Panera Bread 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

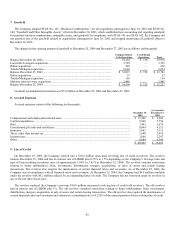

7. Goodwill

The Company adopted SFAS No. 141, “Business Combinations,” for all acquisitions subsequent to June 30, 2001 and SFAS No.

142, “Goodwill and Other Intangible Assets,” effective December 30, 2001, which established new accounting and reporting standards

for purchase business combinations, intangible assets, and goodwill. In compliance with SFAS 141 and SFAS 142, the Company did

not amortize any of the goodwill related to acquisitions subsequent to June 30, 2001 and stopped amortizing all goodwill effective

December 30, 2001.

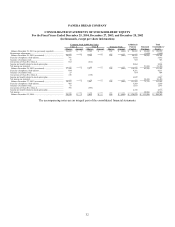

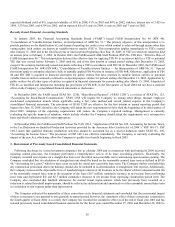

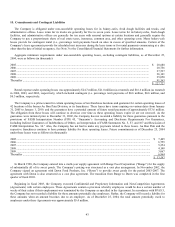

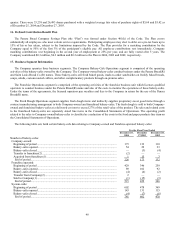

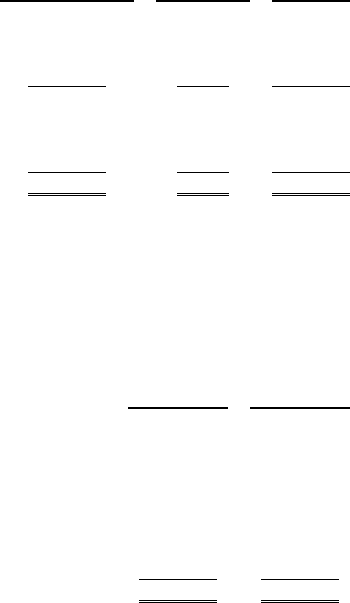

The changes in the carrying amount of goodwill at December 25, 2004 and December 27, 2003 are as follows (in thousands):

Company Bakery-

Cafe Operations

Fresh Dough

Operations

Total

Balance December 28, 2002............................................................................................... 18,242 $ 728 18,970

Louisville/Lexington acquisition........................................................................................ 3,729 — 3,729

Dallas acquisition ............................................................................................................... 410 — 410

Toledo/Michigan acquisition.............................................................................................. 9,634 — 9,634

Balance December 27, 2003............................................................................................... $ 32,015 $ 728 $ 32,743

Dallas acquisition ............................................................................................................... 23 23

Toledo/Michigan acquisition.............................................................................................. 116 116

Minority interest owner acquisition.................................................................................... 2,445 2,445

Balance December 25, 2004............................................................................................... $ 34,599 $ 728 $ 35,327

Goodwill accumulated amortization was $7.9 million at December 25, 2004 and December 27, 2003.

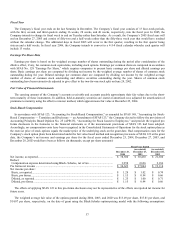

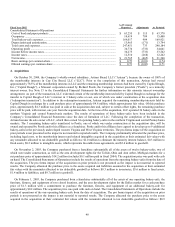

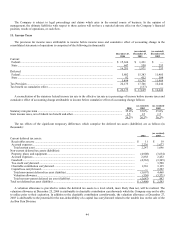

8. Accrued Expenses

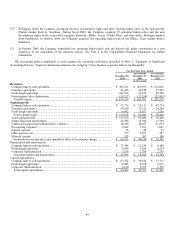

Accrued expenses consist of the following (in thousands):

December 25,

2004

(as restated)

December 27,

2003

Compensation and employment related taxes .............................................................................................. $ 12,540 $ 9,260

Capital expenditures ..................................................................................................................................... 9,066 7,196

Rent .............................................................................................................................................................. 3,443 3,679

Unredeemed gift cards and certificates......................................................................................................... 8,044 4,113

Insurance ...................................................................................................................................................... 3,642 2,112

Taxes, other than income tax........................................................................................................................ 1,680 1,410

Income taxes................................................................................................................................................. 3,606 2,247

Other............................................................................................................................................................. 6,884 6,386

$ 48,905 $ 36,403

9. Line of Credit

On December 19, 2003, the Company entered into a $10.0 million unsecured revolving line of credit (revolver). The revolver

matures December 19, 2006 and has an interest rate of LIBOR plus 0.75% to 1.5% depending on the Company’s leverage ratio and

type of loan (resulting in interest rates of approximately 3.06% to 3.81% at December 25, 2004). The revolver contains restrictions

relating to future indebtedness, liens, investments, distributions, mergers, acquisitions, or sales of assets and certain leasing

transactions. The revolver also requires the maintenance of certain financial ratios and covenants. As of December 25, 2004, the

Company was in compliance with all financial ratios and covenants. At December 25, 2004, the Company had $9.8 million available

under the revolver with $0.2 million utilized by an outstanding letter of credit. The Company has not borrowed under its revolver in

any of the last three fiscal years.

The revolver replaced the Company’s previous $10.0 million unsecured revolving line of credit (old revolver). The old revolver

had an interest rate of LIBOR plus 1%. The old revolver contained restrictions relating to future indebtedness, liens, investments,

distributions, mergers, acquisition, or sale of assets and certain leasing transactions. The old revolver also required the maintenance of

certain financial ratios and covenants and contained a commitment fee of 0.225% of the unused portion of the revolving line of credit.

42