Panera Bread 2004 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company is subject to legal proceedings and claims which arise in the normal course of business. In the opinion of

management, the ultimate liabilities with respect to these actions will not have a material adverse effect on the Company’s financial

position, results of operations, or cash flow.

11. Income Taxes

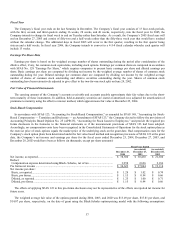

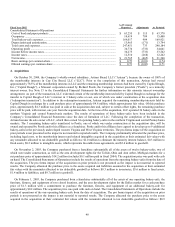

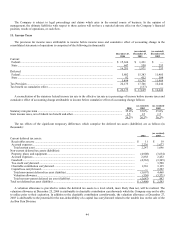

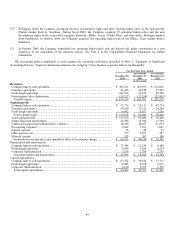

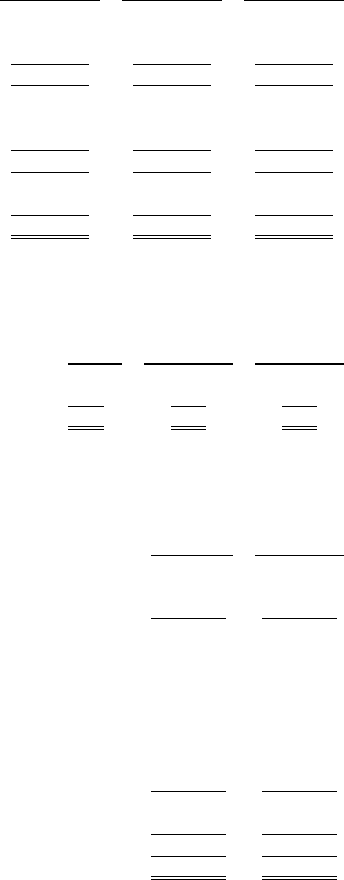

The provision for income taxes attributable to income before income taxes and cumulative effect of accounting change in the

consolidated statements of operations is comprised of the following (in thousands):

December 25,

2004

(as restated)

December 27,

2003

(as restated)

December 28,

2002

Current:

Federal ................................................................................................................................ $ 15,634 $ 1,421 $ —

State .................................................................................................................................... 647 550 253

16,281 1,971 253

Deferred:

Federal ................................................................................................................................ 5,802 15,383 11,405

State .................................................................................................................................... 92 412 584

5,894 15,795 11,989

Tax Provision ....................................................................................................................... 22,175 17,766 12,242

Tax benefit on cumulative effect .......................................................................................... — (137) —

$ 22,175 $ 17,629 $ 12,242

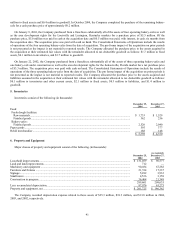

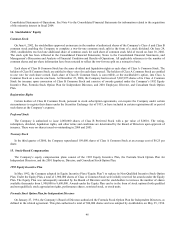

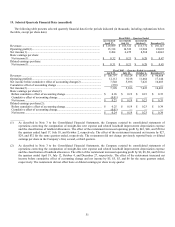

A reconciliation of the statutory federal income tax rate to the effective tax rate as a percentage of income before income taxes and

cumulative effect of accounting change attributable to income before cumulative effect of accounting change follows:

2004

(as restated)

2003

(as restated)

2002

Statutory rate provision ..................................................................................................................... 35.0% 35.0% 35.0%

State income taxes, net of federal tax benefit and other .................................................................... 1.5 1.5 1.5

36.5% 36.5% 36.5%

The tax effects of the significant temporary differences which comprise the deferred tax assets (liabilities) are as follows (in

thousands):

2004

(as restated)

2003

Current deferred tax assets:

Receivables reserve .......................................................................................................................................... $ 11 $ 19

Accrued expenses ............................................................................................................................................. 2,236 1,677

Total current asset.......................................................................................................................................... 2,247 1,696

Non-current deferred tax assets (liabilities):

Property, plant, and equipment......................................................................................................................... (4,908) (3,634)

Accrued expenses ............................................................................................................................................. 2,858 2,452

Goodwill ........................................................................................................................................................... (4,363) (3,365)

Tax credit carryforward .................................................................................................................................... — 3,598

Charitable contribution carryforward ............................................................................................................... 1,316 3,125

Capital loss carryforward.................................................................................................................................. — 2,292

Total non-current deferred tax asset (liability)............................................................................................... (5,097) 4,468

Valuation allowance....................................................................................................................................... (550) (3,571)

Total net non-current deferred tax asset (liability)......................................................................................... (5,647) 897

Total net deferred tax asset (liability)................................................................................................................. $ (3,400) $ 2,593

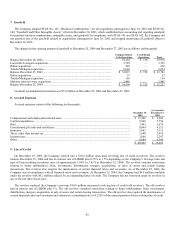

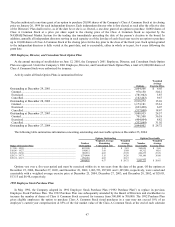

A valuation allowance is provided to reduce the deferred tax assets to a level which, more likely than not, will be realized. The

valuation allowance at December 25, 2004 is attributable to charitable contribution carryforwards which the Company may not be able

to utilize prior to their expiration. In addition to the charitable contribution carryforwards, the valuation allowance at December 27,

2003 is attributable to the potential for the non-deductibility of a capital loss carryforward related to the taxable loss on the sale of the

Au Bon Pain Division.

44