Panera Bread 2004 Annual Report Download - page 27

Download and view the complete annual report

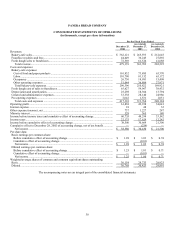

Please find page 27 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating Profit (as restated — see Note 3 to the Consolidated Financial Statements)

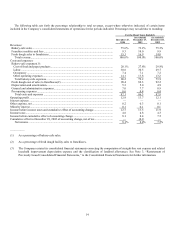

Operating profit for the fifty-two weeks ended December 27, 2003 increased to $49.9 million, or 13.7% of total revenue, from

$34.0 million, or 12.1% of total revenue, for the fifty-two weeks ended December 28, 2002. Operating profit for the fifty-two weeks

ended December 27, 2003 rose as a result of operating leverage that results from opening 29 Company bakery-cafes in 2003 as well as

the factors described above.

Other Expense

Other expense for the fifty-two weeks ended December 27, 2003 increased to $1.2 million, or 0.3% of total revenue, from $0.3

million, or 0.1% of total revenue, for the fifty-two weeks ended December 28, 2002. The increase in other expense results primarily

from increased operating fee payments to the minority interest owner. See Note 13 to the Consolidated Financial Statements for

additional information.

Minority Interest

Minority interest represents the portion of the Company’s operating profit that is attributable to the ownership interest of our

former minority interest owner.

Income Taxes

The provision for income taxes increased to $17.6 million for the fifty-two weeks ended December 27, 2003 compared to $12.2

million for the fifty-two weeks ended December 28, 2002. The tax provisions for the fifty-two weeks ended December 27, 2003 and

December 28, 2002 reflect a consistent combined federal, state, and local effective tax rate of 36.5%.

Income Before Cumulative Effect of Accounting Change (as restated)

Income before cumulative effect of accounting change for the fifty-two weeks ended December 27, 2003 increased $9.4 million, or

44.1%, to $30.7 million, or $1.01 per diluted share, compared to income before cumulative effect of accounting change of $21.3

million, or $0.71 per diluted share, for the fifty-two weeks ended December 28, 2002. The increase in income before cumulative effect

of accounting change in 2003 was primarily due to the operating leverage from the opening of 23 bakery-cafes in 2002 that were open

for a full year in 2003 and leverage from opening 29 bakery-cafes in 2003.

Cumulative Effect of Accounting Change

Effective December 29, 2002, the Company adopted the provisions of Statement of Financial Accounting Standards (SFAS) No.

143, “Accounting for Asset Retirement Obligations.” SFAS 143 addresses financial accounting and reporting for obligations

associated with the retirement of tangible long-lived assets and the associated asset retirement costs. This Statement requires the

Company to record an estimate for costs of retirement obligations that may be incurred at the end of lease terms of existing bakery-

cafes or other facilities. Upon adoption of SFAS 143, the Company recognized a one-time cumulative effect charge of approximately

$0.2 million (net of deferred tax benefit of approximately $0.1 million), or $.01 per diluted share. For further information, see Note 2,

“Summary of Significant Accounting Policies,” to the Consolidated Financial Statements.

Net Income (as restated)

Net income for the fifty-two weeks ended December 27, 2003 increased $9.1 million, or 42.7%, to $30.4 million, or $1.00 per

diluted share, compared to net income of $21.3 million, or $0.71 per diluted share, for the fifty-two weeks ended December 28, 2002.

The increase in net income in 2003 is consistent with the factors described above.

21