Panera Bread 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

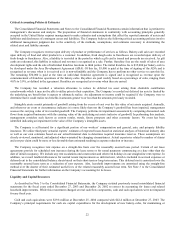

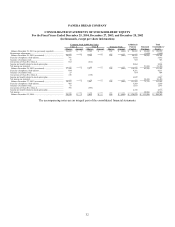

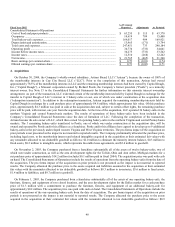

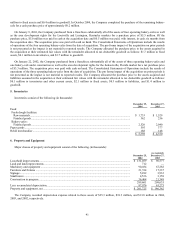

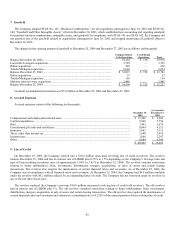

PANERA BREAD COMPANY

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For the Fiscal Years Ended December 25, 2004, December 27, 2003, and December 28, 2002

(in thousands, except per share information)

Common Stock $.0001 Par Value Additional Total

Class A

Class B Treasury Stock Paid-in Retained Stockholders’

Shares

Amount Shares Amount Shares Amount Capital Earnings Equity

Balance December 29, 2001 (as previously reported) .................. 26,018 $ 3 2,589 $ — 109 $ (900) $ 98,101 $ 22,668 $ 119,872

Restatement adjustments................................................................ — — — — — — — (1,688) (1,688)

Balance December 29, 2001 (as restated)..................................... 26,018 3 2,589 — 109 (900) 98,101 20,980 118,184

Exercise of employee stock options ............................................... 781 3,032 3,032

Issuance of common stock............................................................. 35 923 923

Conversion of Class B to Class A.................................................. 612 (612) —

Income tax benefit related to stock option plan.............................. 8,064 8,064

Net income (as restated) ................................................................ — — — — — — — 21,300 21,300

Balance December 28, 2002 (as restated)..................................... 27,446 3 1,977 — 109 (900) 110,120 42,280 151,503

Exercise of employee stock options ............................................... 694 4,211 4,211

Issuance of common stock............................................................. 27 814 814

Conversion of Class B to Class A.................................................. 130 (130) —

Income tax benefit related to stock option plan.............................. 6,847 6,847

Net income (as restated) ................................................................ — — — — — — — 30,430 30,430

Balance December 27, 2003 (as restated)..................................... 28,297 3 1,847 — 109 (900) 121,992 72,710 193,805

Exercise of employee stock options ............................................... 405 3,569 3,569

Issuance of common stock ............................................................. 33 1,073 1,073

Conversion of Class B to Class A.................................................. 395 (395) —

Income tax benefit related to stock option plan.............................. 4,336 4,336

Net income .................................................................................... — — — — — — — 38,580 38,580

Balance December 25, 2004......................................................... 29,130 $ 3 1,452 $ — 109 $ (900) $ 130,970 $ 111,290 $ 241,363

The accompanying notes are an integral part of the consolidated financial statements.

32