Panera Bread 2010 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•Risk-free interest rate — The risk-free interest rate is based on the U.S. Treasury yield curve in effect at the

time of grant and with a maturity that approximates the option awards expected term.

•Dividend yield — The dividend yield is based on the Company’s anticipated dividend payout over the

expected term of the option awards.

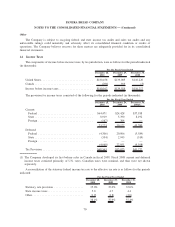

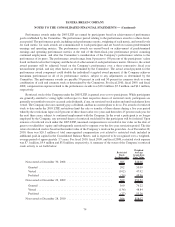

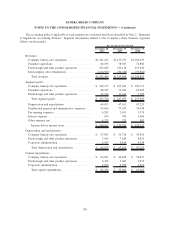

The weighted-average fair value of option awards granted and assumptions used for the Black-Scholes option

pricing model were as follows for the periods indicated:

December 28,

2010

December 29,

2009

December 30,

2008

For the Fiscal Year Ended

Fair value per option awards ..................... $27.97 $21.70 $15.54

Assumptions:

Expected term (years) ........................ 5.0 5.0 4.5

Expected volatility ........................... 41.0% 41.8% 36.5%

Risk-freeinterestrate......................... 1.8% 2.4% 2.5%

Dividend yield .............................. 0.0% 0.0% 0.0%

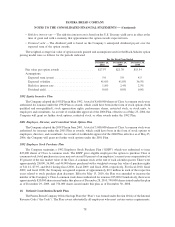

1992 Equity Incentive Plan

The Company adopted the 1992 Plan in May 1992. A total of 8,600,000 shares of Class A common stock were

authorized for issuance under the 1992 Plan as awards, which could have been in the form of stock options (both

qualified and non-qualified), stock appreciation rights, performance shares, restricted stock, or stock units, to

employees and consultants. As a result of stockholder approval of the 2006 Plan, effective as of May 25, 2006, the

Company will grant no further stock options, restricted stock, or other awards under the 1992 Plan.

2001 Employee, Director, and Consultant Stock Option Plan

The Company adopted the 2001 Plan in June 2001. A total of 3,000,000 shares of Class A common stock were

authorized for issuance under the 2001 Plan as awards, which could have been in the form of stock options to

employees, directors, and consultants. As a result of stockholder approval of the 2006 Plan, effective as of May 25,

2006, the Company will grant no further stock options under the 2001 Plan.

1992 Employee Stock Purchase Plan

The Company maintains a 1992 Employee Stock Purchase Plan (“ESPP”) which was authorized to issue

825,000 shares of Class A common stock. The ESPP gives eligible employees the option to purchase Class A

common stock (total purchases in a year may not exceed 10 percent of an employee’s current year compensation) at

85 percent of the fair market value of the Class A common stock at the end of each calendar quarter. There were

approximately 28,000, 36,000, and 44,000 shares purchased with a weighted-average fair value of purchase rights

of $11.41, $7.95, and $6.41 during fiscal 2010, fiscal 2009, and fiscal 2008, respectively. For fiscal 2010, fiscal

2009, and fiscal 2008, the Company recognized expense of approximately $0.3 million in each of the respective

years related to stock purchase plan discounts. Effective May 13, 2010, the Plan was amended to increase the

number of the Company’s Class A common stock shares authorized for issuance 925,000. Cumulatively, there were

approximately 820,000 shares issued under this plan as of December 28, 2010, 790,000 shares issued under this plan

as of December 29, 2009, and 754,000 shares issued under this plan as of December 30, 2008.

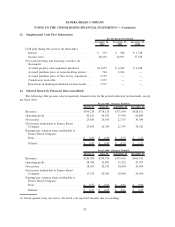

18. Defined Contribution Benefit Plan

The Panera Bread Company 401(k) Savings Plan (the “Plan”) was formed under Section 401(k) of the Internal

Revenue Code (“the Code”). The Plan covers substantially all employees who meet certain service requirements.

78

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)