western

Washington Laborers-Employers Pension Trust was appointed lead plaintiff. On August 7, 2008, the plaintiff filed

an amended complaint, which extended the class period to November 1, 2005 through July 26, 2007. On October 6,

2008, we filed a motion to dismiss all of the claims in this lawsuit. Following filings by both parties on our motion to

dismiss, on June 25, 2009, the Court converted our motion to one for summary judgment and denied it without

prejudice. On August 10, 2009, we filed a new motion for summary judgment. On September 9, 2009, the plaintiff

filed a request to deny or continue our motion for summary judgment to allow the plaintiff to conduct discovery.

Following a hearing and subsequent filings by both parties on the plaintiff’s request for discovery, on November 6,

2009, the Court denied the plaintiff’s request. On March 16, 2010, the Court granted in part and denied in part our

motion for summary judgment. On April 5, 2010, the Court granted a joint motion by the parties to stay the case

through July 6, 2010, which stay was subsequently extended by the Court until July 30, 2010, pending an attempt by

the parties to resolve through mediation. On August 30, 2010 we answered the complaint. On December 3, 2010, the

parties filed a joint motion to stay the case pending the submission of a stipulation of settlement and the plaintiff’s

motion for preliminary approval, to be filed on or before January 28, 2011, which stay was extended until

February 11, 2011. On February 11, 2011, the parties filed with the Court a Stipulation of Settlement regarding the

class action lawsuit. Under the terms of the Stipulation of Settlement, our primary directors and officers liability

insurer will deposit $5.7 million into a settlement fund for payment to class members, plaintiff’s attorneys’ fees and

costs of administering the settlement. The settlement must be approved by the Court before becoming effective. The

Stipulation of Settlement contains no admission of wrongdoing. We and the other defendants have maintained and

continue to deny liability and wrongdoing of any kind with respect to the claims made in the class action lawsuit.

However, given the potential cost and burden of continued litigation, we believe the settlement is in our best

interests and the best interests of our stockholders. On February 22, 2011, the Court preliminarily approved the

settlement and scheduled a settlement hearing on June 22, 2011. If the Court grants final approval of the Stipulation

of Settlement, the Court will dismiss the class action lawsuit with prejudice and the plaintiff will be deemed to have

released all claims against us relating to the allegations in the class action. We can provide no assurance that the

Court will approve the Stipulation of Settlement. If the Court does not approve the Stipulation of Settlement, we will

continue to defend against these claims, which could have a material adverse effect on our financial condition and

business. If these matters were concluded in a manner adverse to us, we could be required to pay substantially more

in damages than the amount provided for in the Stipulation of Settlement. In addition, the costs to us of defending

any litigation or other proceeding, even if resolved in our favor, could be substantial. Such litigation could also

substantially divert the attention of our management and our resources in general. The amount to be

18