Panera Bread 2003 Annual Report Download - page 30

Download and view the complete annual report

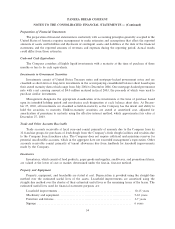

Please find page 30 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.at the bakery-cafes. However, the Company has not experienced to date a signiÑcant reduction in bakery-cafe

proÑt margins as a result of changes in such laws, and management does not anticipate any related future

signiÑcant reductions in gross proÑt margins.

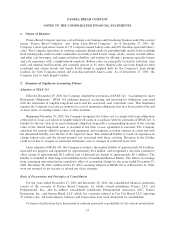

Recent Accounting Pronouncements

In January 2003, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 46

(FIN 46), ""Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51.'' The primary

objective of this interpretation is to provide guidance on the identiÑcation of, and Ñnancial reporting for,

entities over which control is achieved through means other than voting rights; such entities are known as

variable-interest entities (VIE's). This interpretation applies immediately to VIE's created after January 31,

2003 and in the Ñrst Ñscal year or interim period beginning after June 15, 2003, to VIE's in which an enterprise

held an interest prior to February 1, 2003. In October 2003, the FASB issued FASB StaÅ Position

(FSP) No. FIN 46-6, ""EÅective Date of FASB Interpretation 46.'' This interpretation deferred the eÅective

date for applying FIN 46 to an interest held in a VIE or potential VIE that was created before February 1,

2003 until the end of the Ñrst interim or annual period ending after December 15, 2003, except if the company

had already issued statements reÖecting a VIE in accordance with FIN 46. In December 2003, the FASB

issued FASB Interpretation No. 46R (FIN 46R), ""Consolidation of Variable Interest Entities Ì An

Interpretation of ARB No. 51.'' Special provisions apply to enterprises that have fully or partially applied

FIN 46 prior to issuance of FIN 46R. Otherwise, application of FIN 46 and FIN 46R is required in Ñnancial

statements for public entities that have interests in variable interest entities or potential variable interest

entities commonly referred to as special-purpose entities for periods ending after December 15, 2003.

Application by public entities for all other types of entities is required in Ñnancial statements for periods

ending after March 15, 2004. Adoption of the required sections of FIN 46, as modiÑed and interpreted,

including the provisions of FIN 46R, did not have a material eÅect on the Company's consolidated Ñnancial

statements or disclosures. The Company intends to adopt the remaining sections of this guidance when

required in Ñscal 2004. The Company does not expect adoption of FIN 46, as modiÑed and interpreted,

including the provisions of FIN 46R, to have a signiÑcant impact on the Company's Ñnancial statements or

disclosures.

In May 2003, the FASB issued SFAS 150, ""Accounting for Certain Financial Instruments with

Characteristics of both Liabilities and Equity.'' This Statement establishes standards for how an issuer

classiÑes and measures certain Ñnancial instruments with characteristics of both liabilities and equity. It

requires an issuer classify a Ñnancial instrument within its scope as a liability, or an asset in some

circumstances. SFAS 150 is eÅective for Ñnancial instruments entered into or modiÑed after May 31, 2003,

and otherwise is eÅective at the beginning of the Ñrst interim period beginning after June 15, 2003, except that

certain provisions have been deferred indeÑnitely pursuant to FSP No. FAS 150-3. There was no impact on

the Company's Ñnancial statements upon adoption in Ñscal 2003.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

As of December 27, 2003, the Company had no derivative Ñnancial interests or derivative commodity

instruments. We do however purchase certain commodities, such as Öour, butter, and coÅee, for use in our

business. These purchases are sometimes purchased under agreements of one to three year time frames

usually at a Ñxed price. As a result, we are subject to market risk that current market price may be below our

contractual price. However, we do not use Ñnancial instruments to hedge commodity prices.

The Company's unsecured revolving line of credit bears an interest rate using LIBOR as the basis, and

therefore is subject to additional expense should there be an increase in prime or LIBOR interest rates. The

Company has no foreign operations and accordingly, no foreign exchange rate Öuctuation risk.

26