Panera Bread 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

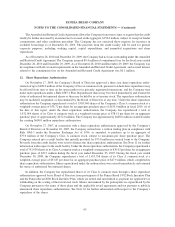

purchase price of $21.1 million plus $0.5 million in acquisition costs. As a result, Paradise became a majority-

owned consolidated subsidiary of the Company, with its operating results included in the Company’s Consolidated

Statements of Operations and the 49 percent portion of equity attributable to Paradise presented as minority interest,

and subsequently as noncontrolling interest, in the Company’s Consolidated Balance Sheets. In connection with this

transaction, the Company received the right to purchase the remaining 49 percent of the outstanding stock of

Paradise after January 1, 2009 at a contractually determined value, which approximated fair value. In addition, the

related agreement provided that if the Company did not exercise its right to purchase the remaining 49 percent of the

outstanding stock of Paradise by June 30, 2009, the remaining Paradise owners had the right to purchase the

Company’s 51 percent interest in Paradise thereafter for $21.1 million.

On June 2, 2009, the Company exercised its right to purchase the remaining 49 percent of the outstanding stock

of Paradise, excluding certain agreed upon assets totaling $0.7 million, for a purchase price of $22.3 million,

$0.1 million in transaction costs, and settlement of $3.4 million of debt owed to the Company by the shareholders of

the remaining 49 percent of Paradise. Approximately $20.0 million of the purchase price, as well as the transaction

costs, were paid on June 2, 2009, with $2.3 million retained by the Company for certain holdbacks. The holdbacks

are primarily for certain indemnifications and expire on the second anniversary of the transaction closing date,

June 2, 2011, with any remaining holdback amounts reverting to the prior shareholders of the remaining 49 percent

of Paradise. The transaction was accounted for as an equity transaction, by adjusting the carrying amount of the

noncontrolling interest balance to reflect the change in the Company’s ownership interest in Paradise, with the

difference between fair value of the consideration paid and the amount by which the noncontrolling interest was

adjusted recognized in equity attributable to the Company.

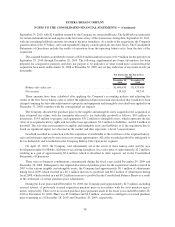

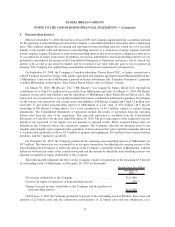

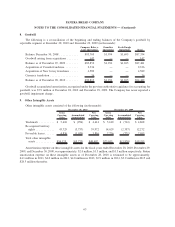

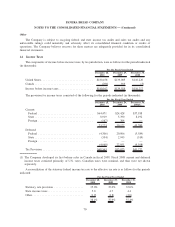

The following table illustrates the effect on the Company’s equity of its purchase of the remaining 49 percent of

outstanding stock of Paradise on June 2, 2009 (in thousands):

December 29, 2009

For the Fiscal Year Ended

Net income attributable to the Company ........................... $86,050

Decrease in equity for purchase of noncontrolling interest .............. (18,799)

Change from net income attributable to the Company and the purchase of

noncontrolling interest....................................... $67,251

During fiscal 2009, the Company recorded an adjustment of $0.7 million to noncontrolling interest to reflect

deferred taxes prior to the purchase of the remaining 49 percent of Paradise. This adjustment was recorded to

additional paid-in capital as a result of the June 2, 2009 purchase of the remainder of Paradise.

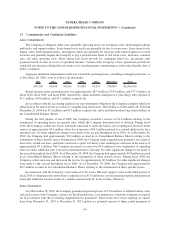

5. Fair Value Measurements

Effective December 26, 2007, the first day of fiscal 2008, the Company implemented the accounting standard

regarding disclosures for financial assets, financial liabilities, non-financial assets, and non-financial liabilities

recognized or disclosed at fair value in the consolidated financial statements on a recurring basis (at least annually).

Effective December 31, 2008, the first day of fiscal 2009, the Company also implemented the accounting standard

for non-financial assets and non-financial liabilities reported or disclosed at fair value on a non-recurring basis, the

adoption of which had no impact on fiscal 2009. This standard defines fair value as the exchange price that would be

received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the

asset or liability in an orderly transaction between market participants on the measurement date. This standard also

establishes a fair value hierarchy which requires an entity to maximize the use of observable inputs and minimize

60

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)