Panera Bread 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

million to fixed assets and $0.4 million to goodwill. In October 2004, the Company completed the purchase of the remaining bakery-

cafe for a cash purchase price of approximately $0.2 million.

On January 9, 2003, the Company purchased from a franchisee substantially all of the assets of four operating bakery-cafes as well

as the area development rights for the Louisville and Lexington, Kentucky markets for a purchase price of $5.5 million. Of the

purchase price, $5.0 million was paid in cash at the acquisition date and $0.5 million was paid, with interest, in cash six months from

the acquisition date. The acquisition price was paid with cash on hand. The Consolidated Statements of Operations include the results

of operations of the four operating bakery-cafes from the date of acquisition. The pro forma impact of the acquisition on prior periods

is not presented as the impact is not material to reported results. The Company allocated the purchase price to the assets acquired in

the acquisition at their estimated fair values with the remainder allocated to tax deductible goodwill as follows: $1.7 million to fixed

assets, $0.1 million to inventories, and $3.7 million to goodwill.

On January 22, 2002, the Company purchased from a franchisee substantially all of the assets of three operating bakery-cafes and

one bakery-cafe under construction as well as the area development rights for the Jacksonville, Florida market for a net purchase price

of $3.3 million. The acquisition price was paid with cash on hand. The Consolidated Statements of Operations include the results of

operations of the three operating bakery-cafes from the date of acquisition. The pro forma impact of the acquisition on prior periods is

not presented as the impact is not material to reported results. The Company allocated the purchase price to the assets acquired and

liabilities assumed in the acquisition at their estimated fair values with the remainder allocated to tax deductible goodwill as follows:

$0.1 million to inventories and other current assets, $2.1 million to fixed assets, $0.3 million to liabilities, and $1.4 million to

goodwill.

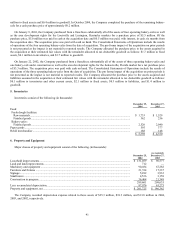

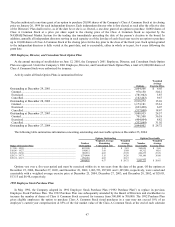

5. Inventories

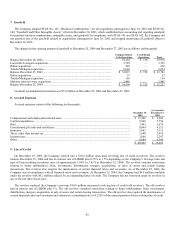

Inventories consist of the following (in thousands):

December 25,

2004

December 27,

2003

Food:

Fresh dough facilities:

Raw materials........................................................................................................................................... $ 1,733 $ 1,529

Finished goods ......................................................................................................................................... 362 256

Bakery-cafes:

Finished goods ......................................................................................................................................... 2,520 2,040

Paper goods .................................................................................................................................................. 595 377

Retail merchandise ....................................................................................................................................... 188 148

$ 5,398 $ 4,350

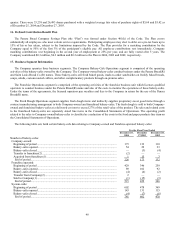

6. Property and Equipment

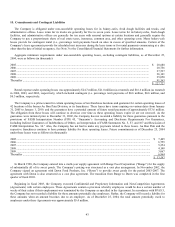

Major classes of property and equipment consist of the following (in thousands):

December 25,

2004

(as restated)

December 27,

2003

Leasehold improvements.............................................................................................................................. $ 131,059 $ 96,577

Land and land improvements ....................................................................................................................... 712 —

Machinery and equipment ............................................................................................................................ 90,034 67,282

Furniture and fixtures ................................................................................................................................... 21,514 17,337

Signage ......................................................................................................................................................... 5,282 3,932

Smallwares ................................................................................................................................................... 4,536 3,158

Construction in progress............................................................................................................................... 36,464 21,349

289,601 209,635

Less: accumulated depreciation.................................................................................................................... 87,876 63,273

Property and equipment, net......................................................................................................................... $ 201,725 $ 146,362

The Company recorded depreciation expense related to these assets of $25.3 million, $18.3 million, and $13.8 million in 2004,

2003, and 2002, respectively.

41