Panera Bread 2004 Annual Report Download - page 17

Download and view the complete annual report

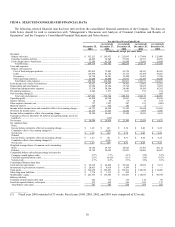

Please find page 17 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) In 2000, the Company received a payment of $0.9 million as consideration for amending the 1999 ABP sale agreement to

permit a subsequent sale. This non-recurring gain was offset by a $0.9 non-recurring charge related to the sale and a $0.5

million charge for asset impairment relating to closure of four Panera Bread bakery-cafes.

(3) Effective December 29, 2002, the Company adopted the provisions of Statement of Financial Accounting Standards (SFAS)

No. 143, “Accounting for Asset Retirement Obligations.” This Statement requires the Company to record an estimate for costs

of retirement obligations that may be incurred at the end of lease terms of existing bakery-cafes or other facilities. Upon

adoption of SFAS 143, the Company recognized a one-time cumulative effect charge of approximately $0.2 million (net of

deferred tax benefit of approximately $0.1 million), or $.01 per diluted share. For further information, see Note 2, “Summary

of Significant Accounting Policies,” to the Consolidated Financial Statements.

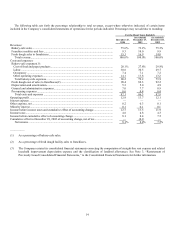

(4) The Company restated its consolidated financial statements correcting the computation of straight-line rent expense and related

leasehold improvement depreciation expense and the classification of landlord allowances. The effect of the restatement

increased total costs and expenses by $0.8 million and $0.3 million for fiscal years 2001 and 2000, respectively, decreased net

income by $0.5 million and $0.2 million for the same fiscal years, respectively, and decreased diluted earnings per share by

$0.02 and $0.01 for the same fiscal years, respectively. The effect of the restatement increased total assets by $4.8 million and

$2.8 million as of December 29, 2001 and December 30, 2000, respectively, and decreased stockholders’ equity by $1.7

million and $1.2 million for the same fiscal years, respectively. See Note 3, “Restatement of Previously Issued Consolidated

Financial Statements,” to the Consolidated Financial Statements for further information.

11