Panera Bread 2004 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

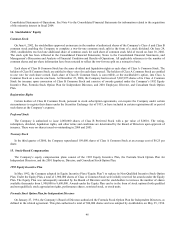

The plan authorized a one-time grant of an option to purchase 20,000 shares of the Company’s Class A Common Stock at its closing

price on January 26, 1994 for each independent director. Each independent director who is first elected as such after the effective date

of the Directors’ Plan shall receive, as of the date he or she is so elected, a one-time grant of an option to purchase 10,000 shares of

Class A Common Stock at a price per share equal to the closing price of the Class A Common Stock as reported by the

NASDAQ/National Market System for the trading day immediately preceding the date of the person’s election to the board. In

addition, annually all independent directors serving in such capacity as of the last day of each fiscal year receive an option to purchase

up to 10,000 shares of Class A Common Stock at the closing price for the day prior to the close of the fiscal year. Each option granted

to the independent directors is fully vested at the grant date, and is exercisable, either in whole or in part, for 6 years following the

grant date.

2001 Employee, Director, and Consultant Stock Option Plan

At the annual meeting of stockholders on June 12, 2001, the Company’s 2001 Employee, Director, and Consultant Stock Option

Plan was approved. Under the Company’s 2001 Employee, Director, and Consultant Stock Option Plan, a total of 2,000,000 shares of

Class A Common Stock were authorized for issuance.

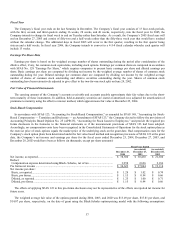

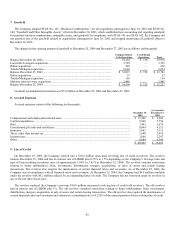

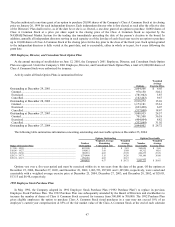

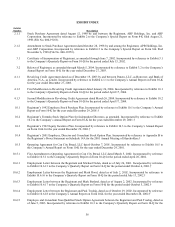

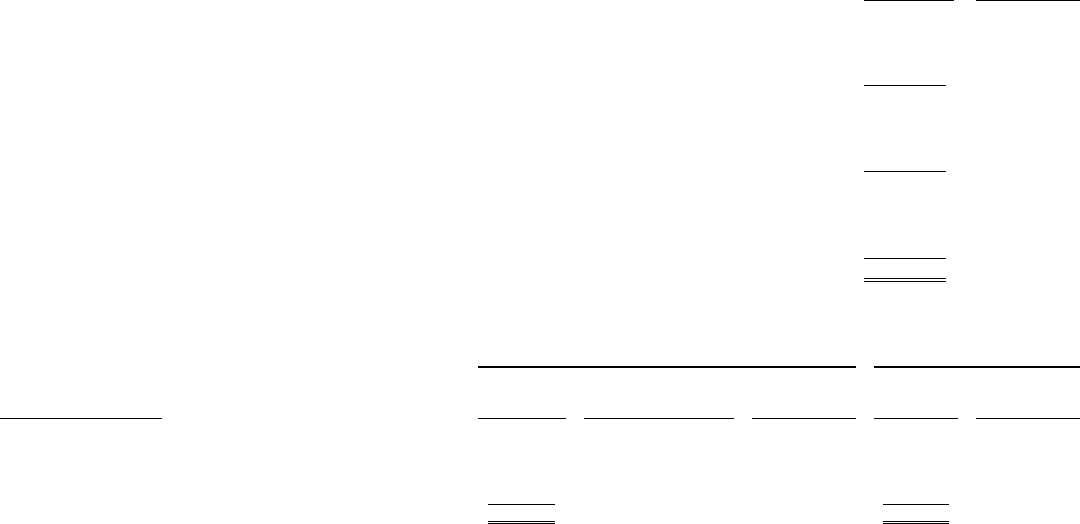

Activity under all Stock Option Plans is summarized below:

Options

Weighted

Average

Exercise Price

Outstanding at December 29, 2001 ............................................................................................................... 2,864,506 $ 6.65

Granted ........................................................................................................................................................ 978,150 30.12

Exercised ..................................................................................................................................................... (781,942) 3.87

Cancelled ..................................................................................................................................................... (142,442) 9.67

Outstanding at December 28, 2002 ............................................................................................................... 2,918,272 15.10

Granted ........................................................................................................................................................ 1,173,181 35.61

Exercised ..................................................................................................................................................... (693,498) 6.07

Cancelled ..................................................................................................................................................... (317,000) 18.67

Outstanding at December 27, 2003 ............................................................................................................... 3,080,955 24.57

Granted ........................................................................................................................................................ 701,500 36.18

Exercised ..................................................................................................................................................... (404,804) 8.82

Cancelled ..................................................................................................................................................... (332,849) 31.02

Outstanding at December 27, 2004 ............................................................................................................... 3,044,802 $ 28.72

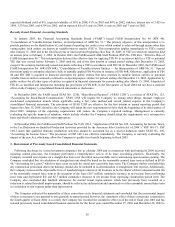

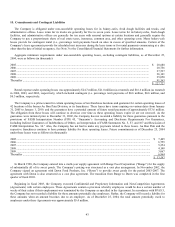

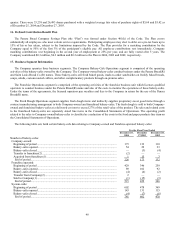

The following table summarizes information concerning outstanding and exercisable options at December 25, 2004:

Options Outstanding Options Exercisable

Range of Exercise Price

Number

Outstanding

Weighted Average

Remaining

Contractual Life

Weighted

Average

Exercise Price

Number

Exercisable

Weighted

Average

Exercise Price

$ 3.00 - 10.05......................................................................................... 407,108 3.11 $ 3.83 362,036 $ 3.68

$10.06 - 19.27......................................................................................... 198,812 3.41 15.88 69,312 14.16

$19.28 - 29.30......................................................................................... 905,581 4.65 27.99 262,275 27.70

$29.31 - 39.73......................................................................................... 1,274,400 5.15 36.26 310,100 36.60

$39.74 - 43.15......................................................................................... 258,901 4.65 43.15 — —

3,044,802 4.57 $ 28.72 1,003,723 $ 20.85

Options vest over a five-year period and must be exercised within six to ten years from the date of the grant. Of the options at

December 25, 2004, December 27, 2003, and December 28, 2002, 1,003,723, 897,481 and 1,105,906, respectively, were vested and

exercisable with a weighted average exercise price at December 25, 2004, December 27, 2003, and December 28, 2002, of $20.85,

$13.15 and $6.48, respectively.

1992 Employee Stock Purchase Plan

In May 1992, the Company adopted its 1992 Employee Stock Purchase Plan (“1992 Purchase Plan”) to replace its previous

Employee Stock Purchase Plan. The 1992 Purchase Plan was subsequently amended by the Board of Directors and stockholders to

increase the number of shares of Class A Common Stock reserved for issuance from 300,000 to 700,000. The 1992 Purchase Plan

gives eligible employees the option to purchase Class A Common Stock (total purchases in a year may not exceed 10% of an

employee’s current year compensation) at 85% of the fair market value of the Class A Common Stock at the end of each calendar

47