Panera Bread 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

to the opening of 42 new Company-owned bakery-cafes, the acquisition of 40 franchise-operated bakery-cafes, and

the 7.5 percent increase in comparable Company-owned net bakery-cafe sales in fiscal 2010, partially offset by the

closure of two Company-owned bakery-cafes and the sale of three Company-owned bakery-cafes. This 7.5 percent

growth in comparable net bakery-cafe sales was driven by approximately 2.1 percent of transaction growth and

approximately 5.4 percent average check growth. Average check growth, in turn, was comprised of retail price

increases of approximately 2.0 percent and positive mix impact of approximately 3.4 percent in comparison to the

same period in the prior fiscal year. In total, Company-owned net bakery-cafe sales as a percentage of total revenues

increased by 0.5 percentage points to 85.7 percent for fiscal 2010 as compared to 85.2 percent in fiscal 2009. In

addition, the increase in average weekly net sales for Company-owned bakery-cafes in fiscal 2010 compared to the

prior fiscal year was primarily due to the previously described average check growth that resulted from our category

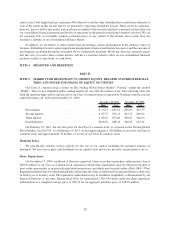

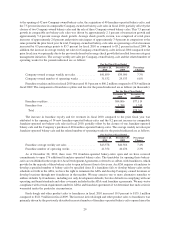

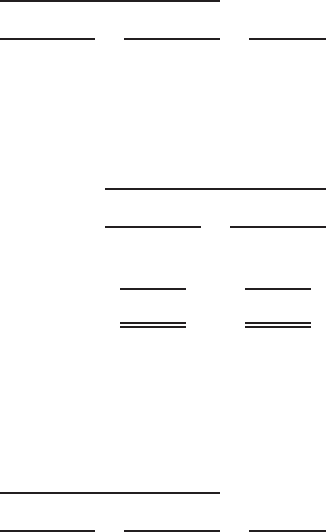

management initiatives. The average weekly net sales per Company-owned bakery-cafe and the related number of

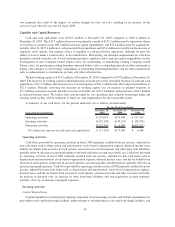

operating weeks for the periods indicated are as follows:

December 28,

2010

December 29,

2009

Percentage

Change

For the Fiscal Year Ended

Company-owned average weekly net sales ............. $41,899 $39,050 7.3%

Company-owned number of operating weeks ........... 31,532 29,533 6.8%

Franchise royalties and fees in fiscal 2010 increased 10.0 percent to $86.2 million compared to $78.4 million in

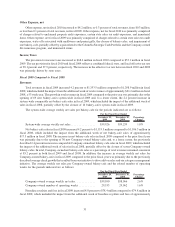

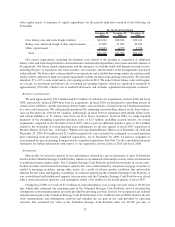

fiscal 2009. The components of franchise royalties and fees for the periods indicated are as follows (in thousands):

December 28,

2010

December 29,

2009

For the Fiscal Year Ended

Franchise royalties ........................................ $84,806 $77,119

Franchise fees ........................................... 1,389 1,248

Total ................................................ $86,195 $78,367

The increase in franchise royalty and fee revenues in fiscal 2010 compared to the prior fiscal year was

attributed to the opening of 34 new franchise-operated bakery-cafes and the 8.2 percent increase in comparable

franchise-operated net bakery-cafe sales in fiscal 2010, partially offset by the closure of one franchise-operated

bakery-cafe and the Company’s purchase of 40 franchise-operated bakery-cafes. The average weekly net sales per

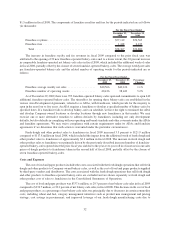

franchise-operated bakery-cafe and the related number of operating weeks for the periods indicated are as follows:

December 28,

2010

December 29,

2009

Percentage

Change

For the Fiscal Year Ended

Franchise average weekly net sales .................. $43,578 $40,566 7.4%

Franchise number of operating weeks ................ 41,354 40,436 2.3%

As of December 28, 2010, there were 791 franchise-operated bakery-cafes open and we have received

commitments to open 176 additional franchise-operated bakery-cafes. The timetables for opening these bakery-

cafes are established in the respective Area Development Agreements, referred to as ADAs, with franchisees, which

provide for the majority of these bakery-cafes to open in the next four to five years. An ADA requires a franchisee to

develop a specified number of bakery-cafes by specified dates. If a franchisee fails to develop bakery-cafes on the

schedule set forth in the ADA, we have the right to terminate the ADA and develop Company-owned locations or

develop locations through new franchisees in that market. We may exercise one or more alternative remedies to

address defaults by franchisees, including not only development defaults, but also defaults in complying with our

operating and brand standards and other covenants included in the ADAs and franchise agreements. We may waive

compliance with certain requirements under its ADAs and franchise agreements if we determine that such action is

warranted under the particular circumstances.

Fresh dough and other product sales to franchisees in fiscal 2010 increased 10.9 percent to $135.1 million

compared to $121.9 million in fiscal 2009. The increase in fresh dough and other product sales to franchisees was

primarily driven by the previously described increased number of franchise-operated bakery-cafes opened since the

29