Panera Bread 2003 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

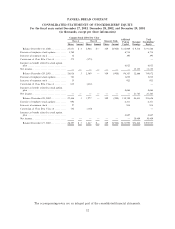

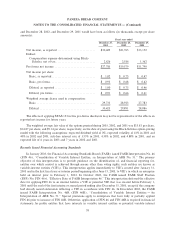

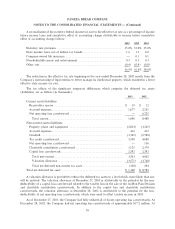

and December 28, 2002, and December 29, 2001 would have been as follows (in thousands, except per share

amounts):

Fiscal year ended

December 27, December 28, December 29,

2003 2002 2001

Net income, as reported ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $30,409 $21,765 $13,152

Deduct:

Compensation expense determined using Black-

Scholes, net of tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,626 2,186 1,362

Pro forma net income ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $27,783 $19,579 $11,790

Net income per share:

Basic, as reportedÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1.02 $ 0.75 $ 0.47

Basic, pro formaÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.93 $ 0.68 $ 0.42

Diluted, as reported ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 1.00 $ 0.73 $ 0.46

Diluted, pro forma ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 0.91 $ 0.66 $ 0.41

Weighted average shares used in compensation:

Basic ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 29,733 28,923 27,783

Diluted ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 30,423 29,891 28,886

The eÅects of applying SFAS 123 in this pro-forma disclosure may not be representative of the eÅects on

reported net income for future years.

The weighted average fair value of the options granted during 2003, 2002, and 2001 was $15.81 per share,

$14.87 per share, and $9.14 per share, respectively, on the date of grant using the Black-Scholes option-pricing

model with the following assumptions: expected dividend yield of 0%, expected volatility of 41% in 2003 and

40% in 2002 and 2001, risk-free interest rate of 3.53% in 2003, 4.30% in 2002, and 4.88% in 2001, and an

expected life of 6 years in 2003 and 7 years in 2002 and 2001.

Recently Issued Financial Accounting Standards

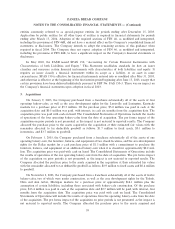

In January 2003, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 46

(FIN 46), ""Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51.'' The primary

objective of this interpretation is to provide guidance on the identiÑcation of, and Ñnancial reporting for,

entities over which control is achieved through means other than voting rights; such entities are known as

variable-interest entities (VIE's). This interpretation applies immediately to VIE's created after January 31,

2003 and in the Ñrst Ñscal year or interim period beginning after June 15, 2003, to VIE's in which an enterprise

held an interest prior to February 1, 2003. In October 2003, the FASB issued FASB StaÅ Position

(FSP) No. FIN 46-6, ""EÅective Date of FASB Interpretation 46.'' This interpretation deferred the eÅective

date for applying FIN 46 to an interest held in a VIE or potential VIE that was created before February 1,

2003 until the end of the Ñrst interim or annual period ending after December 15, 2003, except if the company

had already issued statements reÖecting a VIE in accordance with FIN 46. In December 2003, the FASB

issued FASB Interpretation No. 46R (FIN 46R), ""Consolidation of Variable Interest Entities Ì An

Interpretation of ARB No. 51.'' Special provisions apply to enterprises that have fully or partially applied

FIN 46 prior to issuance of FIN 46R. Otherwise, application of FIN 46 and FIN 46R is required in Ñnancial

statements for public entities that have interests in variable interest entities or potential variable interest

38