Panera Bread 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

recognize the impact of recording rent expense over the reasonably assured lease period, to record depreciation on leasehold

improvements over the shorter of their estimated useful lives or the reasonably assured lease term, and to classify landlord allowances

for normal tenant improvements as deferred rent and amortize them over the reasonably assured lease term as a reduction to rent

expense rather than depreciation.

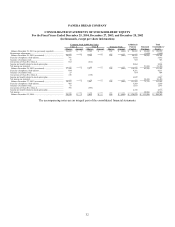

The cumulative effect of the restatement through fiscal 2001 of $1.7 million was recorded as a reduction of the Company’s

beginning retained earnings balance at December 29, 2001, as reflected in its consolidated statements of stockholders’ equity. The

cumulative effect of the restatement through fiscal 2003 increased property and equipment by $10.0 million, increased deferred rent

liability by $12.5 million, increased accrued expenses by $0.9 million, and decreased deferred income tax liability by $1.2 million.

Bakery-cafe occupancy for fiscal years 2003 and 2002 increased by $1.0 million and $0.8 million, respectively, and bakery-cafe cost

of food and paper products for the same fiscal years increased by $0.2 million and $0.1 million, respectively, while depreciation and

amortization for the same fiscal years decreased by $1.2 million and $0.2 million, respectively; operating profit for fiscal year 2003

increased by $0.03 million and decreased by $0.7 million in fiscal 2002, and income before cumulative effect of accounting change

and net income for fiscal year 2003 increased by $0.02 million and net income decreased by $0.5 million in fiscal 2002. The

restatement did not change previously reported diluted earnings per share for the fiscal year ended 2003, but decreased previously

reported diluted earnings per share by $0.02 for the fiscal year ended 2002. The restatement did not impact the Company’s previously

reported net cash flows, revenues or comparable bakery-cafe sales, or compliance with revolving line of credit covenants.

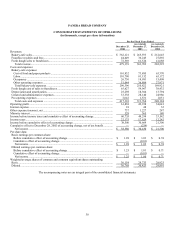

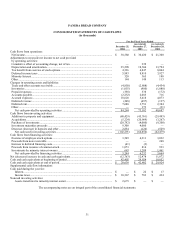

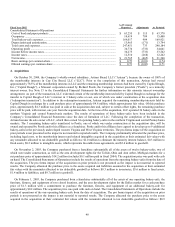

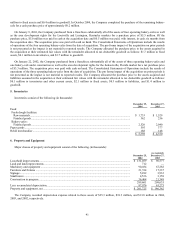

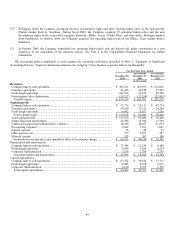

The following table shows the impact of these changes on the consolidated balance sheet for fiscal year 2003 and the consolidated

statements of operations for fiscal years 2002 and 2003 (in thousands, except per share data):

Fiscal Year 2003

As Previously

Reported

Adjustments

As Restated

Consolidated Balance Sheet

Property and equipment, net ................................................................................................. $ 136,367 $ 9,995 $ 146,362

Deferred income taxes .......................................................................................................... — 897 897

Total assets ........................................................................................................................... $ 245,943 $ 10,892 $ 256,835

Accrued expense................................................................................................................... 35,552 851 36,403

Deferred income taxes .......................................................................................................... 328 (328) —

Deferred rent......................................................................................................................... — 12,501 12,501

Total liabilities...................................................................................................................... 46,235 13,024 59,259

Retained earnings ................................................................................................................. 74,842 (2,132) 72,710

Total stockholder’s equity .................................................................................................... 195,937 (2,132) 193,805

Total liabilities and stockholders’ equity.............................................................................. $ 245,943 $ 10,892 $ 256,835

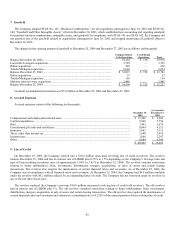

Consolidated Statement of Operations

Cost of food and paper products........................................................................................... $ 73,727 $ 158 $ 73,885

Occupancy ............................................................................................................................ 17,990 991 18,981

Total bakery-cafe expenses................................................................................................... 209,673 1,149 210,822

Depreciation and amortization.............................................................................................. 19,487 (1,183) 18,304

Total costs and expenses....................................................................................................... 313,798 (34) 313,764

Operating profit .................................................................................................................... 49,904 34 49,938

Income before income taxes and cumulative effect of accounting change........................... 48,264 34 48,298

Income taxes......................................................................................................................... 17,616 13 17,629

Income before cumulative effect of accounting change ....................................................... 30,648 21 30,669

Cumulative effect of accounting change............................................................................... (239) — (239)

Net income............................................................................................................................ $ 30,409 $ 21 $ 30,430

Basic earnings per common share:

Before cumulative effect of accounting change ................................................................. $ 1.03 $ — $ 1.03

Cumulative effect of accounting change............................................................................ (0.01) — (0.01)

Net income ......................................................................................................................... $ 1.02 $ — $ 1.02

Diluted earnings per common share:

Before cumulative effect of accounting change ................................................................. $ 1.01 $ — $ 1.01

Cumulative effect of accounting change............................................................................ (0.01) — (0.01)

Net income ......................................................................................................................... $ 1.00 $ — $ 1.00

39