Panera Bread 2004 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

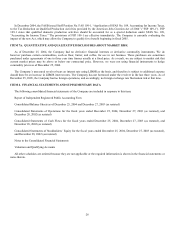

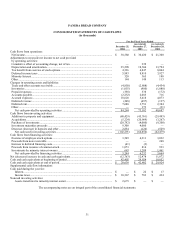

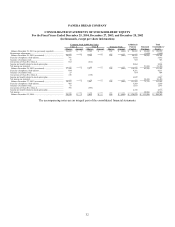

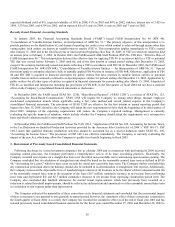

PANERA BREAD COMPANY

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

For the Fiscal Years Ended

December 25,

2004

(as restated)

December 27,

2003

(as restated)

December 28,

2002

Cash flows from operations:

Net income......................................................................................................................... $ 38,580 $ 30,430 $ 21,300

Adjustments to reconcile net income to net cash provided

by operating activities:

Cumulative effect of accounting change, net of tax........................................................... — 239 —

Depreciation and amortization........................................................................................... 25,298 18,304 13,794

Tax benefit from exercise of stock options........................................................................ 4,336 6,847 8,064

Deferred income taxes ....................................................................................................... 5,993 8,810 3,927

Minority Interest................................................................................................................ 328 365 180

Other .................................................................................................................................. 144 148 113

Changes in operating assets and liabilities:

Trade and other accounts receivable.................................................................................. (4,850) (2,808) (4,454)

Inventories ......................................................................................................................... (1,055) (900) (1,080)

Prepaid expenses................................................................................................................ (358) 538 (172)

Accounts payable............................................................................................................... (2,232) 2,085 716

Accrued expenses .............................................................................................................. 10,628 5,618 4,073

Deferred revenue ............................................................................................................... (208) (497) (137)

Deferred rent...................................................................................................................... 7,680 3,751 2,384

Other .................................................................................................................................. — 172 (21)

Net cash provided by operating activities ..................................................................... 84,284 73,102 48,687

Cash flows from investing activities:

Additions to property and equipment ................................................................................ (80,429) (45,761) (29,483)

Acquisitions....................................................................................................................... (5,224) (20,969) (3,267)

Purchase of investments .................................................................................................... (28,792) (4,000) (9,200)

Investment maturities proceeds ......................................................................................... 9,300 4,000 —

Decrease (increase) in deposits and other.......................................................................... 2,854 (126) (529)

Net cash used in investing activities.............................................................................. (102,291) (66,856) (42,479)

Cash flows from financing activities:

Exercise of employee stock options................................................................................... 3,569 4,211 3,032

Proceeds from note receivable........................................................................................... — — 248

Increase in deferred financing costs................................................................................... (41) (2) —

Proceeds from issuance of common stock ......................................................................... 1,073 814 923

Investments by minority interest owners ........................................................................... 643 1,209 1,461

Net cash provided by financing activities ..................................................................... 5,244 6,232 5,664

Net (decrease) increase in cash and cash equivalents.......................................................... (12,763) 12,478 11,872

Cash and cash equivalents at beginning of period............................................................... 42,402 29,924 18,052

Cash and cash equivalents at end of period......................................................................... $ 29,639 $ 42,402 $ 29,924

Supplemental cash flow information:

Cash paid during the year for:

Interest........................................................................................................................... $ — $ 22 $ 17

Income taxes.................................................................................................................. $ 10,367 $ 783 $ 424

Noncash investing activities:

Assets transferred to minority interest owner................................................................ $ 2,673 $ — $ —

The accompanying notes are an integral part of the consolidated financial statements.

31