Panera Bread 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.in accordance with the accounting standard for goodwill by comparing the carrying value of reporting units to their

estimated fair values. The Company completed annual impairment tests as of the first day of the fiscal fourth quarter

of fiscal 2010, fiscal 2009, and fiscal 2008, none of which identified any impairment as the fair value of the

Company’s reporting units exceeded the associated carrying values.

As quoted market prices for the Company’s reporting units are not available, fair value is estimated based on

the present value of expected future cash flows, with forecasted average growth rates of approximately four percent

and average discount rates of 10 percent used in the fiscal 2010 analysis for the reporting units, which are

commensurate with the risks involved in the reporting units. The Company uses current results, trends, future

prospects, and other economic factors as the basis for expected future cash flows.

Assumptions in estimating future cash flows are subject to a high degree of judgment and complexity. The

Company makes every effort to forecast these future cash flows as accurately as possible with the information

available at the time the forecast is developed. However, changes in the assumptions and estimates may affect the

estimated fair value of the Company’s reporting units, and could result in goodwill impairment charges in future

periods. Factors that have the potential to create variances between forecasted cash flows and actual results include

but are not limited to (i) fluctuations in sales volumes, (ii) commodity costs, such as wheat and fuel, and

(iii) acceptance of the Company’s pricing actions undertaken in response to rapidly changing commodity prices and

other product costs. Refer to “Forward-Looking Statements” included in the beginning of the Company’s

Form 10-K for further information regarding the impact of estimates of future cash flows.

The calculation of fair value could increase or decrease depending on changes in the inputs and assumptions

used, such as changes in the financial performance of the reporting units, future growth rate, and discount rate. In

order to evaluate the sensitivity of the fair value calculations on the goodwill impairment test, the Company applied

hypothetical changes to its projected growth rate and discount rate which the Company believes are considered

appropriate. Based on the goodwill analysis performed as of September 29, 2010, the first day of the Company’s

fourth quarter of fiscal 2010, these hypothetical changes in the Company’s assumptions would not affect the results

of the impairment test, as all reporting units individually still had an excess of fair value over their respective

carrying value.

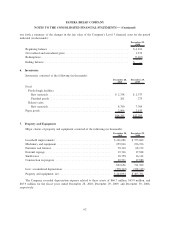

Other Intangible Assets

Other intangible assets consist primarily of favorable lease agreements, re-acquired territory rights, and

trademarks. The Company amortizes the fair value of favorable lease agreements over the remaining related lease

terms at the time of the acquisition, which ranged from approximately 2 years to 17 years. The fair value of re-

acquired territory rights was based on the present value of the acquired bakery-cafe cash flows. The Company

amortizes the fair value of re-acquired territory rights over the remaining contractual terms of the re-acquired

territory rights at the time of the acquisition, which ranged from approximately 13 years to 20 years. The fair value

of trademarks is amortized over their estimated useful life of 22 years.

The Company reviews intangible assets with finite lives for impairment when events or circumstances indicate

these assets might be impaired. When warranted, the Company tests intangible assets with finite lives for

impairment using historical cash flows and other relevant facts and circumstances as the primary basis for an

estimate of future cash flows. As of December 28, 2010, December 29, 2009, and December 30, 2008, no

impairment of intangible assets with finite lives had been recognized. There can be no assurance that future

intangible asset impairment tests will not result in a charge to earnings.

Impairment of Long-Lived Assets

The Company evaluates whether events and circumstances have occurred that indicate the remaining

estimated useful life of long-lived assets may warrant revision or that the remaining balance of an asset may

not be recoverable. When appropriate, the Company determines if there is impairment by comparing anticipated

52

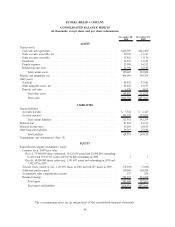

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)