Panera Bread 2004 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.or the reasonably assured lease term at the inception of the lease. The Company also concluded that landlord allowances for normal

tenant improvements, which had previously been recorded as a reduction to related leasehold improvements, should be reflected as

deferred rent and amortized over the reasonably assured lease term as a reduction to rent expense rather than depreciation.

The Company evaluated the materiality of these corrections on its financial statements and concluded that the incremental impact

of these corrections is not material to any quarterly or annual period; however, the cumulative effect of these corrections is material to

the fourth quarter of fiscal 2004. As a result, the Company has recorded the cumulative effect as of the end of fiscal year 2001 and has

restated previously issued consolidated financial statements for the fiscal years ended December 27, 2003 and December 28, 2002 to

recognize the impact of recording rent expense over the reasonably assured lease period, to record depreciation on leasehold

improvements over the shorter of their estimated useful lives or the reasonably assured lease term, and to classify landlord allowances

for normal tenant improvements as deferred rent and amortize them over the reasonably assured lease term as a reduction to rent

expense rather than depreciation. See Note 3 to the Consolidated Financial Statements for further information on the Company’s

accounting for its leases.

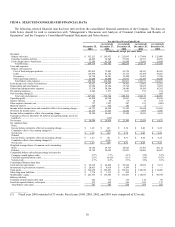

In fiscal 2004, the Company earned $1.25 per diluted share with the following system-wide performance on key metrics: 143 new

bakery-cafes opened in fiscal 2004, including 54 new Company-owned bakery-cafes (nearly double new Company-owned bakery-

cafes opened in fiscal 2003) and 89 new franchise bakery-cafes, comparable bakery-cafe sales growth of 2.7%, and average weekly

sales of $36,008, and operating weeks of 34,470.

The Company expects earnings per diluted share for the first quarter of 2005, which ends on April 19, 2005, of $0.42-$0.43,

representing an increase of 35%-39% from the first quarter of 2004. The Company is changing its fiscal calendar in 2005 to have its

operating week end on Tuesday rather than Saturday. This change will result in an additional three days being included in the first

quarter of 2005 compared to the 2004 first quarter. The first quarter target assumes system-wide comparable sales growth of 5.0% to

6.5%. Additionally, the Company expects system-wide average weekly sales per bakery-cafe for the quarter to be in the range of

$35,500 to $36,500 and expects operating weeks to be in the range of 11,900 to 12,000. Bakery-cafe openings in the quarter are

expected to be 33 (18 company and 15 franchise) compared to 36 (11 company and 25 franchise) in the first quarter of 2004.

The Company expects full year 2005 earnings per diluted share of $1.52 to $1.57, an increase of 22% to 26% from 2004 results.

This target reflects the first quarter performance discussed above and continues to target full year system-wide comparable sales

growth of 2% to 4% as the pricing portion of sales growth will decelerate as the year progresses. The Company expects system-wide

average weekly sales for full year 2005 to be in the range of $36,000 to $37,000 and expects system-wide operating weeks to be in the

range of 41,500 to 42,000. Bakery-cafe openings in 2005 are expected to be 150 to 160 (70 company and 80-90 franchise). Capital

expenditures in 2005 are expected to be $95 million to $100 million for the Company. The 2005 earnings per share targets exclude the

impact of expensing stock options. The Company is required to begin expensing stock option costs no later than the third quarter of

fiscal 2005 under SFAS 123R, “Share-Based Payment.” See Note 2 of the Company’s Consolidated Financial Statements for further

information.

13