Panera Bread 2010 Annual Report Download - page 43

Download and view the complete annual report

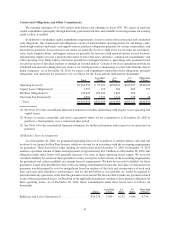

Please find page 43 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.$4.1 million, as of December 30, 2008. During fiscal 2008, we received $17.2 million of cash redemptions at an

average net asset value of $0.963 per unit, which we classified as investment maturity proceeds provided by

investing activities. In total, we recognized a net realized and unrealized loss on the Columbia Strategic Cash

Portfolio units of $1.9 million in fiscal 2008 related to the fair value measurements and redemptions received and

included the net loss in net cash provided by operating activities.

During fiscal 2010, fiscal 2009, and fiscal 2008, we had no investments in U.S. Treasury notes and government

agency securities, and we made no additional cash purchases of investments.

Financing Activities

Financing activities in fiscal 2010 included $153.5 million used to repurchase shares of our Class A common

stock offset by $25.6 million received from the exercise of employee stock options, $3.6 million received from the

tax benefit from exercise of stock options, and $1.8 million received from the issuance of common stock. Financing

activities in fiscal 2009 included $22.8 million received from the exercise of employee stock options, $5.1 million

received from the tax benefit from exercise of stock options, and $1.6 million received from the issuance of common

stock under employee benefit plans, partially offset by $20.1 million used to purchase the remaining interest of

Paradise and approximately $3.5 million to repurchase our Class A common stock. Financing activities in fiscal

2008 included $75.0 million used in net repayments under our credit facility, $48.9 million used to repurchase our

Class A common stock, $17.6 million received from the exercise of stock options, $3.4 million received from the tax

benefit from the exercise of stock options, $1.9 million received from the issuance of common stock under

employee benefit plans, and $1.2 million used for debt issuance costs.

Purchase of Noncontrolling Interest

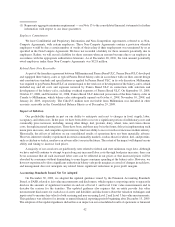

On June 2, 2009, we purchased the remaining 49 percent of the outstanding stock of Paradise, excluding

certain agreed upon assets totaling $0.7 million, for a purchase price of $22.3 million, $0.1 million in transaction

costs, and settlement of $3.4 million of debt owed to us by the former shareholders of the remaining 49 percent of

Paradise, whom we refer to as the Prior Shareholders. Approximately $20.0 million of the purchase price, as well as

the transaction costs, were paid on June 2, 2009, with $2.3 million retained by us for certain holdbacks. The

holdbacks are primarily for certain indemnifications and expire on June 2, 2011, with any remaining holdback

amounts reverting to the Prior Shareholders. The transaction was accounted for as an equity transaction, by

adjusting the carrying amount of the noncontrolling interest balance to reflect the change in our ownership interest

in Paradise, with the difference between fair value of the consideration paid and the amount by which the

noncontrolling interest was adjusted recognized in equity attributable to us.

Share Repurchases

On November 17, 2009, our Board of Directors approved a three year share repurchase authorization of up to

$600.0 million of our Class A common stock, pursuant to which share repurchases may be effected from time to

time on the open market or in privately negotiated transactions and which may be made under a Rule 10b5-1 plan.

Repurchased shares may be retired immediately and will resume the status of authorized but unissued shares or they

may be held by us as treasury stock. The repurchase authorization may be modified, suspended, or discontinued by

our Board of Directors at any time. Under the share repurchase authorization, we repurchased a total of

1,905,540 shares of our Class A common stock at a weighted-average price of $78.72 per share for an aggregate

purchase price of $150.0 million in fiscal 2010. As of the date of this report, under the share repurchase

authorization, we repurchased a total of 1,932,969 shares of our Class A common stock at a weighted-average

price of $78.50 per share for an aggregate purchase price of approximately $152.0 million. We have approximately

$448.0 million available under the existing $600.0 million repurchase authorization.

We have historically repurchased shares of our Class A common stock through a share repurchase autho-

rization approved by our Board of Directors from participants of the Panera Bread 1992 Stock Incentive Plan and

the Panera Bread 2006 Stock Incentive Plan, or collectively, the Plans. Repurchased shares are netted and

surrendered as payment for applicable tax withholding on the vesting of participants’ restricted stock. During

fiscal 2010, we repurchased 44,002 shares of Class A common stock surrendered by participants of the Plans at a

36