Panera Bread 2003 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PANERA BREAD COMPANY

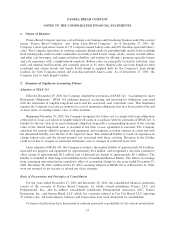

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

The Company's policy is to record advertising costs as expense in the period in which the cost is incurred.

The total amounts recorded as advertising expense were $7.5 million, $5.4 million, and $3.5 million for the

years ended December 27, 2003, December 28, 2002, and December 29, 2001, respectively.

Pre-Opening Costs

All pre-opening costs directly associated with the opening of new bakery-cafe locations, which consists

primarily of labor and food costs incurred during in-store training and preparation for opening, exclusive of

manager training costs which are included in other operating expenses, are expensed when incurred. Direct

costs to open bakery-cafes amounted to $1.5 million, $1.1 million and $0.9 million in 2003, 2002, and 2001,

respectively.

Fiscal Year

The Company's Ñscal year ends on the last Saturday in December. The Company's Ñscal year consists of

13 four-week periods, with the Ñrst, second, and third quarters ending 16 weeks, 28 weeks, and 40 weeks,

respectively, into the Ñscal year.

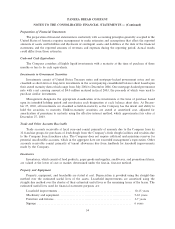

Earnings Per Share Data

Earnings per share is based on the weighted average number of shares outstanding during the period after

consideration of the dilutive eÅect, if any, for common stock equivalents, including stock options. Earnings per

common share are computed in accordance with SFAS No. 128 ""Earnings Per Share,'' which requires

companies to present basic earnings per share and diluted earnings per share. Basic earnings per share are

computed by dividing net income by the weighted average number of shares of common stock outstanding

during the year. Diluted earnings per common share are computed by dividing net income by the weighted

average number of shares of common stock outstanding and dilutive securities outstanding during the year.

Shares of common stock outstanding have been retroactively adjusted to give eÅect to the two-for-one stock

split on June 24, 2002.

Fair Value of Financial Instruments

The carrying amount of the Company's accounts receivable and accounts payable approximate their fair

values due to the short-term maturity of these instruments. In addition, held-to-maturity securities are stated

at amortized cost, adjusted for amortization of premiums to maturity using the eÅective interest method,

which approximates fair value at December 27, 2003.

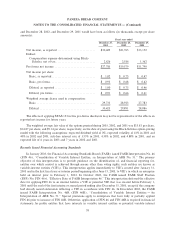

Stock-Based Compensation

In accordance with Statement of Financial Accounting Standards No. 123 (SFAS 123), ""Accounting for

Stock-Based Compensation,'' as amended by SFAS 148, ""Accounting for Stock-Based Compensation Ì

Transition and Disclosure Ì an Amendment of SFAS 123,'' the Company elected to follow the provisions of

Accounting Principles Board Opinion No. 25 (APB 25), ""Accounting for Stock Issued to Employees,'' and

provide the required pro forma disclosure in the footnotes to the Ñnancial statements as if the measurement

provisions of SFAS 123 had been adopted. Accordingly, no compensation costs have been recognized in the

Consolidated Statements of Operations for the stock option plans as the exercise price of stock options equals

the market price of the underlying stock on the grant date. Had compensation costs for the Company's stock

option plans been determined under the fair value based method and recognition provisions of SFAS 123 at

the grant date, the Company's net income and earnings per share for the Ñscal year ended December 27, 2003

37