Panera Bread 2010 Annual Report Download - page 90

Download and view the complete annual report

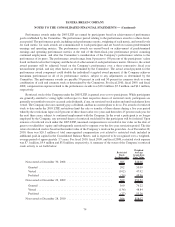

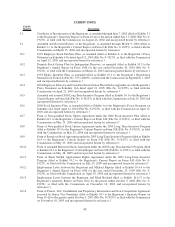

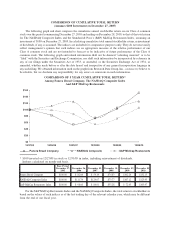

Please find page 90 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The second quarter of fiscal 2010 results included a favorable impact of $0.01 per diluted share from the

repurchase of 897,556 shares under its $600.0 million share repurchase authorization which was offset by a

$2.5 million charge, or $0.05 per diluted share related to an on-going unclaimed property audit.

The third quarter of fiscal 2010 results included a favorable impact of $0.01 per diluted share from the

repurchase of 1,007,984 shares under the Company’s $600.0 million share repurchase authorization.

The second quarter of fiscal 2009 results included a $1.0 million charge, or $0.02 per diluted share, to increase

reserves for certain state sales tax audit exposures and a $0.8 million charge, or $0.02 per diluted share, for the write-

off of smallwares related to the rollout of new china.

The third quarter of fiscal 2009 results included $2.1 million of net charges, or $0.04 per diluted share,

primarily to increase reserves for certain state sales tax audit exposures, which were partially offset by a gain

recorded on both, the redemptions the Company received during the quarter on its investment in the Columbia

Strategic Cash Portfolio, and the change in the recorded fair value of the units held as of September 29, 2009.

The fourth quarter of fiscal 2009 results included a $0.4 million charge, or $0.01 per diluted share, to write-off

equipment related to the rollout of panini grills, a $1.4 million charge, or $0.03 per diluted share, related to the

closure of bakery-cafes, and a $0.6 million charge, or $0.01 per diluted share, related to the impairment of one

bakery-cafe.

83

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)