Panera Bread 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Nature of Business

Panera Bread Company operates a retail bakery-cafe business and franchising business under the concept names Panera Bread(R)

and Saint Louis Bread Co.(R) As of December 25, 2004, the Company’s retail operations consist of 226 Company-owned bakery-

cafes and 515 franchise-operated bakery-cafes. The Company specializes in meeting consumer dining needs by providing high quality

food, including fresh baked goods, made-to-order sandwiches on freshly baked breads, soups, salads, custom roasted coffees, and

other cafe beverages, and targets suburban dwellers and workers by offering a premium specialty bakery and cafe experience with a

neighborhood emphasis. Bakery-cafes are principally located in suburban, strip mall, and regional mall locations and currently operate

in 35 states. Bakery-cafes use fresh dough for their artisan and sourdough breads and bagels. As of December 25, 2004, fresh dough is

supplied daily to both Company-owned and franchise-operated bakery-cafes by the 16 Company-owned and one franchise-operated

fresh dough facilities.

2. Summary of Significant Accounting Policies

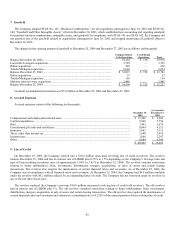

Adoption of SFAS 143

Effective December 29, 2002, the Company adopted the provisions of Statement of Financial Accounting Standards (SFAS) No.

143, “Accounting for Asset Retirement Obligations.” SFAS 143 addresses financial accounting and reporting for obligations

associated with the retirement of tangible long-lived assets and the associated asset retirement costs. This Statement requires the

Company to record an estimate for costs of retirement obligations that may be incurred at the end of lease terms of existing bakery-

cafes or other facilities.

Beginning December 29, 2002, the Company recognizes the future cost to comply with lease obligations at the end of a lease as it

relates to tangible long-lived assets in accordance with the provisions of SFAS 143. A liability for the fair value of an asset retirement

obligation along with a corresponding increase to the carrying value of the related long-lived asset is recorded at the time a lease

agreement is executed. The Company amortizes the amount added to property and equipment and recognizes accretion expense in

connection with the discounted liability over the life of the respective lease. The estimated liability is based on experience in closing

bakery-cafes and the related external cost associated with these activities. Revisions to the liability could occur due to changes in

estimated retirement costs or changes in lease term.

Upon adoption of SFAS 143, the Company recorded a discounted liability of approximately $0.8 million, increased net property

and equipment by approximately $0.4 million, and recognized a one-time cumulative effect charge of approximately $0.2 million (net

of deferred tax benefit of approximately $0.1 million). The liability as of December 25, 2004 and December 27, 2003 was $1.4 million

and $1.1 million, respectively, and is included in other long-term liabilities in the Consolidated Balance Sheets.

Basis of Presentation and Principles of Consolidation

For the years ended December 25, 2004 and December 27, 2003, the consolidated financial statements consist of the accounts of

Panera Bread Company, its wholly owned subsidiaries Panera, LLC and Pumpernickel, Inc., and its indirect consolidated subsidiaries

Pumpernickel Associates, LLC, Panera Enterprises, Inc., Asiago Bread, LLC, Atlanta JV, LLC, and Artisan Bread, LLC. Subsequent

to October 30, 2004, Cap City Bread, LLC was a wholly owned subsidiary of Artisan Bread, LLC. Prior to October 30, 2004, Artisan

Bread, LLC held a majority interest in Cap City Bread, LLC, which then operated 36 bakery-cafes. All intercompany balances and

transactions have been eliminated in consolidation.

Certain reclassifications have been made to conform previously reported data to the current presentation.

Preparation of Financial Statements

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of

America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and

33