Panera Bread 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

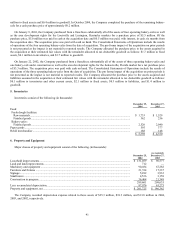

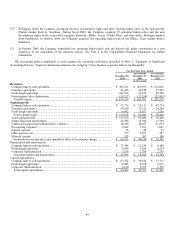

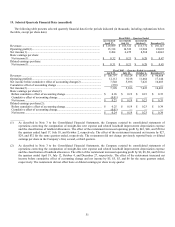

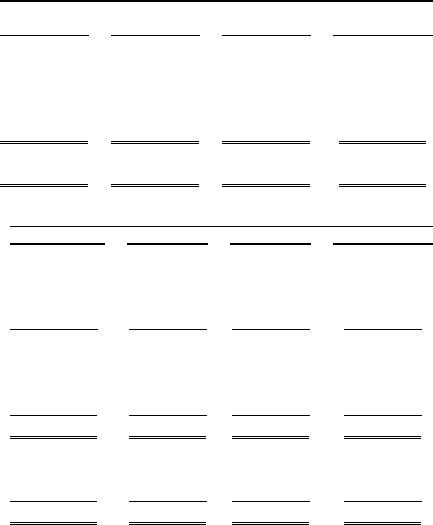

19. Selected Quarterly Financial Data (unaudited)

The following table presents selected quarterly financial data for the periods indicated (in thousands, including explanations below

the table, except per share data):

Fiscal 2004 — Quarters Ended

(as restated)

April 17,

(as restated)

July 10,

(as restated)

October 2,

December 25,

Revenues ............................................................................................................ $ 129,899 $ 105,321 $ 113,772 $ 130,147

Operating profit(1).............................................................................................. 15,318 10,522 13,906 22,092

Net income(1)..................................................................................................... 9,494 6,475 8,568 14,043

Basic earnings per share:

Net income(1)................................................................................................... $ 0.32 $ 0.21 $ 0.28 $ 0.47

Diluted earnings per share:

Net income(1)................................................................................................... $ 0.31 $ 0.21 $ 0.28 $ 0.45

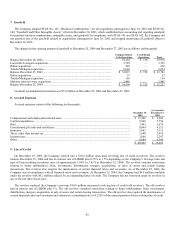

Fiscal 2003 — Quarters Ended (as restated)

April 19, July 12, October 4, December 27,

Revenues .............................................................................................................. $ 100,797 $ 80,324 $ 85,913 $ 96,668

Operating profit(2)................................................................................................ 12,112 9,218 11,464 17,144

Net income before cumulative effect of accounting change(2) ............................ 7,548 5,696 7,022 10,403

Cumulative effect of accounting change .............................................................. (239) — — —

Net income(2)....................................................................................................... 7,309 5,696 7,022 10,403

Basic earnings per share(2):

Before cumulative effect of accounting change.................................................. $ 0.26 $ 0.19 $ 0.23 $ 0.35

Cumulative effect of accounting change............................................................. (0.01) — — —

Net income.......................................................................................................... $ 0.25 $ 0.19 $ 0.23 $ 0.35

Diluted earnings per share(2):

Before cumulative effect of accounting change.................................................. $ 0.25 $ 0.19 $ 0.23 $ 0.34

Cumulative effect of accounting change............................................................. (0.01) — — —

Net income.......................................................................................................... $ 0.24 $ 0.19 $ 0.23 $ 0.34

__________

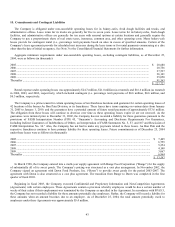

(1) As described in Note 3 to the Consolidated Financial Statements, the Company restated its consolidated statements of

operations correcting the computation of straight-line rent expense and related leasehold improvement depreciation expense

and the classification of landlord allowances. The effect of the restatement increased operating profit by $43, $46, and $50 for

the quarters ended April 17, July 10, and October 2, respectively. The effect of the restatement increased net income by $27,

$29, and $32 for the same quarters ended, respectively. The restatement did not change previously reported basic or diluted

earnings per share in the Company’s first, second, or third quarters.

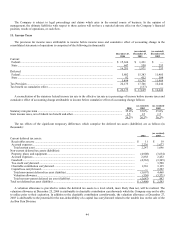

(2) As described in Note 3 to the Consolidated Financial Statements, the Company restated its consolidated statements of

operations correcting the computation of straight-line rent expense and related leasehold improvement depreciation expense

and the classification of landlord allowances. The effect of the restatement increased operating profit by $8, $8, $8, and $10 for

the quarters ended April 19, July 12, October 4, and December 27, respectively. The effect of the restatement increased net

income before cumulative effect of accounting change and net income by $5, $5, $5, and $6 for the same quarters ended,

respectively. The restatement did not effect basic or diluted earnings per share in any quarter.

51