Panera Bread 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Critical Accounting Policies & Estimates

The Consolidated Financial Statements and Notes to the Consolidated Financial Statements contain information that is pertinent to

management’s discussion and analysis. The preparation of financial statements in conformity with accounting principles generally

accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and

liabilities and disclosures of contingent assets and liabilities. The Company believes the following critical accounting policies involve

additional management judgment due to the sensitivity of the methods, assumptions, and estimates necessary in determining the

related asset and liability amounts.

The Company recognizes revenue upon delivery of product or performance of services as follows. Bakery-cafe sales are recorded

upon delivery of food and other products to a customer. In addition, fresh dough sales to franchisees are recorded upon delivery of

fresh dough to franchisees. Also, a liability is recorded in the period in which a gift card is issued and proceeds are received. As gift

cards are redeemed, this liability is reduced and revenue is recognized as a sale. Further, franchise fees are the result of sales of area

development rights and the sale of individual franchise locations to third parties. The initial franchise fee is $35,000 per bakery-cafe to

be developed under the Area Development Agreement (ADA). Of this fee, $5,000 is paid at the time of signing of the ADA and is

recognized as revenue when it is received as it is non-refundable and the Company has to perform no other service to earn this fee.

The remaining $30,000 is paid at the time an individual franchise agreement is signed and is recognized as revenue upon the

commencement of franchise operations of the bakery-cafes. Royalties are paid weekly based on a percentage of sales, ranging from

4.0% to 5.0%, as defined in the agreement. Royalties are recognized as revenue when they are earned.

The Company has recorded a valuation allowance to reduce its deferred tax asset arising from charitable contribution

carryforwards which it may not be able to utilize prior to their expiration. The Company’s recorded net deferred tax asset is limited by

the underlying tax benefit that it expects to ultimately realize. An adjustment to income could be required if the Company were to

determine that it could realize tax benefits in amounts greater to or less than the amounts previously recorded.

Intangible assets consist primarily of goodwill arising from the excess of cost over the fair value of net assets acquired. Annually,

and whenever an event or circumstance indicates it is more likely than not the Company’s goodwill has been impaired, management

assesses the carrying value of its recorded goodwill. The Company performs its impairment assessment by comparing discounted cash

flows from acquired businesses with the carrying value of the underlying net assets inclusive of goodwill. In performing this analysis,

management considers such factors as current results, trends, future prospects and other economic factors. No event has been

identified indicating an impairment in the value of the Company’s intangible assets.

The Company is self-insured for a significant portion of our workers’ compensation and general, auto, and property liability

insurance. We utilize third party actuarial experts’ estimates of expected losses based on statistical analyses of historical industry data

as well as our own estimates based on our actual historical data to determine required insurance reserves. These assumptions are

closely reviewed, monitored, and adjusted when warranted by changing circumstances. Actual experience related to number of claims

and cost per claim could be more or less favorable than estimated resulting in expense reduction or increase.

The Company recognizes rent expense on a straight-line basis over the reasonably assured lease period. Certain of our lease

agreements provide for scheduled rent increases during the lease terms or for rental payments commencing at a date other than the

date of initial occupancy. We include any rent escalations and construction and other rent holidays in our straight-line rent expense. In

addition, we record landlord allowances for normal tenant improvements as deferred rent, which is included in accrued expenses or

deferred rent in the consolidated balance sheets based on their short-term or long-term nature. This deferred rent is amortized over the

reasonably assured lease term as a reduction of rent expense. Also, leasehold improvements are amortized using the straight-line

method over the shorter of their estimated useful lives or the related reasonably assured lease term. See Note 3 to the Consolidated

Financial Statements for further information on the Company’s accounting for its leases.

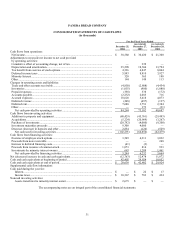

Liquidity and Capital Resources

As described in Note 3 to the Consolidated Financial Statements, the Company restated previously issued consolidated financial

statements for the fiscal years ended December 27, 2003 and December 28, 2002 to correct its accounting for leases and related

leasehold improvements. While this restatement changed several cash flow components, cash and cash equivalents were not impacted

for any fiscal year.

Cash and cash equivalents were $29.6 million at December 25, 2004 compared with $42.4 million at December 27, 2003. The

Company’s principal requirements for cash are capital expenditures for the development of new bakery-cafes, for maintaining or

22