Panera Bread 2004 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

average construction, equipment, furniture and fixture, and signage cost for the 54 Company bakery-cafes opened in 2004 was $0.95

million per bakery-cafe after landlord allowances.

The average bakery-cafe size is 4,480 square feet. The Company leases substantially all of its bakery-cafe locations. Lease terms

are typically ten years with one, two, or three five-year renewal option periods thereafter. Leases typically have charges for minimum

base occupancy, a proportionate share of building and common area operating expenses and real estate taxes, and contingent

percentage rent based on sales above a stipulated sales level. Certain of the Company’s lease agreements provide for scheduled rent

increases during the lease terms or for rental payments commencing at a date other than the date of initial occupancy. See Note 3 to

the Consolidated Financial Statements for further information on the Company’s accounting for its leases.

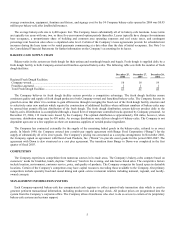

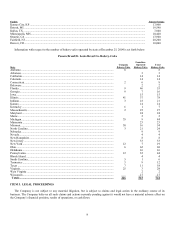

BAKERY-CAFE SUPPLY CHAIN

Bakery-cafes in the system use fresh dough for their artisan and sourdough breads and bagels. Fresh dough is supplied daily by a

fresh dough facility to both Company-owned and franchise-operated bakery-cafes. The following table sets forth the number of fresh

dough facilities:

December 25,

2004

December 27,

2003

December 28,

2002

Regional Fresh Dough Facilities:

Company-owned................................................................................................................. 16 16 14

Franchise-operated.............................................................................................................. 1

1 1

Total Fresh Dough Facilities .............................................................................................. 17 17 15

The Company believes its fresh dough facility system provides a competitive advantage. The fresh dough facilities ensure

consistent quality and supply of fresh dough products to both Company-owned and franchised bakery-cafes. The Company focuses its

growth in areas that allow it to continue to gain efficiencies through leveraging the fixed cost of the fresh dough facility structure and

to selectively enter new markets which require the construction of additional facilities when sufficient numbers of bakery-cafes may

be opened that permit efficient distribution of the fresh dough. The fresh dough distribution system delivers product daily to the

bakery-cafes. Distribution is accomplished through a leased fleet of temperature controlled trucks operated by Company personnel. At

December 25, 2004, 112 trucks were leased by the Company. The optimal distribution is approximately 200 miles, however, when

necessary, distribution range may be 450 miles. An average distribution route delivers dough to 6 bakery-cafes. The Company is not

dependent upon one or a few suppliers as there are numerous suppliers of needed product ingredient.

The Company has contracted externally for the supply of the remaining baked goods in the bakery-cafes, referred to as sweet

goods. In March 1998, the Company entered into a multi-year supply agreement with Bunge Food Corporation (“Bunge”) for the

supply of substantially all of its sweet goods. The Company’s pricing was structured as a cost plus arrangement. In November 2002,

the Company signed an agreement with Dawn Food Products, Inc. (“Dawn”) to provide sweet goods for the period 2003-2007. The

agreement with Dawn is also structured as a cost plus agreement. The transition from Bunge to Dawn was completed in the first

quarter of fiscal 2003.

COMPETITION

The Company experiences competition from numerous sources in its trade areas. The Company’s bakery-cafes compete based on

customers’ needs for breakfast, lunch, daytime “chill-out,” lunch in the evening, and take home bread sales. The competitive factors

include location, environment, customer service, price, and quality of products. The Company competes for leased space in desirable

locations. Certain of the Company’s competitors may have capital resources exceeding those available to the Company. Our primary

competitors include specialty food and casual dining and quick service restaurant retailers including national, regional, and locally-

owned concepts.

MANAGEMENT INFORMATION SYSTEMS

Each Company-operated bakery-cafe has computerized cash registers to collect point-of-sale transaction data which is used to

generate pertinent transactional information, including product mix and average check. All product prices are programmed into the

system from the Company’s corporate office. The Company allows franchisees who elect to do so access to certain of its proprietary

bakery-cafe systems and systems support.

5