Panera Bread 2004 Annual Report Download - page 18

Download and view the complete annual report

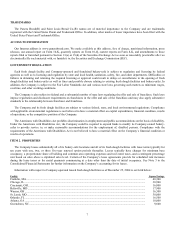

Please find page 18 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

Forward-Looking Statements

Matters discussed in this report and in our public disclosures, whether written or oral, including any discussion, express or implied,

of the Company’s anticipated growth, operating results, future earnings per share, plans and objectives, or statements of the underlying

assumptions of forward-looking statements, contain forward-looking statements within the meaning of Section 27A of the Securities

Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are often identified by the words “believe”,

“positioned”, “estimate”, “project”, “target”, “continue”, “intend”, “expect”, “future”, “anticipates”, and similar expressions. All

forward-looking statements, whether written or oral, are expressly qualified by the cautionary statements described in this provision.

All forward-looking statements included in this report are made only as of the date of this report, and we do not undertake any

obligation to publicly update or correct any forward-looking statements to reflect events or circumstances that occur or of which we

hereafter become aware, after that date. Forward looking information expresses management’s present belief, expectations or

intentions regarding the Company’s future performance. The Company’s actual results could differ materially from those set forth in

the forward-looking statements due to known and unknown risks, uncertainties, and developments and could be negatively impacted

by a number of factors. These factors include but are not limited to the following: the availability of sufficient capital to the Company

and the developers party to franchise development agreements with the Company; variations in the number and timing of bakery-cafe

openings; the ability by the Company and franchisees to operate additional bakery-cafes profitably; public acceptance of new bakery-

cafes; competition; national and regional weather conditions; changes in restaurant operating costs, particularly market changes, food

and labor costs, and inflation; changes in commodity costs; changes in consumer nutritional habits; changes in accounting principles

generally accepted in the United States; and other factors that may affect retailers in general. For all of these reasons, our forward-

looking statements should not be relied upon as a prediction of actual future events, objectives, strategies, trends, or results.

General

The Company’s fiscal year ends on the last Saturday in December. The Company’s fiscal year consists of 13 four-week periods,

with the first, second, and third quarters ending 16 weeks, 28 weeks, and 40 weeks, respectively, into the fiscal year. In 2005, the

Company intends to change its fiscal week to end on Tuesday rather than Saturday. This change will allow the Company to better

serve customers by shifting the weekly closing activities to a less busy day of the week. As a result, the Company’s 2005 fiscal year

will end on December 27, 2005 instead of December 31, 2005 and, therefore, consist of fifty-two and a half weeks rather than the

fifty-three week year that would have resulted without the calendar change. The additional days in fiscal 2005 compared to fiscal 2004

will occur in the first quarter, resulting in the first quarter being sixteen and a half weeks instead of sixteen weeks. In fiscal year 2006,

the Company intends to convert to a 4-5-4 fiscal calendar whereby each quarter will include 13 weeks.

The Company includes information on Company, franchisee, and/or system-wide comparable bakery-cafe sales increases and

average weekly sales. System-wide sales are a non-GAAP financial measure that includes sales at all Company and franchise bakery-

cafes, as reported by franchisees. Management uses system-wide sales information internally in connection with store development

decisions, planning and budgeting analyses, and believes it is useful in assessing consumer acceptance of the Company’s brand and

facilitates understanding of financial performance as the Company’s franchisees pay royalties and contribute to advertising pools

based on a percentage of their sales.

The Company’s revenues are derived from Company-owned bakery-cafe sales, fresh dough sales to franchisees, and franchise

royalties and fees. Fresh dough sales to franchisees are primarily the sales of dough products to our franchisees and the sales of tuna

and cream cheese to certain of our franchisees. Franchise royalties and fees include royalty income and franchise fees. The cost of

food and paper products, labor, occupancy, and other operating expenses relate primarily to Company-owned bakery-cafe sales. The

cost of fresh dough sales relates primarily to the sale of fresh dough products and tuna and cream cheese to our franchisees. General

and administrative, depreciation, and pre-opening expenses relate to all areas of revenue generation.

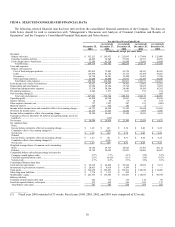

Following disclosure by several restaurant companies late in calendar 2004 and in connection with performing its 2004 year-end

reporting control processes, the Company performed a comprehensive review of its lease accounting practices. Historically, the

Company recorded rent expense on a straight-line basis over the initial non-cancelable term commencing upon location opening. The

Company concluded that its calculation of straight-line rent should be based on the reasonably assured lease term as defined in SFAS

98, “Accounting for Leases,” which in most cases exceeds the initial non-cancelable lease term. The Company further concluded that

any construction period and other rent holidays should also be included in its determination of straight-line rent expense. Additionally,

the Company reassessed the depreciable lives of leasehold improvements at all locations to be the shorter of their estimated useful life

12