Panera Bread 2004 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.__________

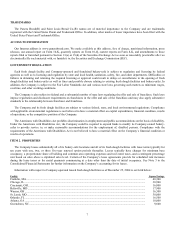

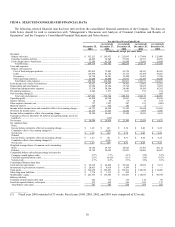

(1) In January 2002, the Company purchased the area development rights and three operating bakery-cafes in the Jacksonville,

Florida market from its franchisee. During fiscal 2003, the Company acquired 15 operating bakery-cafes and the area

development rights in the Louisville/Lexington, Kentucky; Dallas, Texas; Toledo, Ohio; and Ann Arbor, Michigan markets

from franchisees. In October 2004, the Company acquired one operating bakery-cafe in the Dallas, Texas market from a

franchisee.

(2) In October 2004, the Company transferred two operating bakery-cafes and one bakery-cafe under construction to a new

franchisee in the acquisition of the minority interest. See Note 4 of the Company’s Consolidated Financial Statements for

further information.

RESTATEMENT OF PREVIOUSLY ISSUED CONSOLIDATED FINANCIAL STATEMENTS

Following disclosure by several restaurant companies late in calendar 2004 and in connection with performing its 2004 year-end

reporting control processes, the Company performed a comprehensive review of its lease accounting practices. Historically, the

Company recorded rent expense on a straight-line basis over the initial non-cancelable term commencing upon location opening. The

Company concluded that its calculation of straight-line rent should be based on the reasonably assured lease term as defined in SFAS

98, “Accounting for Leases,” which in most cases exceeds the initial non-cancelable lease term. The Company further concluded that

any construction period and other rent holidays should also be included in its determination of straight-line rent expense. Additionally,

the Company reassessed the depreciable lives of leasehold improvements at all locations to be the shorter of their estimated useful life

or the reasonably assured lease term at the inception of the lease. The Company also concluded that landlord allowances for normal

tenant improvements, which had previously been recorded as a reduction to related leasehold improvements, should be reflected as

deferred rent and amortized over the reasonably assured lease term as a reduction to rent expense rather than depreciation.

The Company evaluated the materiality of these corrections on its financial statements and concluded that the incremental impact

of these corrections is not material to any quarterly or annual period; however, the cumulative effect of these corrections is material to

the fourth quarter of fiscal 2004. As a result, the Company has recorded the cumulative effect as of the end of fiscal year 2001 and has

restated previously issued consolidated financial statements for the fiscal years ended December 27, 2003 and December 28, 2002 to

recognize the impact of recording rent expense over the reasonably assured lease period, to record depreciation on leasehold

improvements over the shorter of their estimated useful lives or the reasonably assured lease term, and to classify landlord allowances

for normal tenant improvements as deferred rent and amortize them over the reasonably assured lease term as a reduction to rent

expense rather than depreciation. See Note 3 to the Consolidated Financial Statements for further information on the Company’s

accounting for its leases.

CONCEPT AND STRATEGY

The Company’s concept focuses on the “Specialty Bread/Bakery-Cafe” category. Its artisan breads, which are breads made with

all natural ingredients and a craftsman’s attention to quality and detail, and overall award-winning bakery expertise are at the heart of

the concept’s menu. The concept is designed to deliver against the key consumer trends of today, specifically the need for a more

responsive and more special dining experience than that offered by traditional fast food. The Company’s goal is to make Panera Bread

a nationally dominant brand name. Its menu, prototype, operating systems, design, and real estate strategy allow it to compete

successfully in several sub-businesses: breakfast, lunch, PM “chill out,” lunch in the evening, and take home bread. The Company has

achieved this success as evidenced by several awards it has received. The Company was rated the highest in customer satisfaction for

the third consecutive year in the Sandelman and Associates survey of more than 67,000 consumers’ rating of 117 concepts. The

Company also ranked number one in customer satisfaction in the J.D. Powers survey of 55,000 consumers in the midwest and

northeast. Additionally, the Company has been rated number one in food quality in the Restaurant and Institutions magazine Choice in

Chain survey in each of the last two years. On a system-wide basis, average weekly sales increased 1.1% to $36,008 for the fifty-two

weeks ended December 25, 2004 compared to $35,617 for the fifty-two weeks ended December 27, 2003.

The distinctive nature of the Company’s menu offerings (centered around the fresh artisan bread products), the quality of its

bakery-cafe operations, the Company’s signature cafe design, and the prime locations of its cafes are integral to the Company’s

success. The Company believes its concept has significant growth potential, which it hopes to realize through a combination of

Company and franchisee efforts. Franchising is a key component of the Company’s success. Utilization of franchising has enabled the

Company to grow more rapidly because of the added resources and capabilities they provide to implement the concepts and strategy

3