Panera Bread 2003 Annual Report Download - page 17

Download and view the complete annual report

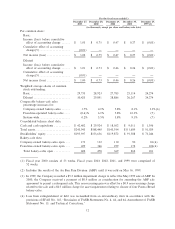

Please find page 17 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(5) EÅective December 29, 2002, the Company adopted the provisions of SFAS 143, ""Accounting for Asset

Retirement Obligations.'' This Statement requires the Company to record an estimate for costs of

retirement obligations that may be incurred at the end of lease terms of existing bakery-cafes or other

facilities. Upon adoption of SFAS 143, the Company recognized a one-time cumulative eÅect charge of

approximately $0.2 million (net of deferred tax beneÑt of approximately $0.1 million), or $.01 per diluted

share. For further information, see Note 2, ""Summary of SigniÑcant Accounting Policies,'' in the Notes

to the Consolidated Financial Statements.

(6) Excludes Au Bon Pain stores.

(7) Information not available.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

Forward Looking Statements

Matters described in this report, including any discussion, express or implied, of the Company's

anticipated growth, operating results, and future earnings per share, contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of

1934. The statements, identiÑed by the words ""believe,'' ""positioned,'' ""estimate,'' ""project,'' ""target,''

""continue,'' ""will,'' ""intend,'' ""expect,'' ""future,'' ""anticipates,'' and similar expressions express management's

present belief, expectations or intentions regarding the Company's future performance. The Company's actual

results could diÅer materially from those set forth in the forward-looking statements due to known and

unknown risks and uncertainties and could be negatively impacted by a number of factors. These factors

include but are not limited to the following: the availability of suÇcient capital to the Company and the

developers party to franchise development agreements within the Company; continued execution of develop-

ment; obligations by franchisee groups; variations in the number and timing of bakery-cafe openings; public

acceptance of new bakery-cafes; competition; availability of labor; national and regional weather conditions,

including the impact on cost and availability of ingredients such as Öour, butter, and protein products; changes

in restaurant operating costs, particularly food and labor; and other factors that may aÅect retailers in general.

General

The Company's Ñscal year ends on the last Saturday in December. The Company's Ñscal year consists of

13 four-week periods, with the Ñrst, second, and third quarters ending 16 weeks, 28 weeks, and 40 weeks,

respectively, into the Ñscal year.

The Company has included in ""Item 7. Management's Discussion and Analysis of Financial Condition

and Results of Operations'' information on franchised and system-wide comparable bakery-cafe sales

increases, annualized average unit volumes, and average weekly sales. Management believes inclusion of

system-wide sales information, particularly annualized average unit volumes and average weekly sales, is

useful in assessing consumer acceptance of the Company's bakery-cafe concept as it measures the impact of

both comparable sales and new stores. Franchised sales information also provides an understanding of the

Company's revenues as royalties from franchisees are based on their sales.

The Company's revenues are derived from Company-owned bakery-cafe sales, fresh dough sales to

franchisees, and franchise royalties and fees. Fresh dough sales to franchisees are the sales of dough products

to our franchisees. Franchise royalties and fees include royalty income and franchise fees. The cost of food and

paper products, labor, occupancy, and other operating expenses relate to Company-owned bakery-cafe sales.

The cost of fresh dough sales relates to the sale of fresh dough products and sweet goods to our franchisees.

General and administrative, depreciation, and pre-opening expenses relate to all areas of revenue generation.

13