Panera Bread 2003 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2003 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

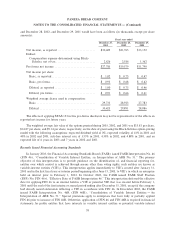

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS Ì (Continued)

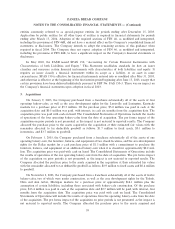

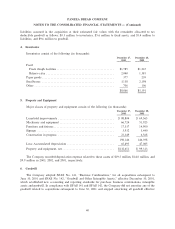

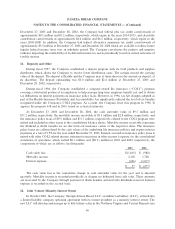

7. Accrued Expenses

Accrued expenses consist of the following (in thousands):

December 27, December 28,

2003 2002

Compensation and employment related taxes ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ $ 9,260 $ 6,875

Capital expendituresÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 7,196 4,421

Rent ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,828 2,206

Advertising ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ Ì 2,037

Unredeemed gift certiÑcates and gift cards ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 4,113 1,857

Insurance ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 2,112 1,412

Taxes, other than income tax ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 1,410 1,393

Other ÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏÏ 8,633 4,734

$35,552 $24,935

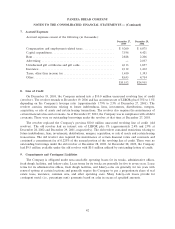

8. Line of Credit

On December 19, 2003, the Company entered into a $10.0 million unsecured revolving line of credit

(revolver). The revolver extends to December 19, 2006 and has an interest rate of LIBOR plus 0.75% to 1.5%

depending on the Company's leverage ratio (approximately 1.79% to 2.5% at December 27, 2003). The

revolver contains restrictions relating to future indebtedness, liens, investments, distributions, mergers,

acquisition, or sale of assets and certain leasing transactions. The revolver also requires the maintenance of

certain Ñnancial ratios and covenants. As of December 27, 2003, the Company was in compliance with all debt

covenants. There were no outstanding borrowings under the revolver at that time at December 27, 2003.

The revolver replaced the Company's previous $10.0 million unsecured revolving line of credit (old

revolver). The old revolver had an interest rate of LIBOR plus 1% (approximately 2.4% and 2.9% at

December 28, 2002 and December 29, 2001, respectively). The old revolver contained restrictions relating to

future indebtedness, liens, investments, distributions, mergers, acquisition, or sale of assets and certain leasing

transactions. The old revolver also required the maintenance of certain Ñnancial ratios and covenants and

contained a commitment fee of 0.225% of the unused portion of the revolving line of credit. There were no

outstanding borrowings under the old revolver at December 28, 2002. At December 28, 2002, the Company

had $9.5 million available under the old revolver with $0.5 million utilized by outstanding letters of credit.

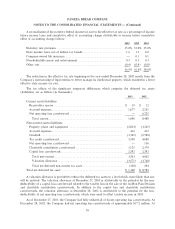

9. Commitments and Contingent Liabilities

The Company is obligated under non-cancelable operating leases for its trucks, administrative oÇces,

fresh dough facilities, and bakery-cafes. Lease terms for its trucks are generally for Ñve to seven years. Lease

terms for its administrative oÇces, fresh dough facilities, and bakery-cafes are generally for ten years with

renewal options at certain locations and generally require the Company to pay a proportionate share of real

estate taxes, insurance, common area, and other operating costs. Many bakery-cafe leases provide for

contingent rental (i.e., percentage rent) payments based on sales in excess of speciÑed amounts.

42