Panera Bread 2010 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Asset Retirement Obligations

The Company recognizes the future cost to comply with lease obligations at the end of a lease as it relates to

tangible long-lived assets in accordance with the accounting standard for the asset retirement and environmental

obligations in the Company’s consolidated financial statements. A liability for the fair value of an asset retirement

obligation along with a corresponding increase to the carrying value of the related long-lived asset is recorded at the

time a lease agreement is executed. The Company amortizes the amount added to property and equipment and

recognizes accretion expense in connection with the discounted liability over the life of the respective lease. The

estimated liability is based on the Company’s historical experience in closing bakery-cafes, FDFs, and support

centers and the related external cost associated with these activities. Revisions to the liability could occur due to

changes in estimated retirement costs or changes in lease terms.

Variable Interest Entities

The Company applies the updated guidance issued by the FASB on accounting for variable interest entities

(“VIE”), which changes the process for how an enterprise determines which party consolidates a VIE to a primarily

qualitative analysis. The enterprise that consolidates the VIE (the primary beneficiary) is defined as the enterprise

with (1) the power to direct activities of the VIE that most significantly affect the VIE’s economic performance and

(2) the obligation to absorb losses of the VIE or the right to receive benefits from the VIE. Upon adoption,

companies must reconsider their conclusions on whether an entity should be consolidated and, should a change

result, record the effect on net assets as a cumulative effect adjustment to retained earnings. The Company does not

possess any ownership interests in franchise entities or other affiliates. The franchise agreements are designed to

provide the franchisee with key decision-making ability to enable it to oversee its operations and to have a

significant impact on the success of the franchise, while the Company’s decision-making rights are related to

protecting its brand. Based upon its analysis of all the relevant facts and considerations of the franchise entities and

other affiliates, the Company has concluded that these entities are not variable interest entities and they have not

been consolidated.

Accounting Standards Issued Not Yet Adopted

On December 30, 2009, the Company adopted the updated guidance issued by the Financial Accounting

Standards Board (“FASB”) related to fair value measurements and disclosures, which requires a reporting entity to

separately disclose the amounts of significant transfers in and out of Level 1 and Level 2 fair value measurements

and to describe the reasons for the transfers. The updated guidance also requires that an entity provide fair value

measurement disclosures for each class of assets and liabilities and disclosures about the valuation techniques and

inputs used to measure fair value for both recurring and non-recurring Level 2 and Level 3 fair value measurements.

This guidance was effective for interim or annual financial reporting periods beginning after December 15, 2009.

The adoption of this updated guidance did not have an impact on the Company’s consolidated results of operations

or financial condition. In addition, the updated guidance requires that in the reconciliation for fair value

measurements using significant unobservable inputs, or Level 3, a reporting entity separately disclose information

about purchases, sales, issuances and settlements on a gross basis rather than as one net number. This guidance is

effective for fiscal years beginning after December 15, 2010 and for interim periods therein. Therefore, the

Company has not yet adopted the guidance with respect to the roll forward activity in Level 3 fair value

measurements. The Company expects that the adoption of this new guidance will not have a material effect on

its consolidated financial position or results of operations.

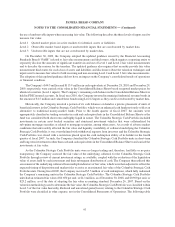

3. Business Combinations

On September 29, 2010 the Company purchased substantially all the assets and certain liabilities of 37 bakery-

cafes and the area development rights from its New Jersey franchisee for a purchase price of approximately

$55.0 million. Approximately $52.2 million of the purchase price, as well as related transaction costs, were paid on

57

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)