Panera Bread 2004 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

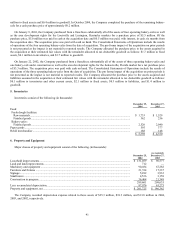

At December 25, 2004 and December 27, 2003, the Company had charitable contribution carryforwards of $3.6 million and $8.6

million, respectively, which expire in the years 2005-2008. At December 27, 2003, the Company had federal jobs tax credit

carryforwards of $0.1 million and federal alternative minimum tax credit carryforwards of $3.5 million, which were both fully utilized

during the fiscal year ended December 25, 2004. The Company reevaluates the positive and negative evidence impacting the

realizability of its deferred income tax assets periodically based on annual estimates of taxable income.

12. Deposits and Other

During fiscal 1997, the Company established a deposit program with its food products and supplies distributor, which allows the

Company to receive lower distribution costs. The savings exceed the carrying value of the deposit. The deposit is flexible and the

Company may at times decrease the amount on deposit at its discretion. The deposit outstanding was $0.2 million and $3.0 million at

December 25, 2004 and December 27, 2003, respectively.

During fiscal 1994, the Company established a company-owned life insurance (“COLI”) program covering a substantial portion of

its employees to help manage long-term employee benefit cost and to obtain tax deductions on interest payments on insurance policy

loans. However, in 1996, tax law changes adopted as part of the Health Insurance Portability and Accountability Act significantly

reduced the level of tax benefits recognized under the Company’s COLI program. As a result, the Company froze this program in

1998. It appears the program will end in 2013 based on actuarial estimates.

At December 25, 2004 and December 27, 2003, the cash surrender values of $7.4 million and $9.5 million, respectively, the

mortality income receivables of $1.0 million and $1.3 million, respectively, and the insurance policy loans of $7.4 million and $9.5

million, respectively, related to the COLI program were netted and included in other assets in the Company’s consolidated balance

sheets. Mortality income receivable represents the dividend or death benefits the Company is due from its insurance carrier at the

respective dates. The insurance policy loans are collateralized by the cash values of the underlying life insurance policies and require

interest payments at a rate of 8.9% for the year ended December 25, 2004. Interest accrued on insurance policy loans is netted with

other COLI related income statement transactions in other income (expense) in the consolidated statements of operations, which netted

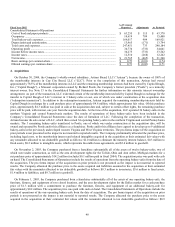

($0.1) million, $0.1 million, and ($0.3) million in 2004, 2003, and 2002, respectively, the components of which are as follows (in

thousands):

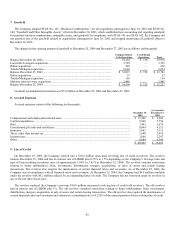

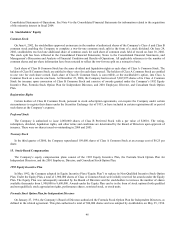

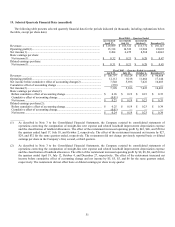

2004 2003 2002

Cash value loss ............................................................................................................................... $ (2,103) $ (1,635) $ (988)

Mortality income ............................................................................................................................ 2,561 2,318 1,728

Interest expense .............................................................................................................................. (584) (626) (1,017)

$ (126) $ 57 $ (277)

The cash value loss is the cumulative change in cash surrender value for the year and is adjusted quarterly. Mortality income is

recorded periodically as charges are deducted from cash value. These amounts are recovered by the Company through payment of

death benefits and mortality dividends received. Interest expense is recorded on the accrual basis.

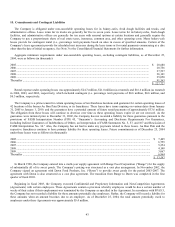

13. Minority Interest Owner

In October 2001, the Company, through Artisan Bread, LLC, an indirect subsidiary (LLC), entered into a limited liability company

operating agreement with its former president as a minority interest owner. The new LLC could develop and manage up to fifty

bakery-cafes in the Northern Virginia and Central Pennsylvania markets. The agreement entitles the minority interest owner to a

specified percentage of the cash flows from the bakery-cafes developed and operated by the LLC. The minority interest owner is

required to make mandatory capital contributions toward each bakery-cafe developed under the agreement. In addition, the minority

interest owner may make additional voluntary contributions towards each bakery-cafe developed under the agreement and receive a

proportionate increase in his share of the cash flows. Although the minority interest owner received no salary for his services, he

received an operating fee equal to the difference between (a) the sum of 4% of the gross sales and $40,000 (increased by 3.5%

annually beginning in 2003) for each bakery-cafe opened by the LLC, and (b) expenses incurred by the LLC in connection with

bakery-cafe operations other than license and administrative fees and expenses which relate solely to an individual bakery-cafe.

Applicable expenses include, without limitation, all costs relating to district, regional, and area supervision above the store level,

bakery supervision, field training, training functions, neighborhood marketing, and recruiting and relocation. Operating fee payments

were $0.2 million, $0.5 million, and $0.1 million in 2004, 2003, and 2002, respectively, and were classified as “Other Expense” in the

45