Panera Bread 2004 Annual Report Download - page 44

Download and view the complete annual report

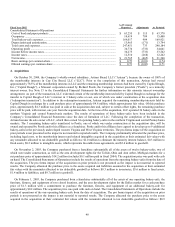

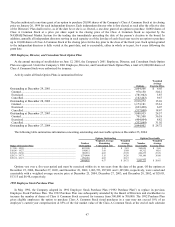

Please find page 44 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.expected dividend yield of 0%, expected volatility of 36% in 2004, 41% in 2003 and 40% in 2002, risk-free interest rate of 3.42% in

2004, 3.53% in 2003, and 4.30% in 2002, and an expected life of 5 years in 2004, 6 years in 2003 and 7 years in 2002.

Recently Issued Financial Accounting Standards

In January 2003, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 46 (FIN 46),

“Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51.” The primary objective of this interpretation is to

provide guidance on the identification of, and financial reporting for, entities over which control is achieved through means other than

voting rights; such entities are known as variable-interest entities (VIE’s). This interpretation applies immediately to VIE’s created

after January 31, 2003 and in the first fiscal year or interim period beginning after June 15, 2003, to VIE’s in which an enterprise held

an interest prior to February 1, 2003. In October 2003, the FASB issued FASB Staff Position (FSP) No. FIN 46-6, “Effective Date of

FASB Interpretation 46.” This interpretation deferred the effective date for applying FIN 46 to an interest held in a VIE or potential

VIE that was created before February 1, 2003 until the end of the first interim or annual period ending after December 15, 2003,

except if the company had already issued statements reflecting a VIE in accordance with FIN 46. In December 2003, the FASB issued

FASB Interpretation No. 46R (FIN 46R), “Consolidation of Variable Interest Entities — An Interpretation of ARB No. 51.” Special

provisions apply to enterprises that have fully or partially applied FIN 46 prior to issuance of FIN 46R. Otherwise, application of FIN

46 and FIN 46R is required in financial statements for public entities that have interests in variable interest entities or potential

variable interest entities commonly referred to as special-purpose entities for periods ending after December 15, 2003. Application by

public entities for all other types of entities is required in financial statements for periods ending after March 15, 2004. Adoption of

FIN 46, as modified and interpreted, including the provisions of FIN 46R, in the first quarter of fiscal 2004 did not have a material

effect on the Company’s consolidated financial statements or disclosures.

In December 2004, the FASB issued SFAS No. 123R, “Share-Based Payment” (“SFAS 123R”), a revision of SFAS No. 123,

“Accounting for Stock-Based Compensation.” SFAS 123R will require the Company to, among other things, measure employee

stock-based compensation awards where applicable using a fair value method and record related expense in the Company’s

consolidated financial statements. The provisions of SFAS 123R are effective for the first interim or annual reporting period that

begins after June 15, 2005; therefore, the Company will adopt the new requirements no later than the beginning of its third quarter of

fiscal 2005. Adoption of the expensing requirements will reduce the Company’s reported earnings. Management is currently

evaluating the specific impacts of adoption, which include whether the Company should adopt the requirements on a retrospective

basis and which valuation model is most appropriate.

In December 2004, the FASB issued Staff Position No. FAS 109-1, “Application of SFAS No. 109, Accounting for Income Taxes,

to the Tax Deduction on Qualified Production Activities provided by the American Jobs Creation Act of 2004” (“FSP 109-1”). FSP

109-1 states that qualified domestic production activities should be accounted for as a special deduction under SFAS No. 109,

“Accounting for Income Taxes.” The provisions of FSP 109-1 are effective immediately. The Company is currently evaluating the

impact of the new Act, which may allow the Company to qualify for a benefit beginning in fiscal 2005.

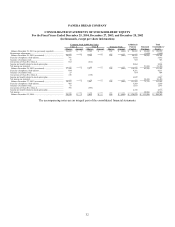

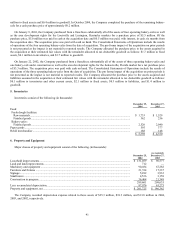

3. Restatement of Previously Issued Consolidated Financial Statements

Following disclosure by several restaurant companies late in calendar 2004 and in connection with performing its 2004 year-end

reporting control processes, the Company performed a comprehensive review of its lease accounting practices. Historically, the

Company recorded rent expense on a straight-line basis over the initial non-cancelable term commencing upon location opening. The

Company concluded that its calculation of straight-line rent should be based on the reasonably assured lease term as defined in SFAS

98, “Accounting for Leases,” which in most cases exceeds the initial non-cancelable lease term. The Company further concluded that

any construction period and other rent holidays should also be included in its determination of straight-line rent expense. Additionally,

the Company reassessed the depreciable lives of leasehold improvements at all locations to be the shorter of their estimated useful life

or the reasonably assured lease term at the inception of the lease ($0.7 million cumulative increase in net income from conforming

lease term and depreciable life and $2.7 million cumulative decrease in net income from expensing construction period rent). The

Company also concluded that landlord allowances for normal tenant improvements, which had previously been recorded as a

reduction to related leasehold improvements, should be reflected as deferred rent and amortized over the reasonably assured lease term

as a reduction to rent expense rather than depreciation.

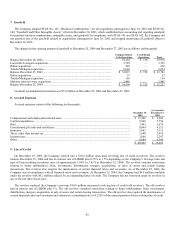

The Company evaluated the materiality of these corrections on its financial statements and concluded that the incremental impact

of these corrections is not material to any quarterly or annual period; however, the cumulative effect of these corrections is material to

the fourth quarter of fiscal 2004. As a result, the Company has recorded the cumulative effect as of the end of fiscal year 2001 and has

restated previously issued consolidated financial statements for the fiscal years ended December 27, 2003 and December 28, 2002 to

38