Panera Bread 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

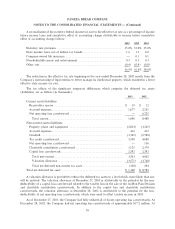

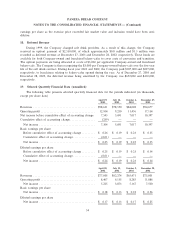

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

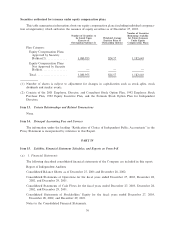

Treasury Stock

In the third quarter of 2000, the Company repurchased 109,000 shares of Class A Common Stock at an

average cost of $8.25 per share.

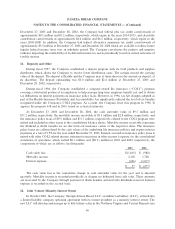

14. Stock-Based Compensation

The Company's equity compensation plans consist of the 1992 Equity Incentive Plan, the Formula Stock

Option Plan for Independent Directors, and the 2001 Employee, Director, and Consultant Stock Option Plan.

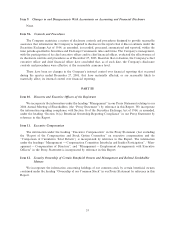

1992 Equity Incentive Plan

In May 1992, the Company adopted its Equity Incentive Plan (""Equity Plan'') to replace its Non-

QualiÑed Incentive Stock Option Plan. Under the Equity Plan, a total of 1,900,000 shares of Class A

Common Stock were initially reserved for awards under the Equity Plan. The Equity Plan was subsequently

amended by the Board of Directors and the stockholders to increase the number of shares available thereunder

from 1,900,000 to 8,600,000. Awards under the Equity Plan can be in the form of stock options (both qualiÑed

and non-qualiÑed), stock appreciation rights, performance shares, restricted stock, or stock units.

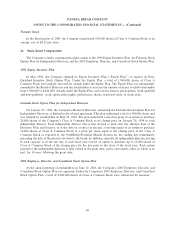

Formula Stock Option Plan for Independent Directors

On January 27, 1994, the Company's Board of Directors authorized the Formula Stock Option Plan for

Independent Directors, as deÑned in the related agreement. This plan authorized a total of 300,000 shares and

was adopted by stockholders on May 25, 1994. The plan authorized a one-time grant of an option to purchase

20,000 shares of the Company's Class A Common Stock at its closing price on January 26, 1994 to each

independent director. Each independent director who is Ñrst elected as such after the eÅective date of the

Directors' Plan shall receive, as of the date he or she is so elected, a one-time grant of an option to purchase

10,000 shares of Class A Common Stock at a price per share equal to the closing price of the Class A

Common Stock as reported by the NASDAQ/National Market System for the trading day immediately

preceding the date of the person's election to the board. In addition, annually all independent directors serving

in such capacity as of the last day of each Ñscal year receive an option to purchase up to 10,000 shares of

Class A Common Stock at the closing price for the day prior to the close of the Ñscal year. Each option

granted to the independent directors is fully vested at the grant date, and is exercisable, either in whole or in

part, for 10 years following the grant date.

2001 Employee, Director, and Consultant Stock Option Plan

At the annual meeting of stockholders on June 12, 2001, the Company's 2001 Employee, Director, and

Consultant Stock Option Plan was approved. Under the Company's 2001 Employee, Director, and Consultant

Stock Option Plan, a total of 2,000,000 shares of Class A Common Stock were authorized for issuance.

48