Panera Bread 2004 Annual Report Download - page 24

Download and view the complete annual report

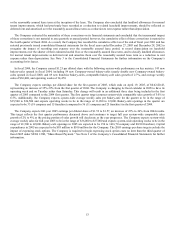

Please find page 24 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.two weeks ended December 27, 2003. The increase in the fresh dough cost of sales rate in fiscal 2004 was primarily due to increased

commodity costs, including butter, tuna, and cream cheese.

Depreciation and amortization was $25.3 million, or 5.3% of total revenue, for the fifty-two weeks ended December 25, 2004

compared to $18.3 million, or 5.0% of total revenue, for the fifty-two weeks ended December 27, 2003. The increase in depreciation

and amortization as a percentage of total revenue for the fifty-two weeks ended December 25, 2004 compared to the fifty-two weeks

ended December 27, 2003 is primarily due to the impact of a full year’s depreciation of prior year’s capital expenditures and increased

capital expenditures in the current year.

General and administrative expenses were $33.3 million, or 7.0% of total revenue, and $28.1 million, or 7.7% of total revenue, for

the fifty-two weeks ended December 25, 2004 and December 27, 2003, respectively. The decrease in the general and administrative

expense rate between 2004 and 2003 is primarily the result of the improved leveraging of these costs over higher revenue.

Pre-opening expenses, which consist primarily of labor and food costs incurred during in-store training and preparation for

opening, exclusive of manager training costs which are included in general and administrative expenses, were $2.6 million, or 0.6% of

total revenue, for the fifty-two weeks ended December 25, 2004 compared to $1.5 million, or 0.4% of total revenue, for the fifty-two

weeks ended December 27, 2003. The increase in pre-opening expenses as a percentage of total revenue for the fifty-two weeks ended

December 25, 2004 compared to the fifty-two weeks ended December 27, 2003 is primarily due to increased number of Company

bakery-cafe openings in 2004 compared to 2003 as described above.

Operating Profit

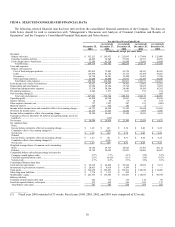

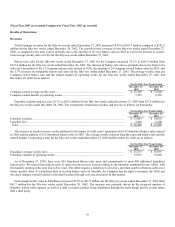

Operating profit for the fifty-two weeks ended December 25, 2004 increased to $61.8 million, or 12.9% of total revenue, from

$49.9 million (as restated), or 13.7% (as restated) of total revenue, for the fifty-two weeks ended December 27, 2003. Operating profit

as a percentage of total revenues for the fifty-two weeks ended December 25, 2004 declined as a result of the factors described above.

Other Expense

Other expense for the fifty-two weeks ended December 25, 2004 decreased to $0.7 million, or 0.2% of total revenue, from $1.2

million, or 0.3% of total revenue, for the fifty-two weeks ended December 27, 2003. The decrease in other expense results primarily

from increased interest income in 2004.

Minority Interest

Minority interest represents the portion of the Company’s operating profit that is attributable to the ownership interest of our

former minority interest owner. See Note 4 to the Consolidated Financial Statements for additional information.

Income Taxes

The provision for income taxes increased to $22.2 million for the fifty-two weeks ended December 25, 2004 compared to $17.6

million (as restated) for the fifty-two weeks ended December 27, 2003. The tax provisions for the fifty-two weeks ended December

25, 2004 and December 27, 2003 reflects a consistent combined federal, state, and local effective tax rate of 36.5%.

Income Before Cumulative Effect of Accounting Change

Income before cumulative effect of accounting change for the fifty-two weeks ended December 25, 2004 increased $7.9 million, or

25.7%, to $38.6 million, or $1.25 per diluted share, compared to income before cumulative effect of accounting change of $30.7

million (as restated), or $1.01 per diluted share (as restated), for the fifty-two weeks ended December 27, 2003. The 2004 increase in

income before cumulative effect of accounting change was primarily due to an increase in bakery-cafe sales, franchise royalties and

fees, and fresh dough sales to franchisees partially offset by higher costs as described above.

Net Income

Net income for the fifty-two weeks ended December 25, 2004 increased $8.2 million, or 27.0%, to $38.6 million, or $1.25 per

diluted share, compared to net income of $30.4 million (as restated), or $1.00 per diluted share (as restated), for the fifty-two weeks

ended December 27, 2003. The increase in net income in 2004 is consistent with the factors described above.

18