Panera Bread 2004 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2004 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In December 2004, the FASB issued Staff Position No. FAS 109-1, “Application of SFAS No. 109, Accounting for Income Taxes,

to the Tax Deduction on Qualified Production Activities provided by the American Jobs Creation Act of 2004” (“FSP 109-1”). FSP

109-1 states that qualified domestic production activities should be accounted for as a special deduction under SFAS No. 109,

“Accounting for Income Taxes.” The provisions of FSP 109-1 are effective immediately. The Company is currently evaluating the

impact of the new Act, which may allow the Company to qualify for a benefit beginning in fiscal 2005.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As of December 25, 2004, the Company had no derivative financial interests or derivative commodity instruments. We do

however purchase certain commodities, such as flour, butter, and coffee, for use in our business. These purchases are sometimes

purchased under agreements of one to three year time frames usually at a fixed price. As a result, we are subject to market risk that

current market prices may be above or below our contractual price. However, we were not using financial instruments to hedge

commodity prices as of December 25, 2004.

The Company’s unsecured revolver bears an interest rate using LIBOR as the basis, and therefore is subject to additional expense

should there be an increase in LIBOR interest rates. The Company has not borrowed under the revolver in the last three years. As of

December 25, 2005, the Company had no foreign operations, and accordingly, no foreign exchange rate fluctuation risk at that time.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The following consolidated financial statements of the Company are included in response to this item:

Report of Independent Registered Public Accounting Firm

Consolidated Balance Sheets as of December 25, 2004 and December 27, 2003 (as restated)

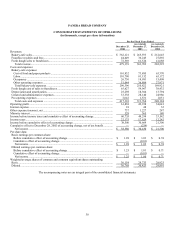

Consolidated Statements of Operations for the fiscal years ended December 25, 2004, December 27, 2003 (as restated), and

December 28, 2002 (as restated)

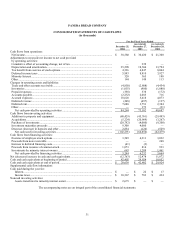

Consolidated Statements of Cash Flows for the fiscal years ended December 25, 2004, December 27, 2003 (as restated), and

December 28, 2002 (as restated)

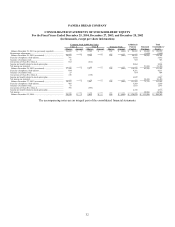

Consolidated Statements of Stockholders’ Equity for the fiscal years ended December 25, 2004, December 27, 2003 (as restated),

and December 28, 2002 (as restated)

Notes to the Consolidated Financial Statements

Valuation and Qualifying Accounts

All other schedules are omitted because they are not applicable or the required information is shown in the financial statements or

notes thereto.

26