Panera Bread 2010 Annual Report Download - page 76

Download and view the complete annual report

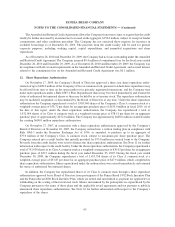

Please find page 76 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Settlement, the Company agreed, among other things, to implement and maintain certain corporate governance

additions, modifications and/or formalizations, and its insurer will pay plaintiff’s attorneys’ fees and expenses of

$1.4 million. The Stipulation of Settlement contains no admission of wrongdoing. The Company and the other

defendants have maintained and continue to deny liability and wrongdoing of any kind with respect to the claims

made in the shareholder derivative action. However, given the potential cost and burden of continued litigation, the

Company believes the settlement is in its best interests and the best interests of our stockholders. On February 22,

2011, the Court preliminarily approved the settlement and scheduled a settlement hearing on April 8, 2011. If the

Court grants final approval of the Stipulation of Settlement, the Court will dismiss the shareholder derivative lawsuit

with prejudice and the plaintiff will be deemed to have released all claims against the Company relating to the

allegations in the derivative action. The Company can provide no assurance that the Court will approve the

Stipulation of Settlement. If the Court does not approve the Stipulation of Settlement, it will continue to defend

against these claims, which could have a material adverse effect on our financial condition and business. If these

matters were concluded in a manner adverse to the Company, it could be required to pay substantially more in

damages than the amount provided for in the Stipulation of Settlement. In addition, the costs to the Company of

defending any litigation or other proceeding, even if resolved in its favor, could be substantial. Such litigation could

also substantially divert the attention of its management and resources in general. The amount to be deposited by the

Company’s primary directors and officers liability insurer into the settlement fund of $1.4 million is included in

other accounts receivable and accrued expenses in the Company’s Consolidated Balance Sheets.

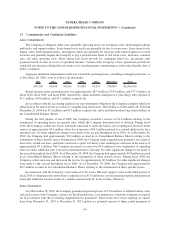

On December 9, 2009, a purported class action lawsuit was filed against the Company and one of its

subsidiaries by Nick Sotoudeh, a former employee of the Company. The lawsuit was filed in the California Superior

Court, County of Contra Costa. The complaint alleges, among other things, violations of the California Labor Code,

failure to pay overtime, failure to provide meal and rest periods and termination compensation and violations of

California’s Unfair Competition Law. The complaint seeks, among other relief, collective and class certification of

the lawsuit, unspecified damages, costs and expenses, including attorneys’ fees, and such other relief as the Court

might find just and proper. The Company believes it and the other defendant have meritorious defenses to each of

the claims in this lawsuit and the Company is prepared to vigorously defend the lawsuit. There can be no assurance,

however, that the Company will be successful, and an adverse resolution of the lawsuit could have a material

adverse effect on the Company’s consolidated financial position and results of operations in the period in which the

lawsuit is resolved. The Company is not presently able to reasonably estimate potential losses, if any, related to the

lawsuit and as such, has not recorded a liability in its Consolidated Balance Sheets.

On December 16, 2010, a purported class action lawsuit was filed against the Company by Denarius Lewis and

Corey Weiner, former employees of one of the Company’s subsidiaries, and Caroll Ruiz, an employee of one of the

Company’s franchisees. The lawsuit was filed in the United States District Court for Middle District of Florida. The

complaint alleges, among other things, violations of the Fair Labor Standards Act. The complaint seeks, among

other relief, collective, and class certification of the lawsuit, unspecified damages, costs and expenses, including

attorneys’ fees and such other relief as the Court might find just and proper. The Company believes it and the other

defendant have meritorious defenses to each of the claims in this lawsuit and the Company is prepared to vigorously

defend the lawsuit. There can be no assurance, however, that the Company will be successful, and an adverse

resolution of the lawsuit could have a material adverse effect on the Company’s consolidated financial position and

results of operations in the period in which the lawsuit is resolved. The Company is not presently able to reasonably

estimate potential losses, if any, related to the lawsuit and as such, has not recorded a liability in its Consolidated

Balance Sheets.

In addition, the Company is subject to other routine legal proceedings, claims, and litigation in the ordinary

course of its business. Defending lawsuits requires significant management attention and financial resources and the

outcome of any litigation, including the matters described above, is inherently uncertain. The Company does not,

however, currently expect that the costs to resolve these routine matters will have a material adverse effect on its

consolidated financial position, results of operations, or cash flows.

69

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)